Let’s debunk some financial myths!

There are many ways to get advice on being smart with money— how you can make money, increase income and manage it thanks to personal finance websites, finance experts, money gurus on television, and feedback from your family, friends, and neighbours. But the information you get from such sources can sometimes make it difficult to separate facts from fiction.

We have gathered some well known financial myths that we will debunk today!

All of the below is for information only. Please always seek professional advice before acting.

We hope the following information will allow you to get a new perspective on your current financial situation.

Myth: Buying is better than renting

Reality: It is a famous myth that buying is better than renting. Renting can have a negative stigma attached to it, with the view that people who rent are wasting their money by paying mortgages of someone else instead of building equity in the property.

But you might not know that changes in the real estate market and taxes can make it hard to own a home. Also, owning a home has less flexibility and comes with many other additional costs, including household insurance, taxes, repairs, interest and more. Therefore, we are here to tell you that buying is not always better than renting.

Myth: Investing is only for rich people

Reality: it is one of the biggest misconceptions that exist. You can make more money when you invest more, and everyone can benefit by investing when they adopt a long term mindset and invest wisely. Just make sure to always focus on the interest rate, your risk appetite, and time to get maximum benefits when it comes to investing.

Myth: You should have 3 – 6 months of income in an emergency reserve.

Reality: The rule of three to six months’ savings has been around for years. However, the fact is that you need enough money to fulfil your financial needs in case of an emergency, such as when you are looking for a job.

Depending on the circumstances, it can take more than six months to find a job. Based on this reality, you may need larger emergency reserves.

Myth: Larger debts should be tackled first.

Reality: Financial advisers all over the country preach the importance of paying off large debts with higher interest rates first. While paying off larger loans is a good idea, there is a need to talk about paying off small debts. According to Harvard Business Review research, people get motivated by seeing modest balances vanish. In addition, paying off small loans can significantly influence one’s sense of accomplishment.

Myth: Money doesn’t buy happiness

Reality: we have often heard that money doesn’t buy happiness. It turns out it does, especially for individuals with low and middle incomes. According to a Princeton University study, individuals’ views on life improved as their financial status improved. In addition, an increase in income also improves the quality of life and overall emotional well being.

Myth: Credit cards are the gateway to debt.

Reality: Credit cards can cause problems for overspenders; therefore, the idea of avoiding them is reasonable. But credit cards are not always bad. On the contrary, you can use them to achieve your financial goals, such as paying off debt and improving your credit score. To prevent interest, you should always make payments on time and in full each month.

In addition, some credit card providers offer loyalty programmes and rewards through which you can earn points when you use them. As a result, credit cards can be a good funding source when you use them wisely and make repayments on time.

Myth: You can save for retirement later.

Reality: Most young adults, especially those in their twenties, do not prioritise savings because of the fact that there is a long time to retire. However, it is never too early to start planning for retirement. You can even start with 5% of your salary. One good rule of investment is that the longer you invest money, the more time it has to develop and earn you more.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

How P2P can help solve the housing crisis

Peer-to-peer lending platforms can help solve the ongoing housing crisis by financing good quality loans and supporting small- and medium-sized enterprise (SME) housebuilders.

UK’s Investment Platform Kuflink Connects Open Banking Services to their P2P Platform

As noted by Kuflink‘s management, January was quite a busy month for them, with many new feature releases and updates to their previous releases. The company is hoping that their clients appreciate these updates.

Kuflink adds select IFISA loans to secondary market

Kuflink investors can now buy and sell select Innovative Finance ISA (IFISA) loans on the peer-to-peer lending platform’s secondary market.

Kuflink’s new features for February 2022

January has been a busy month for us, with many new Feature releases and updates to our previous releases. We hope you enjoy them as much as we have enjoyed building them.

Quote for February 2022

“Going the extra mile. Render more and better service than that for which you are paid, and sooner or later you will receive compound interest on compound interest from your investment. The most successful people are those who serve the greatest number of people.” – 10 of 17. Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

Released

1) Released! View which deals are compounded

You can now see, at a glance, which deals you have compounded and which you have not in your portfolio. Simply head to your Portfolio to view.

2) Released! Buy and sell IF-ISA on the secondary market.

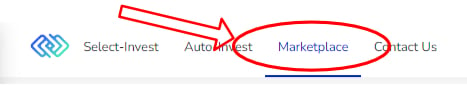

You’ve always been able to sell your Select Invest loan parts on the secondary market, should you wish to (for more detail, visit the marketplace here). But now, you are also able to buy and sell Select IF-ISA loans too.

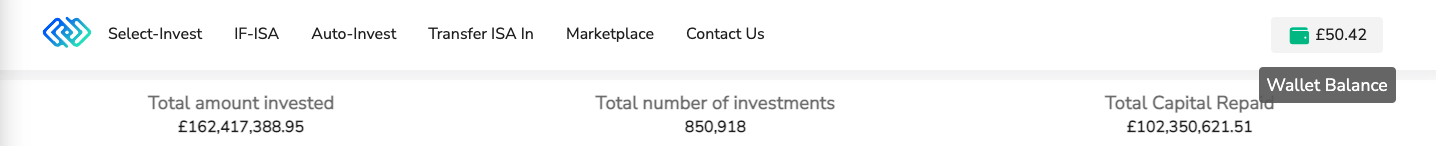

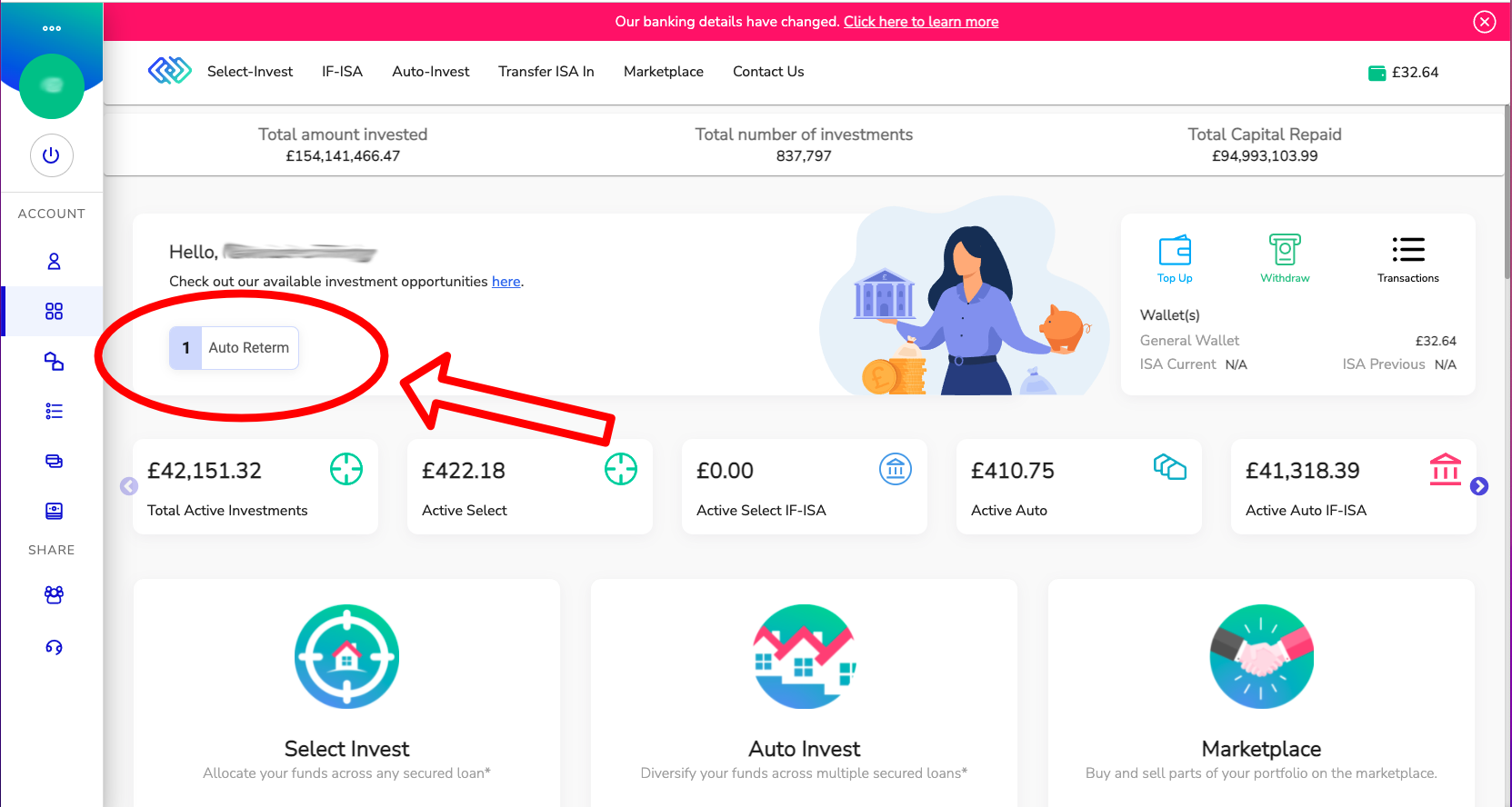

3) Released! Wallet Balance now shows the total of all Wallets.

Due to the release of new wallets:

1) General Wallet;

2) ISA Current Wallet; and

3) ISA Previous wallet

We have updated the top right wallet balance to now include the total of all wallets.

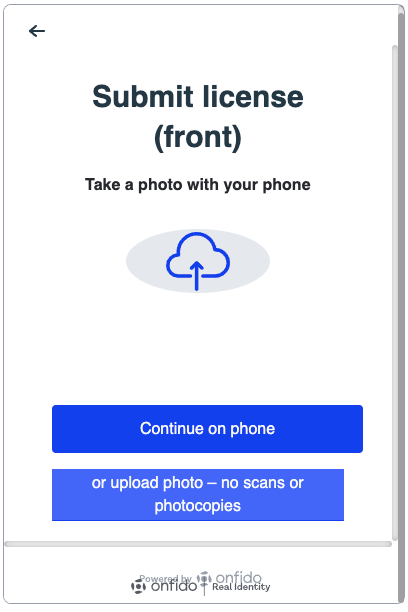

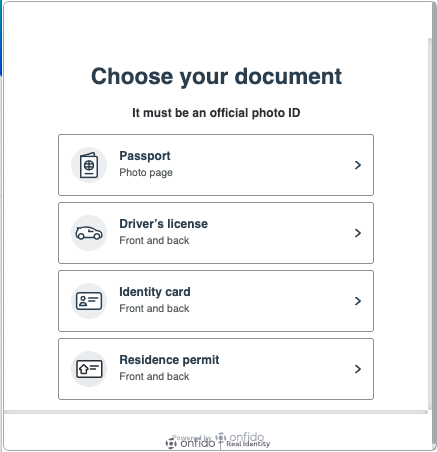

4) Released! Upgrade to our AML/KYC software

We work closely with our AML/KYC partners and have just released a new version for “Know Your Client” checks. Please note that you can either upload your ID documents via an SMS link through your mobile or UPLOAD documents via Desktop.

Now we also accept Residence Permits

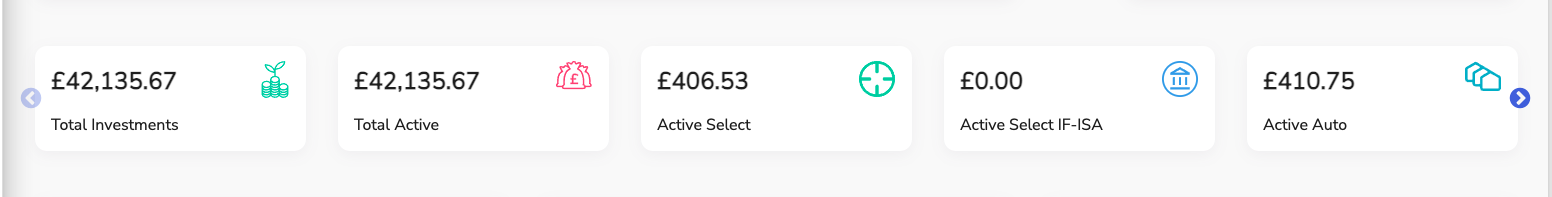

5) Released! New Dashboard Totals

Due to client requests, we have just released a new “Total Investments” figure, a new “Total Reserve” figure to include Select Invest Reserve and Select IF-ISA Reserve totals, and a “Select IF-ISA Reserve” figure.

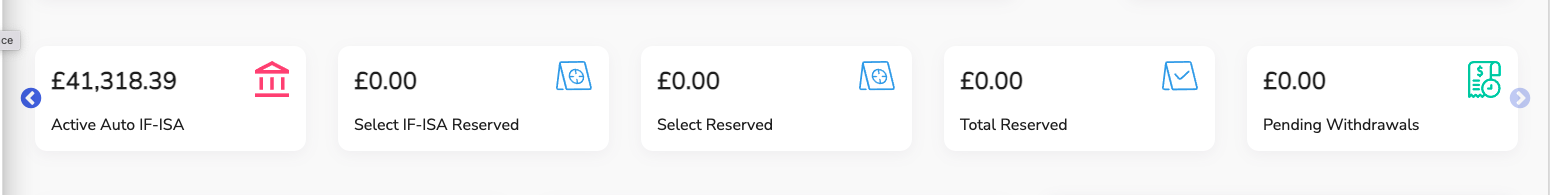

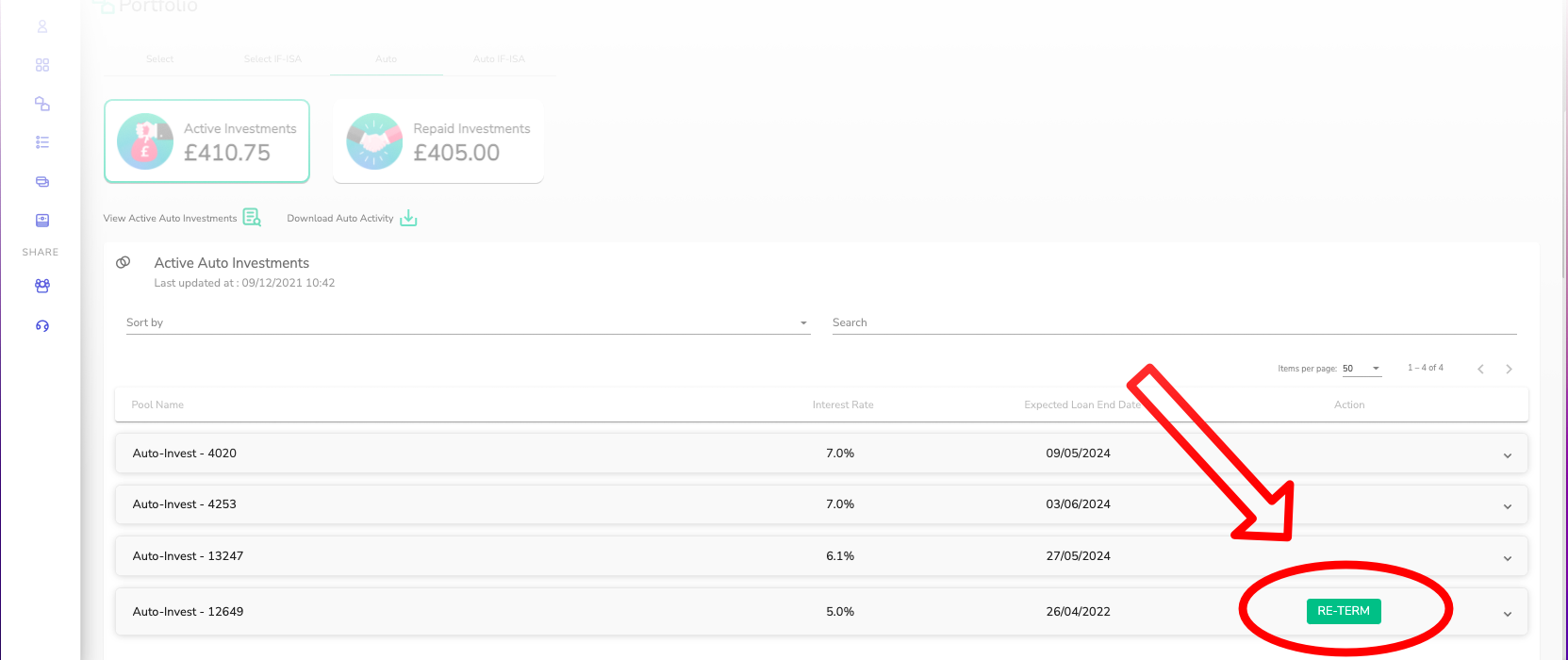

6) Released! You can re-term your Auto and IF-ISA investments on the platform before they expire

You can now re-term your IF-ISA and Auto-investments up to 190 days prior to their expiry. When multiple investments mature close together, especially at the end of the financial year, it can be a hectic time so you can now re-term early and know that your investments will continue to earn you interest. It takes just a few mouse clicks.

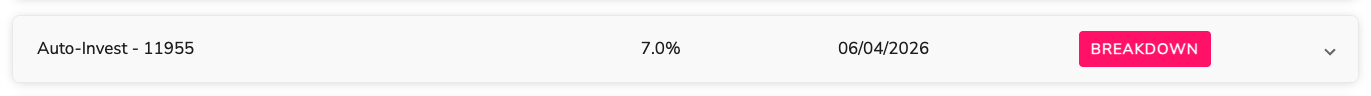

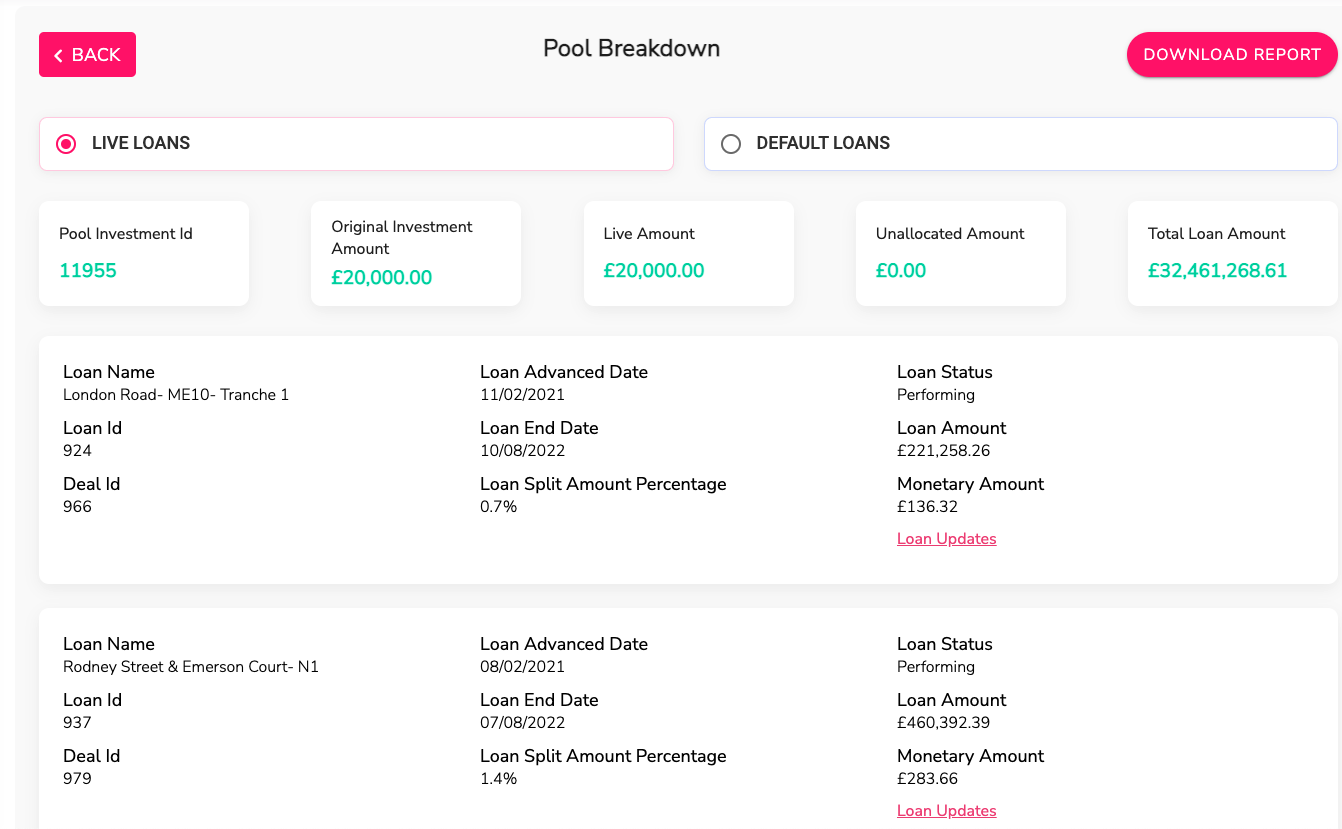

7) Released! Pool Investment Live loan Amount Break-down has been upgraded.

The real-time Pool “Breakdown” per Auto or Auto IF-ISA investment which showed unallocated cash, loan updates, default section, now has a downloadable report function, in the Portfolio section.

Breakdown

8) Released! The Audited Accounts page has had a face-lift.

In January 2022 we released our latest, 5th year of Independently Audited accounts for the platform, for period-ending 30th June 2021. We decided to upgrade the page for you with links to previously independently audited accounts for all the regulated companies and the main Group company. Click here to view the page.

Coming Soon

1) Coming Soon! We are in the process of showing images of how our development loans are progressing.

This is part of the new features to show where each development loan is in regards to our new 7 phases of development – work has started.

3) Coming Soon! A NEW segregated SIPP wallet – development has started. A SIPP is Self Invested Personal Pension, which will be done in partnership with Morgan Lloyd (a Specialist in Self-Invested Pensions).

4) Coming Soon! A NEW Environmental, Social and Governance (ESG) page is being built, to show information such as sponsorships, funds and time allocated to charities, Taxes paid, Green property developments funded, Governance committees established, etc. We will also show some of Kuflinks Key performance indicators (KPI’s) to demonstrate our adherence to the New Consumer Duty coming in the 3rd quarter of 2022.

5) Coming Soon! Pre-notification system for Bank transfers to the Kuflink wallet. We have nearly completed this system where you can advise us of any bank transfers that you have made on the day. This will assist us in updating our systems to expect funds from you.

Update!

1) Update! We have completed our first Consumer Duty Survey and the results were amazing. But we have also taken on board some of your suggestions, some of which has been released already and some will come through shortly. We are most grateful to all those who took part, as together we are fulfilling our purpose to “connect people to financial freedom”.

2) Update! We have connected our Open banking platform to our P2P Platform successfully, to enable bank transfers to be immediately updated to Kuflink client wallets. We are still working with NatWest in regards to NatWest to NatWest transfers which are still manually uploaded. But we are hopeful this will be resolved by our next Tech Blog update.

Chief Technical Officer’s (CTO) thoughts for February 2022

We have been lending money secured on property, for 10 years (since 2011), and have operated an online electronic Peer to Peer platform for 5 years (since 2016). We have just launched an Open banking Platform this year (2022). Throughout this period, Kuflink has ensured no investor has lost a penny thanks to our:

- Experienced Underwriting team;

- RICS approved valuers;

- SRA approved Solicitors;

- Credit committees (with developers, valuers, and bankers experience);

- Experienced Collections Team; and

- Experienced Board of Directors.

We are excited about the future and are now looking into applying tech to a variety of data sources to empower our due diligence, underwriting and monitoring processes. Artificial intelligence (AI) is the next frontier for lending and we have started building support algorithms to help us predict future trends based on historical data (implicit and explicit). As we grow, we intend technology to stay at par with all our processes/controls – Due diligence, Collections, Compliance, Risk and Control frameworks and Operational resilience.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Who can Invest in an IFISA?

What Is An IFISA?

With the increasing popularity of alternative finance, the UK government introduced Innovative Finance ISAs (IFISA) on 6th April 2016. The purpose was to provide investors with an alternative asset class and a way to diversify their investment portfolios.

The IFISA enables investors to invest in Peer to Peer (P2P) loans and receive interest in a tax-free wrapper. It means that any interest you earn through P2P loans will not be subject to tax, and will not count towards your saving allowance.

However, there is a limit on how much you can subscribe to ISAs every tax year, known as the Annual ISA limit. Currently, the annual allowance limit in the UK is £20,000. You can either fully deploy this allowance in an IFISA or spread it across different types of ISAs.

In addition, you can also transfer funds from cash ISAs, stocks and shares ISAs into IFISAs. Your previous year’s ISAs do not count towards the current year’s allowance, so it provides you with a great opportunity to explore P2P lending.

Who Can Open An IFISA?

To open an IFISA account, you must meet some requirements including:

- You must be of age 18 or over

- You should be a resident of the UK

- A crown servant, spouse, or civil partner if you are not a UK resident.

How Do IFISA Transfers Work?

The rules for transferring your ISA savings to Innovative Finance ISAs are the same as those governing you for transferring to cash or stocks and shares ISAs. You can open only one IFISA account each tax year. However, you can transfer funds from your cash ISA or stocks and shares ISA to an Innovative Finance ISA.

You can transfer funds by following simple steps:

- If you want to transfer cash from your current tax year’s cash or stocks and shares ISAs, you have to transfer the full amount.

- From your previous year’s ISAs, you can transfer as little as you want to, and it will not affect your current year’s annual allowance.

- You need to fill out a transfer form given to you by the innovative finance ISA provider you choose to transfer funds to.

- You should not withdraw cash from other ISAs to transfer because it can impact your current annual allowance.

- You can transfer cash, if you have stocks and shares, you have to sell them, and then the cash will be used to invest in P2P loans.

How Many ISAs Can You Have?

You can have different ISAs, but you can open only one IFISA account per tax year. As of the 2022-23 tax year, you can collectively invest up to £20,000 in all ISAs. It is your choice whether you want to spread this investment across Cash ISAs, stocks and shares ISAs, Lifetime and Innovative Finance ISAs, or invest all money in a single type of ISA.

By opening an IFISA account with Kuflink, you can start investing with just £100 and earn up to 7.44% (compounded rate of return) gross interest per annum.*

Why Choose Kuflink IFISA?

Kuflink provides an opportunity to invest in property-backed loans* and enjoy the benefits of tax-free returns that come with ISAs.

1) Auto Invest IF-ISA, which allows you to create a diversified portfolio and spread your investment and risk across multiple property-backed loans*. In addition, you can choose loan terms and earn interest in relation to it. Kuflink’s Auto-Invest IF-ISA comes with the following features:

- Up to 7%* gross interest per annum.

- Blended LTV & LTGDV circa 65%.

- Flexible terms of 1,3, and 5 years.

- You can get started with £100.

- Entire Pool secured against UK Property* (1st & 2nd legal charges).

- Diversify your funds across multiple secured loans*.

- Tax-efficient Innovative Finance ISA wrapper

2) Select Invest IF-ISA – where you can allocate your funds across any secured loan* and get the tax free benefits you do in Auto Invest IF-ISA.

- Up to 7.44%* gross interest per annum.

- Secured against UK Property* (1st & 2nd legal charges).

- Secondary market available for Select Invest IF-ISA investments (T&C’s apply)

- Kuflink co-invests up to 5% in every loan with you*

- ISA Previous and ISA current wallets available

- Tax-efficient Innovative Finance ISA wrapper

Interested in learning more? Visit https://www.kuflink.com/innovative-finance-isa/ to begin.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Property Trends Investors Must Know

From the start of 2022, we have seen the resilience and strength of the UK property market. The property prices and rents are increasing exponentially in some areas across the country. As a result, property investors are looking for new investment opportunities after seeing this post-pandemic boom in the real estate market. So, let’s look at four property trends in 2022 for smart investors.

Increase in prices, but ease in momentum

The property experts expect the property prices to increase but not with a speed witnessed in 2021. According to Rightmove’s prediction, the frantic pandemic will lower this year and return closer to normal1. They expect the current national asking price of the market, £342,401 to rise by 5%, which means there will be an increase of around £17,000 in 20222.

The Private Rental Market Will Continue to Display Positive Growth

The UK rental market is expected to be strong and grow continuously. According to a report by Zoopla, the rental market sector is expected to rise by 4.5% in 2022. Their UK Rental Market Report shows that in the year 2021 the rents were up by 4.6%, after a rise of 3% due to increasing demand in city centres. The rent increase has hit a 13 year high because city centres’ rental property demand has increased3. About a third of millennials are expected to live in rental properties their entire lives.

More focus on Sustainable Eco Living

With the increase in climate change, we could see homeowners setting targets to improve the energy performance of their homes this year. In the UK, homes caused up to 15% of greenhouse gas emissions in 2018. The government recognises that if they have to meet Net Zero, there is a great need to eliminate emissions from the housing stocks by 2050. Eventually, the government introduced its Green Finance strategy in July 2019, intending to grow green finance products and increase home energy performance improvements.

The Midlands and the North Will Continue to Outperform

We also expect that Prime Minister’s Levelling Up policies will continue closing the north-south divide. The JLL’s 2022-2026 UK residential forecast report describes the top-performing cities and regions, depending on economic, social and market factors, thus providing the most accurate forecast4. West Midlands is expected to lead the UK’s house prices with 7% growth during this period that is 2% higher than the national average. Southwest, Scotland and Yorkshire are also expected to see similar growth. However, the slowest growth is expected to see in London properties that is only 3%5.

As a whole, we can say that the UK property market trends will remain buoyant in 2022 due to pandemic related trends and structural shortage of housing. As a result, the market is expected to be more stable and less frantic than in 2021.

Moreover, this renovated trust in the resilience of UK property will lead to the growth of the market further and result in more investment and development activities.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

1The pandemic property market will return to ‘closer to normal’ in 2022

2 UK Property Market Forecasts 2022

3 Rent increases hit 13-year high as demand in major cities doubles

Investing to Stay Ahead of Inflation

Earning money is hard, and if you think your money isn’t going as far as it used to, you are not wrong. However, the increase in prices across the UK economy is real. Therefore, you need to understand what it means for you and take steps to stay ahead of inflation.

All of the below is for information only. Please always seek professional advice before acting.

So, what is inflation?

Inflation is a gradual hike in prices across an economy, and it is usually caused by an increase in consumer demand or production costs. This rise in prices is felt widely across goods and services, along with the products included in our weekly groceries and the energy we use at home. Therefore, it is called a rise in the cost of living.

The most common measurement of inflation rate in the UK is the Retail Price Index (RPI), which can be used to calculate such things as rail ticket prices or mobile phone contract prices. However, the different ways these indices track change in pricing and the items in the basket of goods can vary.

You must know that the Pound value does not follow inflation in the UK, which means that while the prices increase, your money falls behind in real terms.

How does inflation affect investments?

Effects of inflation can be negligible in the short term, but they significantly affect the real value of your money and investments over time. For instance, if you owned £10 twenty-one years ago, the goods you could have bought would now cost around £17.24 and this shows how its purchasing power has been decreased by 42% due to inflation, equal to 2.8% a year.

While inflation over the next twenty years may rise more slowly than it has in the past, a low inflation rate can build up or compound to erode the actual value of money over time unless you plan to beat it.

Let’s get to some serious business of investing our money to stay ahead of inflation.

Best Investments to Stay Ahead of Inflation

If you want to protect your wealth, you need to invest, keeping in mind inflation and selecting assets that can keep pace with rising prices naturally. Such assets mainly include real, tangible assets, or investments that can pay a variable interest rate and increase over time.

Unfortunately, you still can lose money because of inflation with a high-interest rate since high-interest rates are usually paired with high inflation rates. The Bank of England uses it as a tool to cool a steep rise in the cost of living. Let’s review some inflation-proof investments so you can protect your wealth.

Equities

Investments that are linked to the stock market have proven to beat the impact of inflation when held consistently and long-term, delivering returns ahead of prices, although past performances shouldn’t be a guide for future investments. As prices increase, the profits and revenues of the companies selling services and goods increase, raising both the value of their shares and, in some cases, the payments made to shareholders.

Some equities, especially those in specific sectors, have shown an even better record in terms of performance in the past and have usually outperformed the markets themselves. These growth stocks can provide even better opportunities for people looking to boost their wealth to stay ahead of inflation. However, fluctuations in the prices can mean they are high risk.

Real Estate (or property investments)

Real estate investment is a very common and popular option for investors because of its accurate and reliable nature. However, it can be a complicated asset because investors need a high initial cost. Therefore, retail investors can access property indirectly by collective property funds while gaining many of the advantages experienced by investment landlords.

Investing money in real estate can be an excellent choice to keep up with inflation due to investment returns and the asset involved in this investment. Usually, investors can benefit from the properties in two ways: rental income from the tenants and the increase in property value at the time of sale. Generally, the property’s value has increased more than the inflation rate as the demand for the property increases, which also causes a cumulative effect on the rent that investors can generate. Such an increase in value makes property investment one of the best investments to keep up with inflation and a source of income generation in the long run.

In some recent years, investors have been facing some difficulties in gaining access to collective property funds. So you need to understand the restrictions and get advice from real estate experts.

Peer to Peer Lending

With rising inflation, unless you take some risks with your money, you might be losing money. However, while traditionally shares were thought of as the only way to seek higher returns, Peer to Peer lending has proven to become more popular among people wanting to earn profit without having to dip their toe in the stock market or property market.

For instance, Kuflink offers 7.2%* gross per annum for people who lend their money in Peer to Peer loans secured against UK Property*.

Furthermore, you can reduce the risk by diversifying your investments across loans using Pool products.

Bonds

Bonds are usually considered safer and less profitable assets for investments. However, they can outperform inflation in the long run. In the last two decades, the interest by government bonds has maintained reasonable value compared to inflation. But, in recent years, bond yields have been lower, and they might not rise to the previous levels.

There are other types of bonds that provide high yields. However, the index-linked bonds usually provide an effective hedge against inflation in the long term. Index-linked bonds work because they offer variable interest rates that change with inflation, which is generally linked to an inflation index like CPI or RPI. But, keep in mind that these bonds are sensitive to change in interest rates and their prices fluctuate depending on the current economic outlook.

Commodities

The word commodity is usually used for precious metals and raw materials such as timber, copper, and gold, which are used to produce goods worldwide. However, it can also be used for some consumables that include gas and energy. The price of commodities is highly influenced by the demand and production of commodities all over the world. Thus, we can say that it directly links the prices paid by consumers for services and products they need.

Commodities offer a great hedge against inflation and are useful to diversify investment portfolios. Thanks to the Exchange Traded Funds (ETFs), it is easier to track the price of different commodities accurately.

All Investments Are Not The Same

As we have described, there are some assets that can help you to overcome the effect of inflation but there are also many other ways to invest, and you should keep in mind that all investments do not behave in the same manner. All the investments have their benefits and drawbacks. It is essential to build a diversified investment portfolio to get the benefits of each investment while reducing the amount of risk on your capital.

Although investing for inflation is vital to grow your money and maintain its value, it should not out weigh your long term investment objectives. Of course, it is also imperative to hold an easily accessible cash buffer, but you should always have a clear objective and investment strategy in your priorities.

All of the above is for information only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

What We Learned From Kuflink’s First Profitable Accounts

Kuflink* has just reported its first ever profit of about £400,000, off the back of real earnings of about £3 million, for 2021.