Parked Prices; A Look Back On April

Month four of lockdown, and there seems to be some light at the end of the tunnel.

Let’s reflect briefly over the changes throughout the economy during these strange and unprecedented times and see how the property market fared.

April; month one of lockdown. The worrisome unknowing of COVID-19 was at its peak, freedom of movement had been restricted, and a downturn was inevitable.

What was the effect?

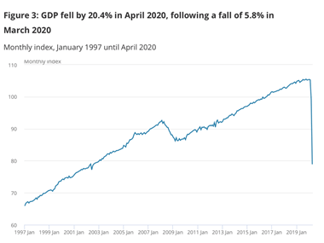

“April’s fall in GDP is the biggest the UK has ever seen, more than three times larger than last month and almost ten times larger than the steepest pre-covid-19 fall. In April the economy was around 25% smaller than in February.”

Jonathan Athow –

Deputy National Statistician for Economic Statistics

Record falls were also seen across all sectors:

- Services – largest monthly fall since series began in 1997

- Production – largest monthly fall since series began in 1968

- Manufacturing – largest monthly fall since series began in 1968

- Construction – largest monthly fall since series began in 2010Where did this leave the property market?

Guilfoyle, J., Rubinsohn, S., Ellison, S., Parsons, T. and Zehra, K., 2020. UK Residential Market Survey. [online] Rics.org. Available at: <https://www.rics.org/uk/news-insight/research/market-surveys/uk-residential-market-survey/>

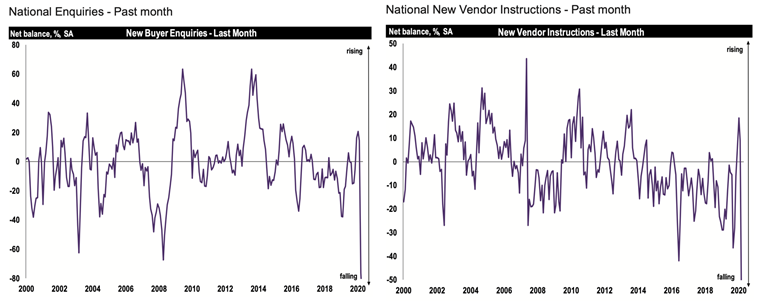

The two graphs above show market demand through enquiries (left), in comparison with new vendor instructions (right).

RICS reported in April that “80% of survey contributors have seen buyers and sellers pull out of transactions” as a direct result of the pandemic (Guilfoyle et al., 2020).

This might seem alarming, however; Savills report on April demonstrated there to be no change in price (Hampson and Buckle, 2020). This was due to efficient market forces. New vendor instructions “fell in sync” with enquiries (Hampson and Buckle, 2020) as a result; property prices remained constant throughout April. It can be argued that actors within the market acted rationally during April. The combination of previously agreed sales being executed, and a pause in activity; enabled the property market maintained its value.

With property showing itself to be a good form of security, maintaining value during COVID-19’s first month of lockdown; sectors such as the P2P industry consider themselves to be in a forward-facing position. Narinder Khattoare, CEO at Kuflink, an exclusively property backed investment P2P company; is optimistic in future market conditions, stating that the steadiness in property prices “helps to show the effectiveness and stability of the P2P industry during times of crises” *. With properties maintaining their prices throughout April and May, and with COVID cases decreasing throughout the UK, the reopening of the market will have a positive impact on the P2P industry. In Narinder’s view; “Pent up demand will act as a catalyst” in propelling the industry forward, coming out of lockdown. Savill’s report echoes this sentiment, adding that although there is a pent-up demand, that demand has changed with an increase in desire for countryside properties and those with a garden. (Hampson and Buckle, 2020).

April was a strange time for everyone. Nearly all activity ceased, and fear increased. Looking back and analysing various sources of data; the efficiency of the market, along with policy implementation has prevented a repeat of the 2008/2009 housing crises. The drop in enquiries, along with new vendor instruction enabled value to be stored and an equilibrium maintained. For sectors such as the P2P industry, house prices remaining constant has been a great additional advantage, easing borrower and investor fear, whilst giving the sector an opportunity to prove its strength, and capabilities during economic downturn and crises.

Written by Jarom, June 2020.

References:

Athow, J., 2020. GDP Monthly Estimate, UK – Office For National Statistics. [online] Ons.gov.uk. Available at: www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/april2020

Guilfoyle, J., Rubinsohn, S., Ellison, S., Parsons, T. and Zehra, K., 2020. UK Residential Market Survey. [online] Rics.org. Available at: www.rics.org/uk/news-insight/research/market-surveys/uk-residential-market-survey

Hampson, E. and Buckle, C., 2020. Savills UK | UK Housing Market Update – May 2020. [online] Savills.co.uk. Available at: www.savills.co.uk/research_articles/229130/300057-0

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Please read our risk statement for full details.