Kuflink’s New features for September 2021. Stand Up with CTO

The Kuflink Tech Team has continued to worked diligently to bring new features for September 2021 forward. Together, with your feedback, we are able to fulfil Kuflink’s purpose in ‘Connecting People to Financial Freedom’.

Quote for September 2021

“Going the Extra mile: When you go the extra mile, the Law of Compensation comes into play. Going the extra mile is the action of rendering more and better service than that for which you are presently paid. When you go the extra mile, the Law of Compensation comes into play.” – 4 of 17 Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

What’s New or on its way to the Kuflink Platform & Kuflink Mobile APP for September 2021

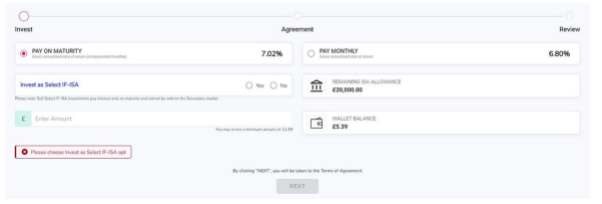

1) Released! Platform made simpler for Select IF-ISA

Our most recent improvement has been made to make it clearer for our investors when investing into our Select-Invest deals. We received a lot of feedback from people about making their Investment ISA eligible, saying it was easy to miss.

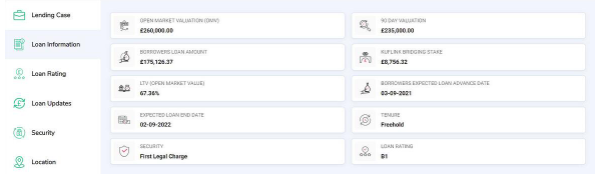

You will also see that as you click through the different scenarios of the deal, when investing (Lending case, Loan information, Loan rating etc.) we have made the information a lot clearer for our investors.

2) Released! Changes to the portfolio screen

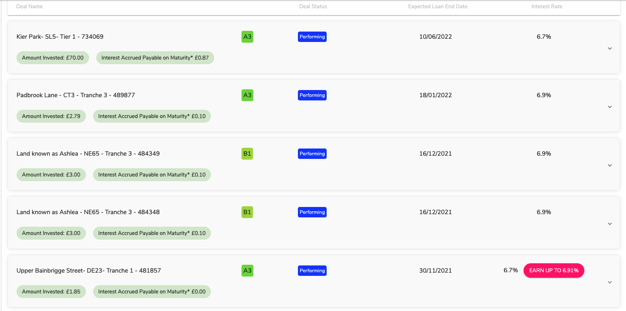

You are now able to see the amount you have invested along with the interest accrued without having to click on each of your investments.

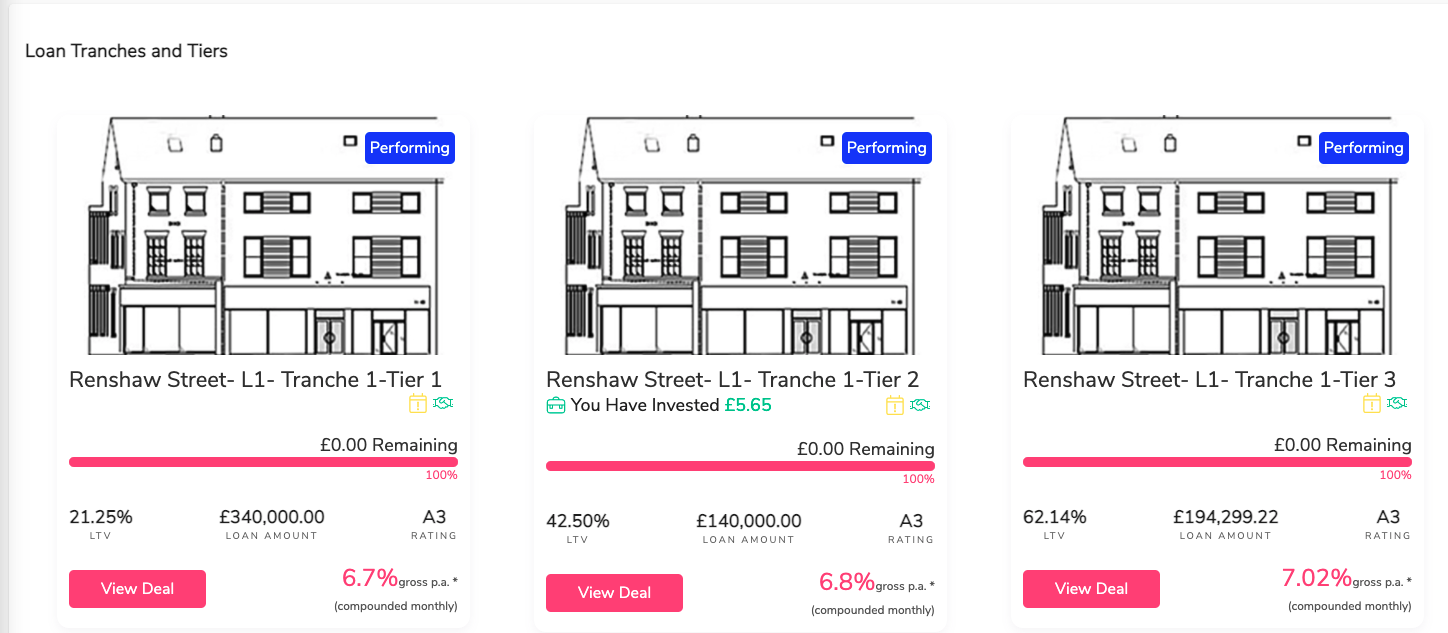

3) Released! The way we name deals has changed.

For “Land” deals, we have now put the road name first so that this will be easier for you to search your portfolio.

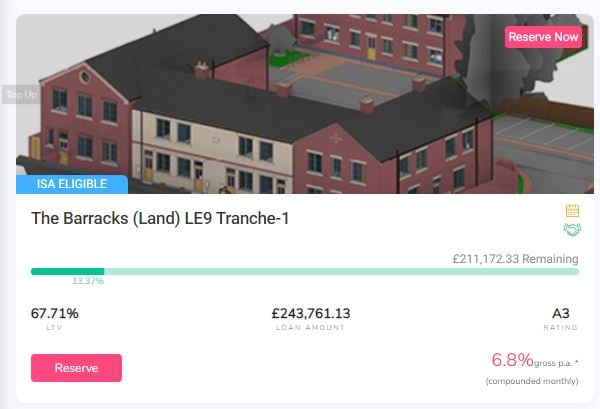

4) Released! The feature to show all other linked Tiers and Tranches in Select deals has now been introduced.

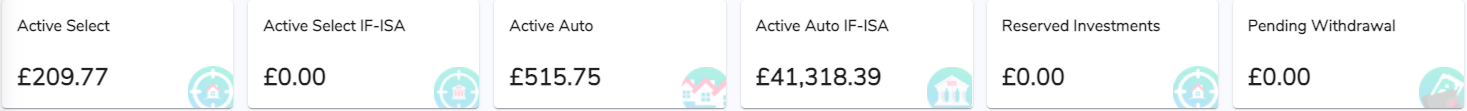

5) Released! You can now see a release of our new dashboard which shows you Select investments with or without an IF-ISA wrapper.

6) Coming Soon! We are now working on a new feature that will allow IF ISA Transfers In to enter into ISA eligible Select Invest Deals – this means clients can decide which ISA eligible Select Invest deals they want their ISA transfer to go into.

7) Coming Soon! A new segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started.

8) Coming Soon! A new feature showing borrowers who have links as individuals, shareholders or directors, to other loans already on the platform is being built. As an interim measure, we comment within the lending case if there is a link to another loan for the borrowers.

9) Coming Soon! A new feature showing where each development loan is in regards our new 7 phases of development – work is progressing.

10) Coming Soon! On the lending arm, we are currently building the process, through Open banking, to add an additional layer of borrower verification in real time and building a process to ascertain income vs expenditure for a potential borrower across all accounts. This is a step forward in reducing paperwork and unnecessary communication thereby improving efficiency in the process. All in all we should, in theory, gain access to all necessary information through a simplified online process as opposed to numerous phone calls, email chasers etc.

11) Coming Soon! Work on upgrading our proprietary deal risk / pricing tool in our CRM system by connecting to live data feeds, and allowing new fields to better assess the risk and price on deals is continuing. This is especially important in light of economic events like Brexit, the COVID-19 pandemic, and price hikes on raw materials (which will affect on-going Development appraisals). We are working with a ‘Royal Institution of Chartered Surveyors’ (‘RICS’) valuer and a seasoned developer / builder (both in our Credit committee), to further enhance the tool’s sensitivity to such events. We envisage connecting this information to our live loans on our platform to provide a timeline of any given loans risk.

12) Coming Soon! We are working on upgrading our Dashboard. Live Charts, proprietary budget tools, links to other investments, accrued interest, etc. will be on display in a singular view.

13) Coming Soon! A new feature to allow clients to re-term their Auto Invest / Auto IF-ISA investments.

CTO thoughts for September 2021

What is Fintech? This term in essence is about automating movement of funds in a simple and smooth way. Innovation is the key. Originally this would have been called the Barter System, which gradually moved to currency. Innovation is at the heart of how money is handled.

Fintech has an extra edge with technology. In our hearts we wish to “Serve our customers”, which fuels innovation. The urge of making lives simpler for our customer, understanding their pain points, quick query resolution and the need of automation together feeds our purpose.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

How To Buy a House in the UK?

Owning a home is everyone’s dream. However, buying a house means having to save more than you might have first thought. The one way to avoid any mishaps and nasty surprises down the line is to budget and understand the whole process of buying a house.

All the below is for information purposes only. Please always seek professional advice before acting.

We have created a step-by-step guide for buying a house which you can use as your checklist to becoming a homeowner.

- Decide if it is the right time for you to become a home owner

Although most people in the UK want to own their own home, it is not always the right move for everyone. There are a few things you must consider before deciding to buy a house. The most important one is, can you afford it? Also, it would be wise to sort out your finances, check your credit report, make sure you have the savings to pay for a deposit and ensure you can actually afford your monthly mortgage payments.

- You may need to sell first

If you already own a house but are looking to move, you will need to decide whether selling your house first would be an option for you or not. It may be riskier in a growing market but there are upsides to not being in a chain i.e. being a cash buyer can quite often mean you will secure a property over others who put in an offer but have a property to sell and you are able to move quickly if you have nothing to sell.

- Determine a budget

Make sure you have an estimate of how much you wish to spend. The estimate depends on the amount of deposit you can gather for the house. Also, keep in mind the ongoing and the one-off costs associated with buying a house.

These costs can add up to 15% extra and even more if you want to redecorate or rebuild.

- Have your finances in order

When buying a house, once you have decided on your deposit amount you then need to look at other aspects such as your savings, are there any funds from parents or grandparents and how much are you likely to sell your current property for. If you have a long-term savings deposit, then this might be the time to use it!

Another important thing to decide is what type of mortgage you want on your house. There are plenty of different options with mortgages so it is important to do your research to ensure you get the right one for you. If you want advice, then seeing a mortgage broker may be helpful. This way, you can go through the variety of mortgages available, and brokers can also help you if you have an unusual situation or you are self-employed.

- Decide on the location where you want to live

If you would like to continue living in the same neighbourhood, then there is not much to decide as you are already familiar with the neighbourhood. However, if you wish to move to a different town, then deciding on an area can be time-consuming.

So, try not to get it wrong. Otherwise, you can be stuck living in a place that you don’t even like. Instead, take your time to shortlist the potential areas where you would want to live and then visit each location a number of times at different times of the day so you can make an informed decision.

- Choose the property you like

Once you have decided on an area where you want to live, the next step would be to research the houses in that area and find a local estate agent.

Visit as many houses as you can and ask questions about the neighbourhood, schools, businesses etc. You can also do a lot of research online. Since you will potentially spend the rest of your life there, be sure you take your time with this.

Also, don’t forget to find out whether the property you like is leasehold or freehold.

- Make an offer on the house

You need to get yourself into the strongest position you can as a buyer. You must decide on a figure that you are prepared to pay for the house, including the fittings and fixtures and then get ready to make your offer.

- Get a mortgage

Ideally, you will have a mortgage in principle agreed before making an offer, as we mentioned in step 4. If so, once your offer has been accepted you can go to your lender and start the buying process.

- Find a conveyancer or a solicitor

Once the offer on the property is agreed upon, you must get a conveyancer or a solicitor to handle all the legal work of buying the house.

Your mortgage company and/or estate agent may well suggest some solicitors that are on their panel for you to use but you do not have to choose one of these, although it can sometimes be quicker if you do as they will have a good working relationship with them.

After getting a few quotes for solicitor fees, you will need to decide which one you are going to choose and then start the process. The solicitor will undertake all necessary searches and obtain all relevant paperwork to ensure your house move happens as smoothly as possible.

- Get a property valuation

Your mortgage company will require a surveyor’s valuation to ensure the house is in good condition to lend against. However, this will not be a full structural survey but this is something you can pay extra for.

The full survey will evaluate the condition of the house and will identify any potential issues you could face once you move in. Even though this survey is a choice, it is a good idea to get it done.

- Time to submit the deposit

Before you exchange contracts, you have to pay a 10% deposit and this will be done through your solicitor.

- Exchange of contracts

When the exchange of contracts happens, you become legally bound to purchasing the house. If for any reason, you pull out after the exchange, you will lose the 10% deposit that you submitted. Therefore, remember to exchange contracts only once you are 100% happy with everything.

In addition, before exchanging contracts, you need to decide on a day for completion with your seller, usually about four weeks after the exchange happens. Also, the exchange of contracts can only happen after your solicitor is satisfied with their searches, you have the formal mortgage offer and the 10% deposit has been paid.

Don’t forget to apply for adequate buildings insurance for your new home, which you must have in place at exchange of contracts, as you are committed to completing. Please seek advice to ensure you have the correct amount covered, such as covering VAT on reinstatement insurance is sometimes missed out. Nevertheless, upon completion, taking adequate Insurance will usually be a condition from the mortgage company.

- Final negotiations and arrangements

There may be a few final bits to sort out prior to the day of completion such as whether the seller is leaving any furniture or fixtures and fittings etc. Next, you will need to think about the supply of water, gas, SKY, Digital, telephone service, and electricity as you will need this to be transferred to your name.

Your solicitor will arrange for the land registry to transfer ownership of the property upon completion and will communicate with the mortgage lenders to confirm that the money is ready for completion.

- Completion of sale

To complete the sale of property, all funds need to be transferred between all solicitors in the chain. This process can take a number of hours depending on how many people are in the chain but this is usually complete by early afternoon. Once you have received confirmation of completion, the house is yours!

- Time to move in!

Upon completion, the seller will have to leave the house and you can collect the keys, usually from the agent. You can then move in or do the rebuilding work before you move in if needed.

All the above is for information purposes only. Please always seek professional advice before acting.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Ways to Teach Children Money Skills from a Young Age

The key to living a balanced life is managing your money well. It is one of the most basic and necessary life skills that all of us need. However, most of us don’t know where to start when teaching our kids about money. The most complicated task is to decide which age is right to educate children about finance and what to cover.

All the below is for information purposes only. Please always seek professional advice before acting.

Therefore, we are going to share some tips on how to teach children money skills from a young age.

1. Teach Maths with the help of sugar packets

Sugar packets are an easy method of teaching basic maths skills in early childhood. Parents can use the tiny sugar packets to introduce simple maths equations such as 2+2 and 4-1. Then they can slowly use this tactic to frame questions around money.

For instance, give your child a specific number of sugar packets, telling them that each white packet represents money and the brown sugar packets are the monthly electricity bills. Then ask them if, after paying bills, they have money left to buy a new toy.

Make learning engaging and fun. This way, your child’s understanding of money starts developing without even them knowing it.

2. Talk and promote a healthy attitude towards money

You can always teach practical lessons to children about money. A good place to start teaching your children about money is to encourage them to have a healthy attitude towards money. You need to show them what money is (i.e., a tool), what is it used for (i.e., we use it for a purpose and don’t earn money for its own sake) and that it is very critical to be in control of it, instead of being controlled by it.

3. Set up and play pretend store

A smart activity to use for teaching children about money is playing pretend store with your children. For starters, let your child pick a range of items from the house to put in the pretend store. Then, have them arrange those products on sofas or shelves, just to make it look similar to what they see in a real store.

Next, help them price each item with the help of paper and crayons. The price of each product in the store does not have to be accurate. But make sure to keep the prices lower, for example, between £0.10 to £1.00.

Finally, you need to give your children a few pounds and ask them to go shopping.

You should do a variation of the game and switch roles which means you shop while your child works at the register. You can teach your children about money habits by having them make choices within their means.

Throughout this play, you need to talk to them about the savings (for example, £1 off a single item and £2 off when you purchase two items, etc.) and tell them why it is essential to look for savings before going shopping.

4. Allow your kids to see how you plan your budget

Kids are observant learners. They learn by observing and copying their parents. Why not use this learning to teach them some skills? When your kids reach the age of middle childhood and up, this is the right age to teach them a little advanced level of Maths. If you write your budget somewhere or a mobile app to keep finances on track, allow your children to see the time and the effort you put in to managing your money.

They are likely to remember watching you make these decisions when they make their own future decisions.

Let’s discuss how you can achieve this.

Trips to grocery stores

When shopping, be open about your decisions, tell them why you chose an item on sale over one that is not on sale. Talk to them about why these saved pounds are important for your budget.

Visit the ATM

- Explain to them that the money coming from the ATM is coming from your bank account (money that you own and is not a loan or from a credit card).

- Discuss how much cash you are taking out and what you will use this money for.

Your kids may ask you a lot of follow up questions, such as if you have more money in the bank or how you will get more money. These are good questions to normalise teaching children about money.

5. Talk about budgeting, using their allowance

Sometimes it is OK to buy our children everything they want. But you can use this as a learning opportunity. Don’t be scared of discussing the budget with them and how money is a finite resource that should be used wisely. Involve your children in talks about finances and budgets when they are 10 or 11 years of age. Make them understand why you can’t afford to buy them something they want instead of just saying No.

Most parents give children a weekly or monthly allowance to spend. This is a great opportunity to teach them about managing finances. You can tie all or part of their allowance to different chores or good grades, which teaches them goal-setting and work ethic. Talk about savings and budgets and how they can decide what to do with their pocket money. This teaches them about financial responsibility and reinforces them to spend money more wisely.

6. Create a kid-sized budget

- Even if the numbers are small, the budgeting will still be relative. For instance, if your kids earn £5 per week in allowance, you can help them plan the money in their budget. Your kid’s budget for £5 per week may look something like this:

- £2 for spending money

- £2.50 goes towards savings

- £0.50 they can donate to a charity of their choice

Learning to make a budget endorses money skills that benefit your children for years. You may like to encourage your children to donate to charity to help them learn the importance of giving back.

7. Make them practice money handling with an app

It is important to talk to children using tools that interest them. Since this generation is all about phones and apps, use an app to help them manage money.

With an app, kids can keep an eye on their pocket money while deciding on where to spend it, and it gets them familiar with pins numbers etc. This way, they learn to manage and budget their money. They can get used to checking their account before they buy something. They can also keep up with how much they are saving up. As a parent, you can create a spending limit on the app and get a notification to keep a check on how your child is spending money.

8. Help your kids learn to save up to buy things they want

Since it has got easier to ‘buy now and pay later’, kids need to learn how and why they need to save their money. When your child wants to buy a specific toy, discuss whether that toy is worth it. Then ask them to wait for a few weeks, save their allowance and buy that toy. This way, they get the toy they wanted and learn the value/reward of savings and money. Using this exercise, your kids will learn to assess what they want, how to buy it and shop for the best deal.

9. Trust kids with the responsibility of choosing how they spend money

Finally, do not underestimate your kids. Don’t be afraid to give them responsibility. If they are old enough to understand the concept of budgeting, then allow them to decide where to buy things they would like.

For example, on holiday, talk about your holiday budget openly and make it clear to them that it is a finite amount. Allocate each child a ‘decision day’ and this way they can decide on where to spend their money like going out for dinner or an activity.

So, there you have it, we have given you nine ideas to teach your children about money. Help them grow up equipped with confidence and tools to manage their money.

All the above is for information purposes only. Please always seek professional advice before acting.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

In the Spotlight with Jeff Bungar, Kuflink

We spoke to Jeff Bungar, head of business development at Kuflink, about what its proposition offers to intermediaries and how the market will continue to react to the Covid-19 pandemic.

Kuflink mulls new BTL product suite as demand heats up

Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2021/09/Screenshot-2021-09-01-at-16.31.55.png

Kuflink introduces instant bank transfers using open banking

Copy the link below if the Read More link expires.