Kuflink is Southampton FC’s P2P Investment Partner

Kuflink, a Peer to peer Platform, and Southampton FC share similar values and aspirations, making this partnership opportunity the ideal fit.

£50 Million Milestone for P2P Investment Platform Kuflink

Having undertaken just over 300,000 investments, in mid-June the P2P Investment Platform announced it had funded over £50 million worth of bridging and development loans since its establishment.

Kuflink to target development finance

Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2020/12/Kuflink-to-target-development-finance-_-Peer2Peer-Finance-News.pdf

Coffee With Kuflink: A chat with Kuflink CEO Narinder Khattoare

We chat with Kuflink CEO Narinder Khattoare again, in our feature “Coffee with Kuflink”. This week: Prudence, Professionalism and Performance

When I was looking for a summary of what investors should be looking for in an investment vehicle, the three PS above seemed an appropriate shorthand to apply when searching for the right path to take.

As a P2P platform, Kuflink has managed to tick each box for its investors. Kuflink’s philosophy is based on a prudent approach to investment by ensuring that all of its investment opportunities are properly assessed and secured against property* which has been properly valued. In 4 years, (although there are no guarantees) not one investment has lost any part of our investors’ money*.

Our whole ethos is based around a team which is justifiably proud of its professionalism and deep knowledge of the property market. Our systems are designed to make investment on our platform as simple to navigate as possible and our online tools provide investors with all the information they need to make positive decisions over their future investment.

During the pandemic, Kuflink has maintained its presence in the market and continued to lend, where some of our peers have not. At the same time our approach saw us adjust our risk appetite to reflect the potential changes in the property market by reducing Loan to Values (LTVs), increasing terms and being particularly vigilant over valuations and cautious about large retail units.

Finally, our performance has remained consistent with realistic returns being offered and paid out*. In fact, unlike some of our competitors we have continued to pay interest to our investors throughout lock down.

That is the Kuflink difference.

Coffee with Kuflink; a chat with Narinder Khattoare, CEO

The first in a new series we’re bringing you; Coffee with Kuflink. An informal chat – what’s new, what’s current, and what’s on our minds.

Narinder Khattoare said, “There is no doubt that lenders like Kuflink have come through the COVID crisis very well. So many lenders dependent on the whims of their funders had to pull out and have yet to return. As a P2P business offering investors strong but sensible returns backed by the value of commercial property*, we were largely insulated and able to lend throughout the lockdown period.

We have been able to help a number of adviser firms who had clients caught out when their favoured lenders pulled offers or closed the door to new business. It also brings into perspective the old chestnut surrounding headline rates. So many brokers have been conditioned to look for the cheapest product, which is fine in principle if we are looking at long term lending but makes little sense in bridging particularly with terms of less then one year. Advisers should be looking for funding on which their clients can rely, rather than chasing a rate, for which very few cases will actually qualify and if they do, the money ‘saved’ in interest is actually negligible in real terms. At Kuflink, we maintain that the quality of service and funding availability we provide more than offsets the paper thin difference in interest charged.

In terms of what we are looking for as a lender, the answer is to move towards a stronger appetite for development finance, which we feel will be an area which is going to see considerable growth as the property market comes back to life.

Part of the reason also lies with the changing habits of investors, many of whom are looking to invest over longer periods, which would fit nicely with longer term development projects.

Ultimately though our mantra is that if we like the asset, can see a proper exit strategy then we are happy to lend over any term our products will allow from a few months upwards.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed.

Parked Prices; A Look Back On April

Month four of lockdown, and there seems to be some light at the end of the tunnel.

Let’s reflect briefly over the changes throughout the economy during these strange and unprecedented times and see how the property market fared.

April; month one of lockdown. The worrisome unknowing of COVID-19 was at its peak, freedom of movement had been restricted, and a downturn was inevitable.

What was the effect?

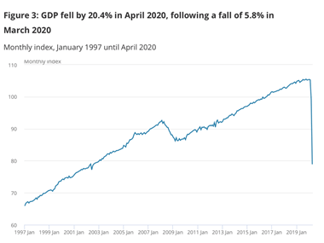

“April’s fall in GDP is the biggest the UK has ever seen, more than three times larger than last month and almost ten times larger than the steepest pre-covid-19 fall. In April the economy was around 25% smaller than in February.”

Jonathan Athow –

Deputy National Statistician for Economic Statistics

Record falls were also seen across all sectors:

- Services – largest monthly fall since series began in 1997

- Production – largest monthly fall since series began in 1968

- Manufacturing – largest monthly fall since series began in 1968

- Construction – largest monthly fall since series began in 2010Where did this leave the property market?

Guilfoyle, J., Rubinsohn, S., Ellison, S., Parsons, T. and Zehra, K., 2020. UK Residential Market Survey. [online] Rics.org. Available at: <https://www.rics.org/uk/news-insight/research/market-surveys/uk-residential-market-survey/>

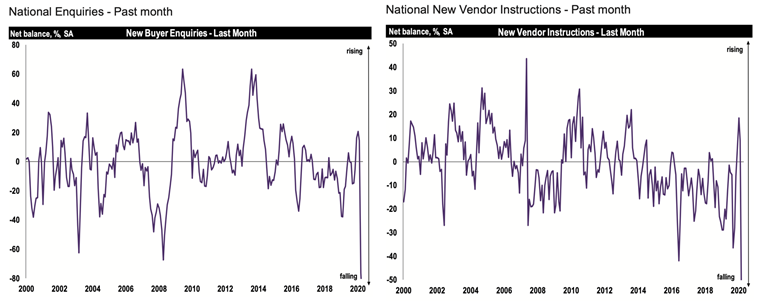

The two graphs above show market demand through enquiries (left), in comparison with new vendor instructions (right).

RICS reported in April that “80% of survey contributors have seen buyers and sellers pull out of transactions” as a direct result of the pandemic (Guilfoyle et al., 2020).

This might seem alarming, however; Savills report on April demonstrated there to be no change in price (Hampson and Buckle, 2020). This was due to efficient market forces. New vendor instructions “fell in sync” with enquiries (Hampson and Buckle, 2020) as a result; property prices remained constant throughout April. It can be argued that actors within the market acted rationally during April. The combination of previously agreed sales being executed, and a pause in activity; enabled the property market maintained its value.

With property showing itself to be a good form of security, maintaining value during COVID-19’s first month of lockdown; sectors such as the P2P industry consider themselves to be in a forward-facing position. Narinder Khattoare, CEO at Kuflink, an exclusively property backed investment P2P company; is optimistic in future market conditions, stating that the steadiness in property prices “helps to show the effectiveness and stability of the P2P industry during times of crises” *. With properties maintaining their prices throughout April and May, and with COVID cases decreasing throughout the UK, the reopening of the market will have a positive impact on the P2P industry. In Narinder’s view; “Pent up demand will act as a catalyst” in propelling the industry forward, coming out of lockdown. Savill’s report echoes this sentiment, adding that although there is a pent-up demand, that demand has changed with an increase in desire for countryside properties and those with a garden. (Hampson and Buckle, 2020).

April was a strange time for everyone. Nearly all activity ceased, and fear increased. Looking back and analysing various sources of data; the efficiency of the market, along with policy implementation has prevented a repeat of the 2008/2009 housing crises. The drop in enquiries, along with new vendor instruction enabled value to be stored and an equilibrium maintained. For sectors such as the P2P industry, house prices remaining constant has been a great additional advantage, easing borrower and investor fear, whilst giving the sector an opportunity to prove its strength, and capabilities during economic downturn and crises.

Written by Jarom, June 2020.

References:

Athow, J., 2020. GDP Monthly Estimate, UK – Office For National Statistics. [online] Ons.gov.uk. Available at: www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/april2020

Guilfoyle, J., Rubinsohn, S., Ellison, S., Parsons, T. and Zehra, K., 2020. UK Residential Market Survey. [online] Rics.org. Available at: www.rics.org/uk/news-insight/research/market-surveys/uk-residential-market-survey

Hampson, E. and Buckle, C., 2020. Savills UK | UK Housing Market Update – May 2020. [online] Savills.co.uk. Available at: www.savills.co.uk/research_articles/229130/300057-0

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Please read our risk statement for full details.

Warwick Crescent: Development Finance in Action

At the start of 2018, a property professional with impressive plans for a new housing development approached us seeking just over £3.5 million to bring his vision to life.

Money well lent

Luckily for him, Kuflink Bridging know a great project when we see one and were keen to help. Fast forward a year and we’ve lent £3,214,000 to date, which a quick wander around the site suggests is money well lent!

Warwick Crescent is a brand-new waterfront housing development of 9 high spec, 4-bedroom homes, all complete with their very own private garage, driveway and garden. It is based in the historic Kentish town of Rochester and has an anticipated gross development value of £5,075,000.00.

From hard work, to house, to home

As of 15th January 2019, independent valuers certified that works to the value of circa £2,291,000.00 have taken place on site. So, what does a little over two million pounds get you when you’re constructing a brand new housing development?

- We started with a vacant site, that had been cleared ready for works to start

- First up, the access road was resurfaced, drainage installed and foundations laid for all nine properties

- Structural brickwork was then completed and roof structures added for all nine properties

- Next, the houses were made wind and water tight

- The builders then set about finishing the first fix of electrics and plumbing

- In February 2019, the homes were finally listed for sale!

No stopping us now!

Thanks to a bout of bad weather, our clients had to adjust their construction program with a slightly later completion date. However, after a lot of hard work, they are now approximately 3 weeks in front of their adjusted program!

If you or your clients require bespoke development finance at fantastic rates, call or email for a free quotation today – decisions in principle in less than 4 hours!

01474 33 44 88 hello@kuflink.com

Kuflink helps first-time hotelier complete a fast purchase

Kuflink was recently approached by a client who had just exchanged contracts to purchase a hotel in Wales, however had a shortfall in the deposit. He needed to borrow £210,000 to complete this purchase and to clear circa £120,000 in existing debt against the security, and was working to an extremely tight timescale.

Kuflink were able to provide a bridging loan of £210,000 in just 10 days, taking a first legal charge over two one-bedroom flats in Dartford at a loan to value of 70% as security. The client was then able to finalise the purchase of his exciting new business venture and will exit the loan at the end of the six-month term by refinancing onto a longer-term option.

Feedback from the broker

The broker for this loan, Dil Thandi at Clear Financial Solutions, was extremely pleased with the result; “I recently approached Jeff at Kuflink for a client of mine who was making his first venture into the leisure industry. My client required a speedy refinance of some property that he owned as there was a shortfall in the deposit and our client had already exchanged. Working on extremely tight deadlines and with non-standard, multi-unit freehold properties, Jeff and Kuflink were able to work to the client’s desired timescales and ensure his purchase was not at risk. I would definitely use Kuflink again and would not hesitate to recommend them to other brokers.”

Specialist Valuations? No Problem!

The Key Points

- Our client was looking to borrow £440,400

- This was to assist with the refurbishment and conversion of the security (a former care home) into 4 self-contained assisted living flats

- The clients run a company specialising in care services with over 24 years’ experience

The Context

A broker recently approached us with a niche deal from their clients, who needed £440,400 to assist with the refurbishment and conversion of the security into assisted-living accommodation. The security had previously been used as a care home and needed specialist expertise to properly appraise both its current value and the gross development value. Our broker advised that other lenders had been cautious of the deal because of this, but Kuflink have built up a trusted panel of valuers over the years and knew we had the right contacts to make it happen.

The Resolution

With the tricky valuations now complete, we proceeded on the basis of a fantastic 44% loan to value and sent funds to our client, kickstarting their 12-month conversion project in great time.

The loan is being released in tranches, with a day one advance of just over a third of the total amount. The rest of the loan will be released in accordance with the progress made with the property and in consultation with our specialist surveyors.