Will high savings rates kill off peer to peer?

Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2022/10/Will-high-savings-rates-kill-off-peer-to-peer_-_-Money-_-The-Sunday-Times.pdf

Kuflink’s new features for July 2022

April 22 to July 22 have been very effective months for us, with many new Feature releases and updates to our previous releases. We hope you enjoy them as much as we have enjoyed building them.

Quote for July 2022

“Budgeting Time & Money. Effectiveness in human endeavour calls for the organised budgeting of time. For the average man, the 24 hours of each day should be divided into 8 hours for sleep, 8 hours for work and 8 hours for recreation and spare time.” – 12 of 17. Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

Released – Online P2P Platform

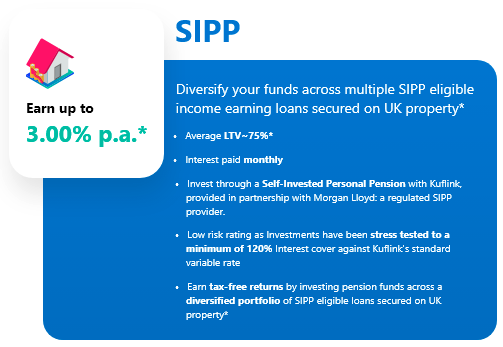

2) Released! A NEW SIPP Pool Product is now live with its own SIPP wallet. A SIPP is Self Invested Personal Pension, which will be done in partnership with Morgan Lloyd (a Specialist in Self-Invested Pensions). The SIPP Pool will have SIPP-eligible property loans. To open a specific SIPP account with us please reach out to us and we will help you through the process.

3) Released! New Updated releases for Mobile App for Android and Apple. We have completely upgraded the APP so that you now see features on the desktop that are now available on the APP. This has been a long time in the making and we are proud of the team of this Beta Release. Please ensure you download the latest version on the APP store.

4) Released! NEW Environmental, Social and Governance (ESG) page has been built, to show some of Kuflink’s Key performance indicators (KPIs), energy performance certificates for the head office, Consumer survey results, Ongoing Management information: Profit & Loss, Balance sheet, Taxes paid, Green property developments funded, Governance committees, and much more.

Click here to view the ESG Page.

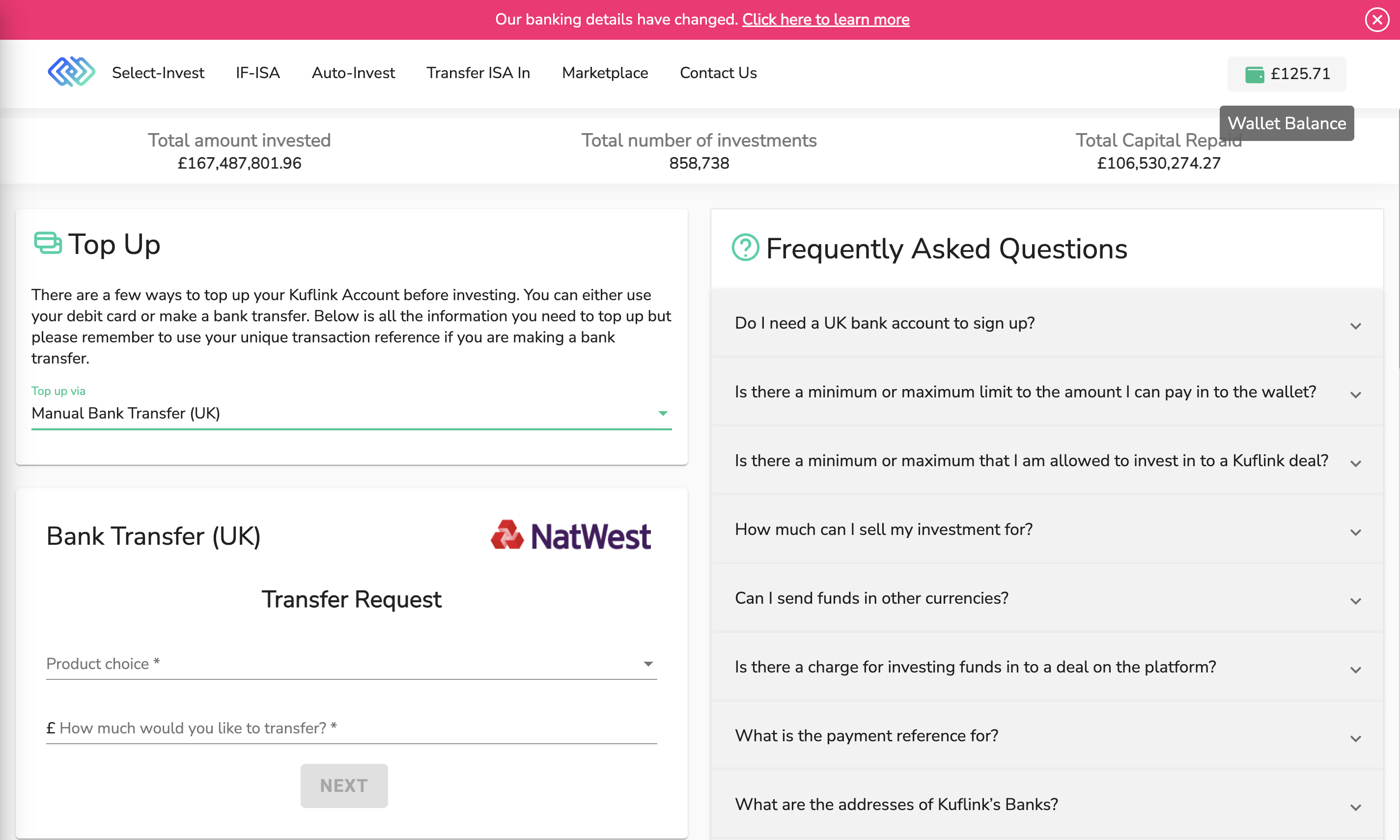

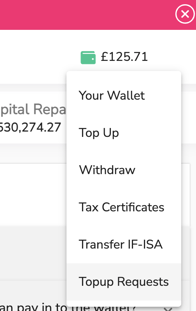

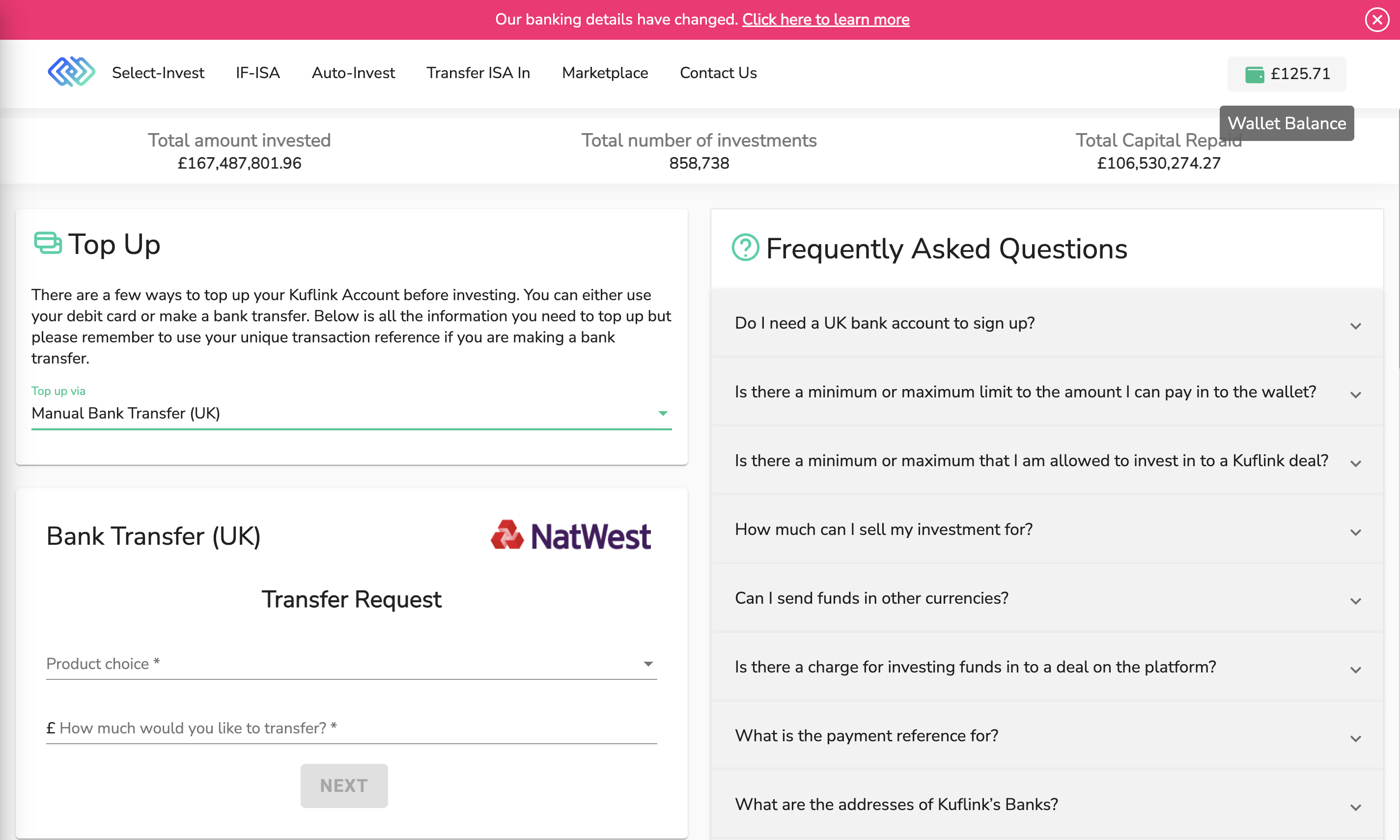

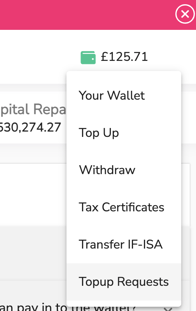

5) Released! New Notification System for Bank transfers to the Kuflink wallet. We have completed this system where you can advise us of any bank transfers that you have made on the day or expect to make. This will assist us in updating our systems to expect funds from you. To get started, press the wallet image, go to Top Up, and then choose Manual Bank Transfer (UK) from the drop-down menu. Please note, on receipt of your transferred funds they will not automatically invest into your desired product, this is still solely your responsibility.

You can amend any notification by scrolling down to Topup Requests.

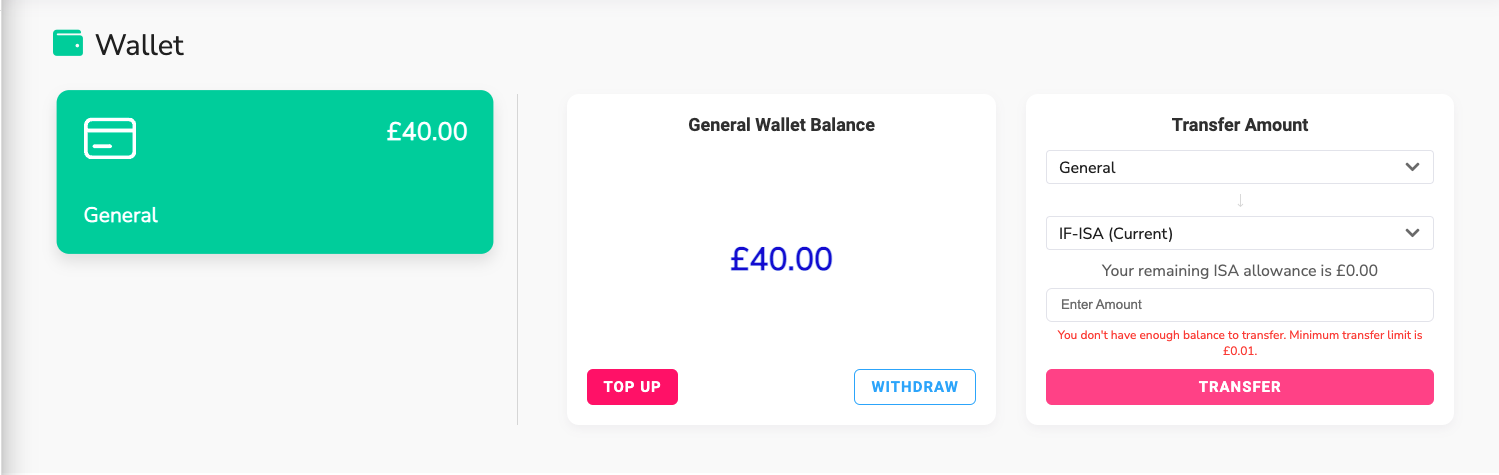

6) Released! New Wallet Balance transfer option between Wallets.

Due to the release of new wallets:

i) General Wallet;

ii) ISA Current Wallet; and

iii) ISA Previous wallet

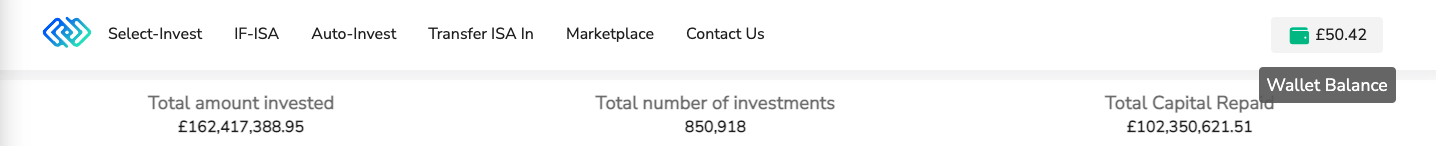

We have updated the top right wallet balance to now include the total of all wallets.

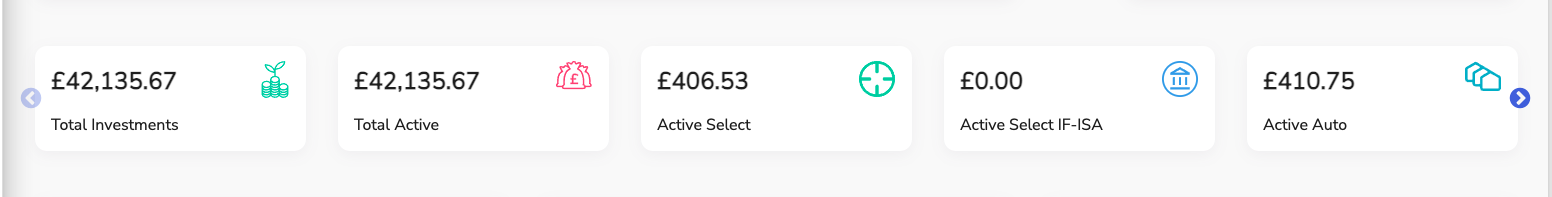

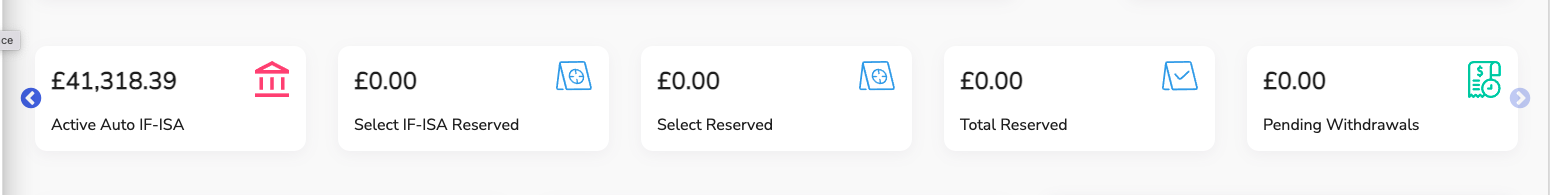

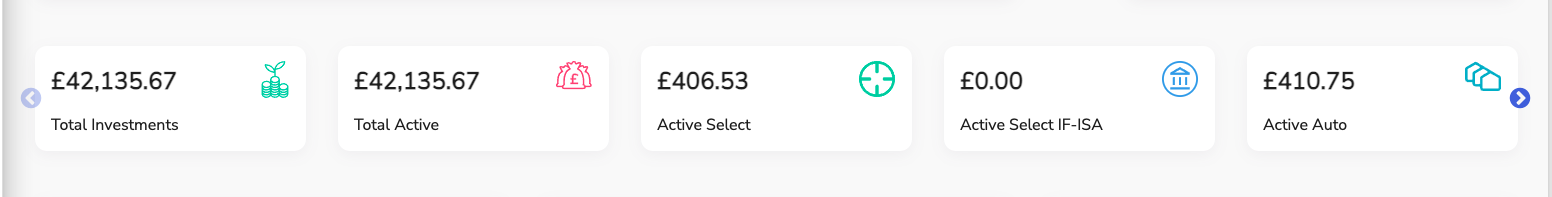

7) Released! Dashboard Totals

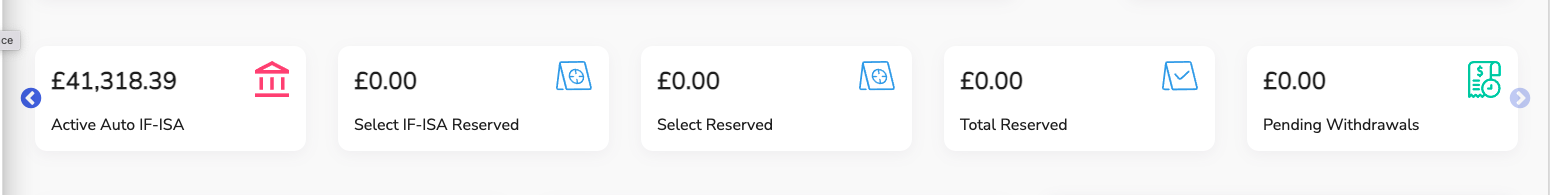

Due to client requests, we have just released a new “Total Investments” figure, a new “Total Reserve” figure to include Select Invest Reserve and Select IF-ISA Reserve totals, and a “Select IF-ISA Reserve” figure.

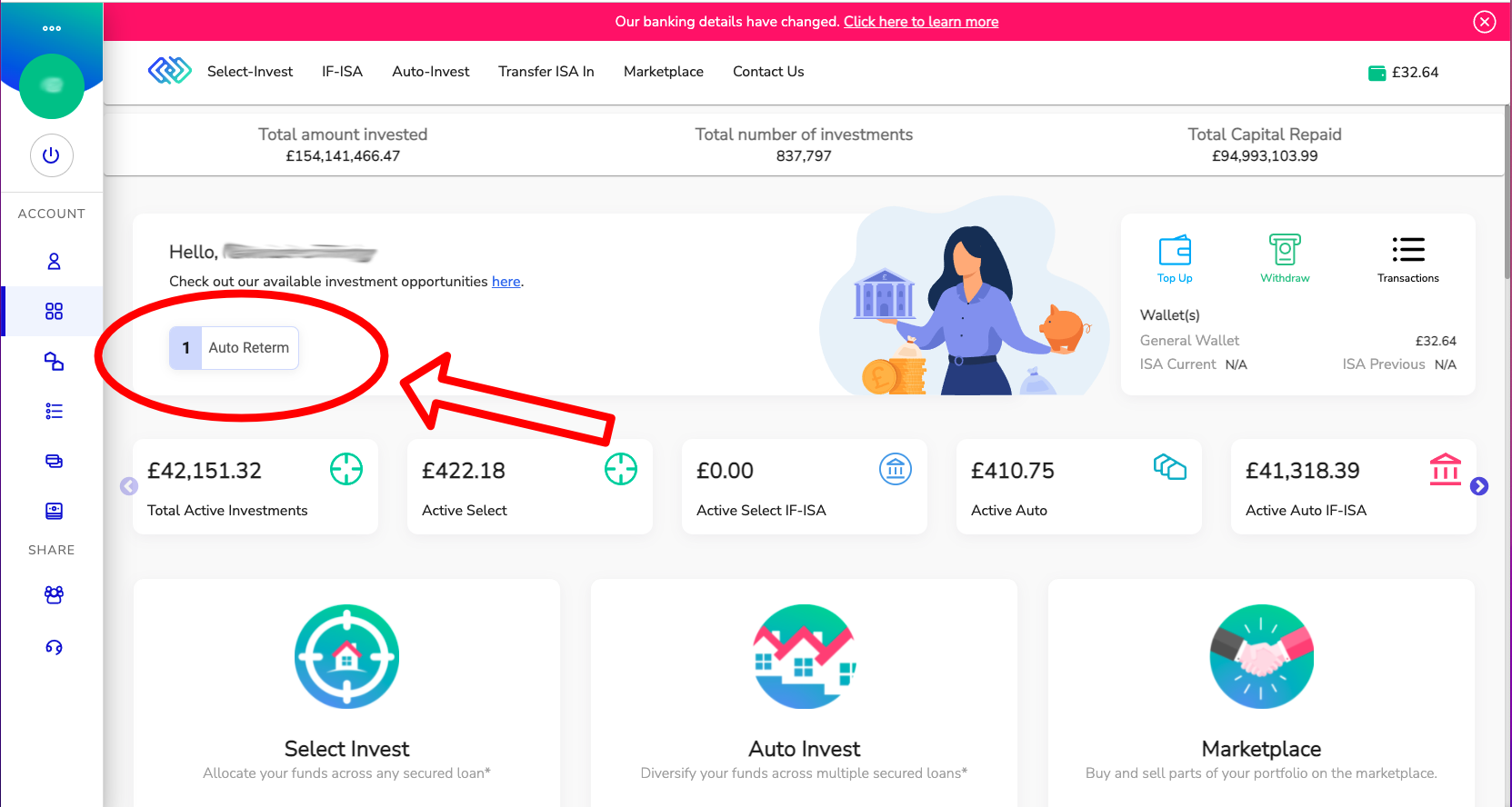

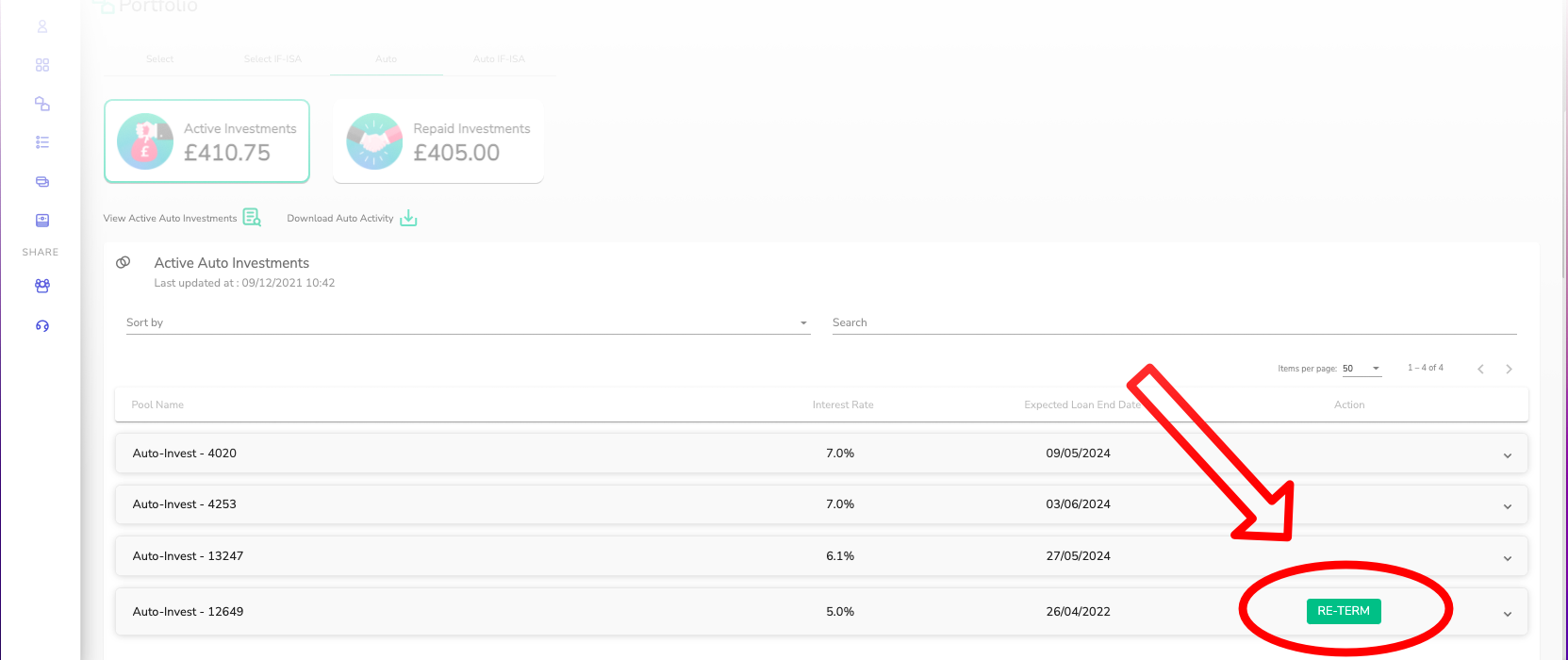

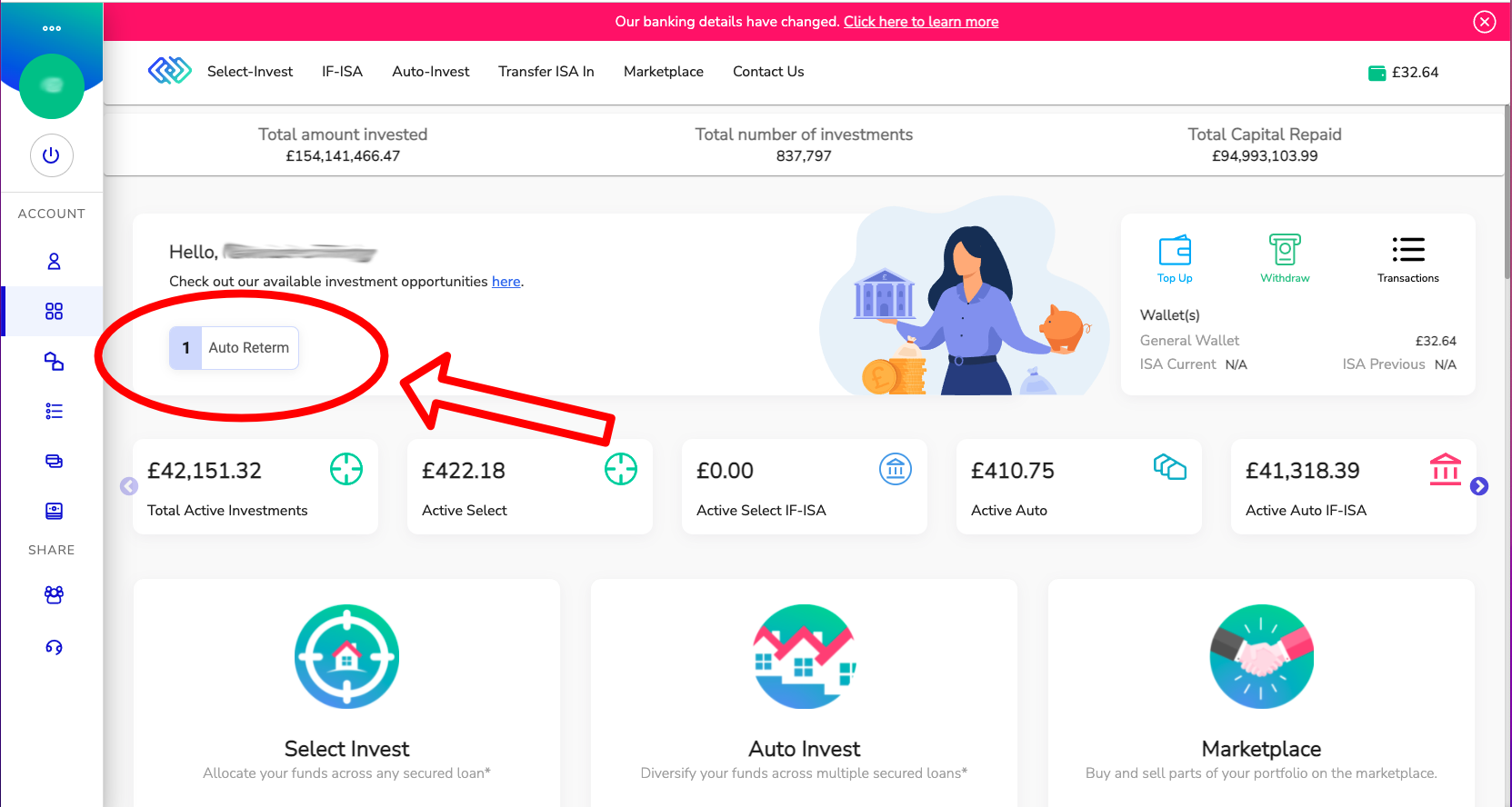

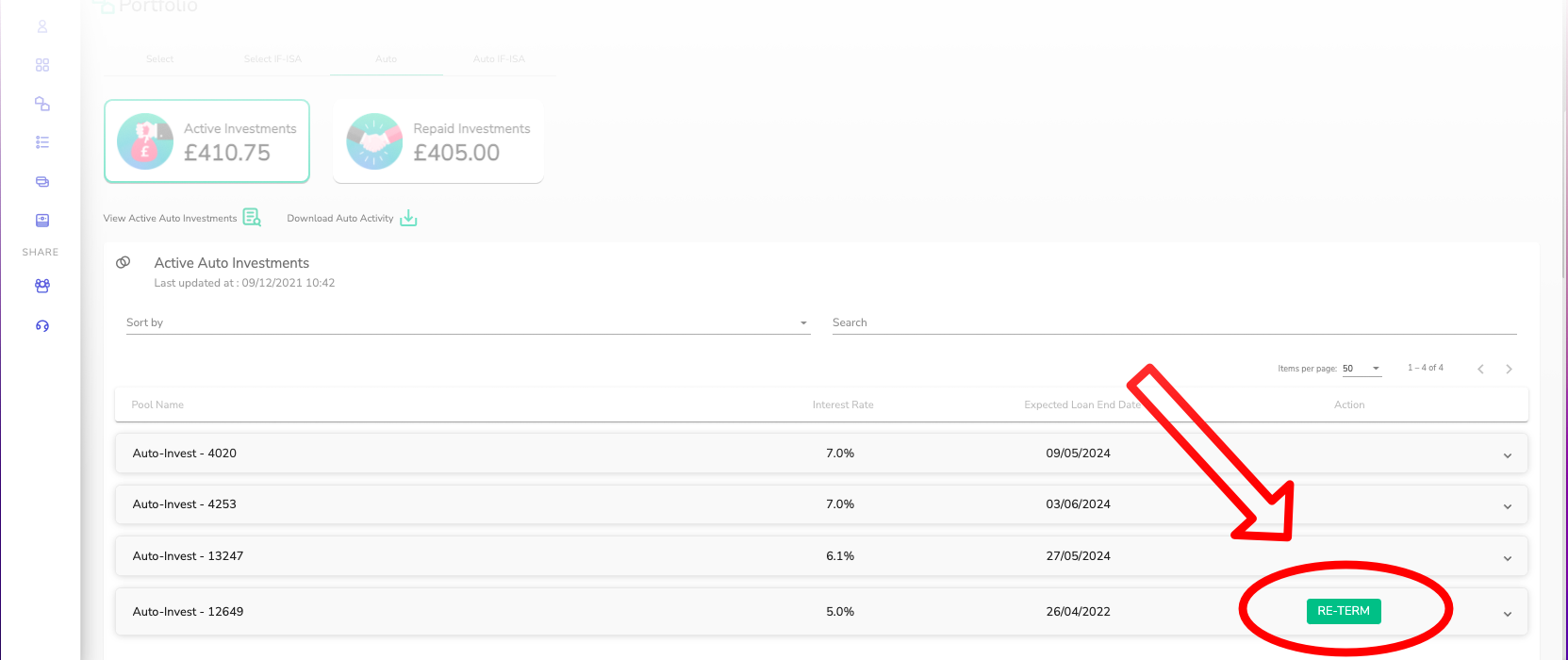

8) Released! You can re-term your Auto and IF-ISA investments on the platform before they expire

You can now re-term your IF-ISA and Auto-investments up to 190 days prior to their expiry. When multiple investments mature close together, especially at the end of the financial year, it can be a hectic time so you can now re-term early and know that your investments will continue to earn you interest. It takes just a few mouse clicks.

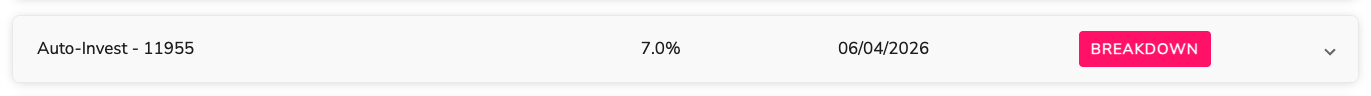

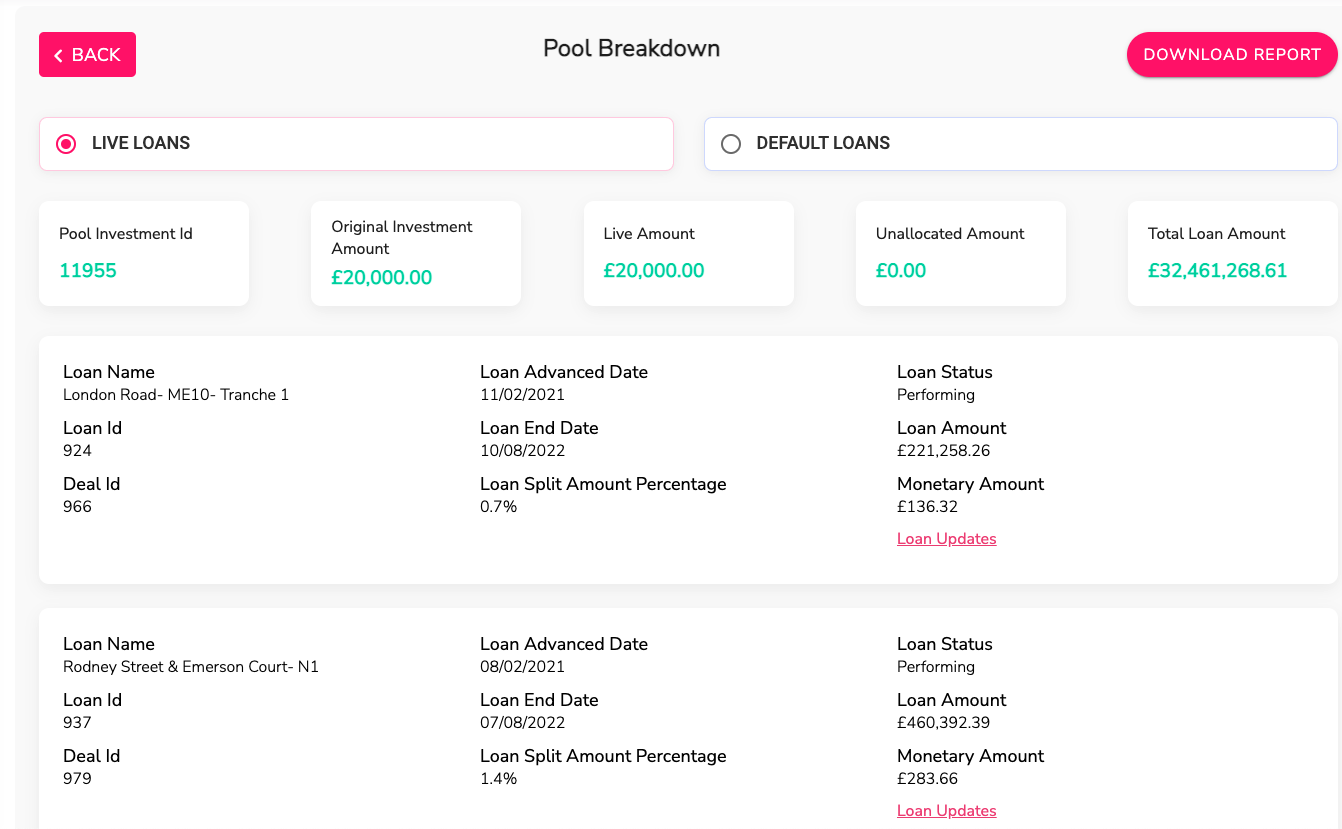

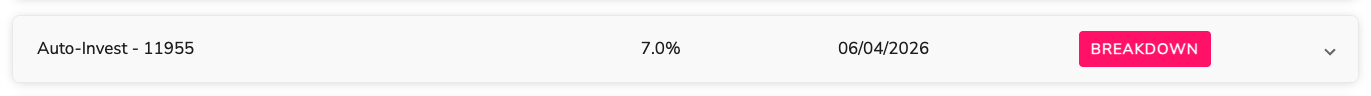

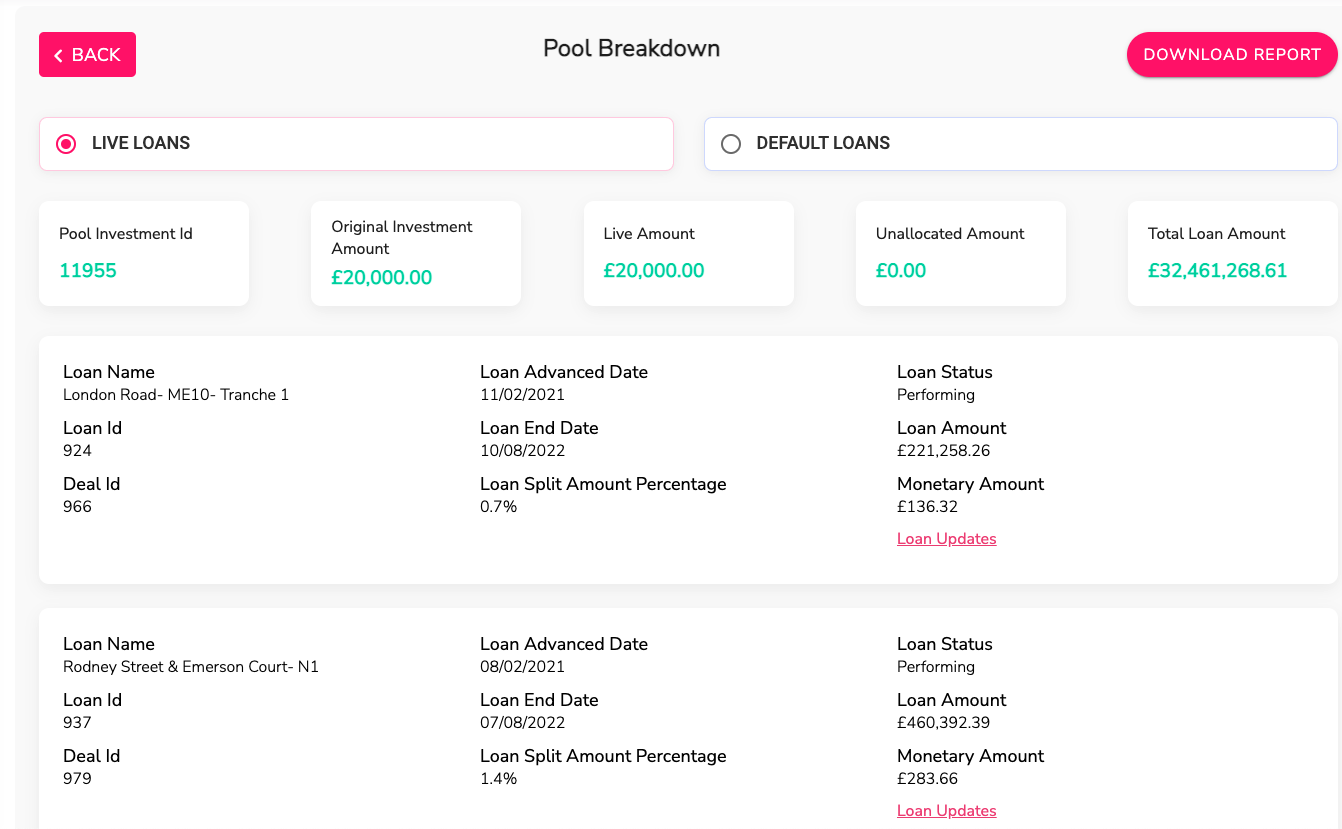

9) Released! Pool Investment Live loan Amount Break-down has been upgraded.

The real-time Pool “Breakdown” per Auto or Auto IF-ISA investment which showed unallocated cash, loan updates, default section, now has a downloadable report function, in the Portfolio section.

Breakdown

10) Released! Buy and sell IF-ISA on the secondary market.

You’ve always been able to sell your Select Invest loan parts on the secondary market, should you wish to (for more detail, visit the marketplace here). But now, you are also able to buy and sell Select IF-ISA loans too.

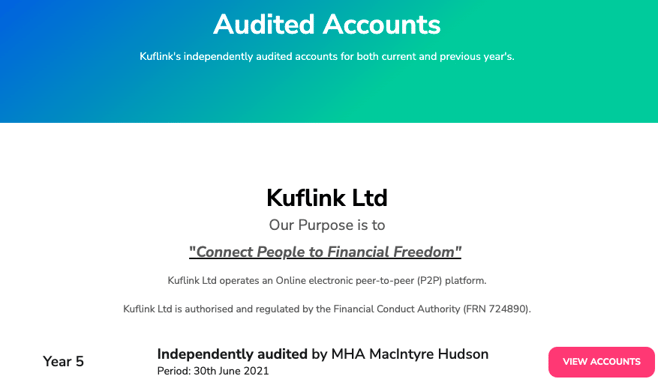

11) Released! The Audited Accounts page has had a face-lift.

Our Management accounts up to June 2022 are available on the Kuflink ESG page.

In January 2022 we released our latest, 5th year of Independently Audited accounts for the platform, for the period ending 30th June 2021. We decided to upgrade the page for you with links to previously independently audited accounts for all the regulated companies and the main Group company. Click here to view the page.

Coming Soon! – Online P2P Platform

1) Coming Soon! We are in the final testing phase of allowing clients to automate the withdrawal of their monthly paid interest. This is a feature that some of our clients wanted as it was a repetitive task for them every month.

2) Coming Soon! We are in the final testing phase of introducing “Multi-Factor Authentication” (“MFA”). Adding an additional layer of security to your account is a way in which we can double-check it’s really you.

3) Coming Soon! Some new Proprietary features based on your feedback.

Updates!

1) Update! We have completed our Third Consumer Duty Survey (to our retail clients) and the results were amazing again. Please see the Kuflink ESG page to see the results. We are most grateful to all those who took part, as together we are fulfilling our purpose to “connect people to financial freedom”.

2) Update! We have connected our Open banking platform to our P2P Platform successfully, to enable bank transfers to be immediately updated to Kuflink client wallets. We are still working with NatWest in regards to NatWest to NatWest transfers which are still manually uploaded. We have found another way to update these automatically and so will be implementing this soon.

3) Update! On Thursday 21st April 2022 we started protecting client money for Corporates as we do for Individual client money under FCA Client money rules (CASS 7).

4) Update! We have successfully passed our ISO27001 Audit (UKAS). Press here for a copy of the certificate.

5) Update! Some of our directors have successfully housed a family from Ukraine and are continuing to help in any way that they can to find some peace and normality in this traumatic crisis.

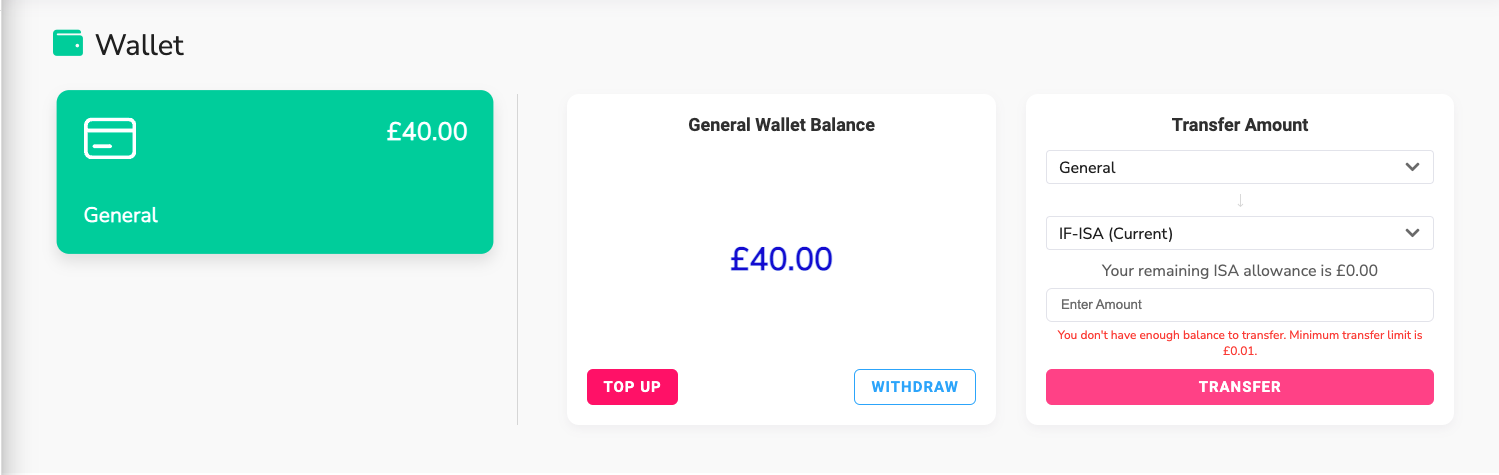

6) Update! At times, unexpected popularity can result in pool availability being sharply taken up, leaving clients without the pool option for their ISA investment before the Financial Year End. The good news is we have a solution that will enable you to allocate money to this Financial Year without losing any allowance. Simply transfer funds from the General Wallet to IF-ISA (Current), after clicking “transfer” the amount you have transferred will be deducted from your general wallet and be used against this year’s allowance. You will then be able to invest these funds once we have further availability again.

7) Update! We have successfully internally passed the Bcorp Assessment, scoring significantly higher than the minimum (80 out of 100). BCorp assessors are now processing a verification Audit and are hopeful we will have our BCorp certificate in the near future. For the moment we have released the assessment answers on our Kuflink ESG page.

8) Update! As part of our objectives of the Kuflink Foundation and the Kuflink Group, we are pleased to announce a new two-year deal with Ebbsfleet United with a long-term principal club sponsorship. We are committed to our local community and the support of Ebbsfleet United – through sponsorship and in person at the club.

9) Update! We are onboarding with a major new service provider for debit card transactions.

10) Update! Last year we managed to open bank accounts with Natwest Bank plc which for a Peer to Peer platform was challenging at best. We are happy to report, that we have also now managed to open bank accounts with Barclays Bank Plc, which helps with our resilience models.

Chief Technical Officer’s (CTO) thoughts for July 2022

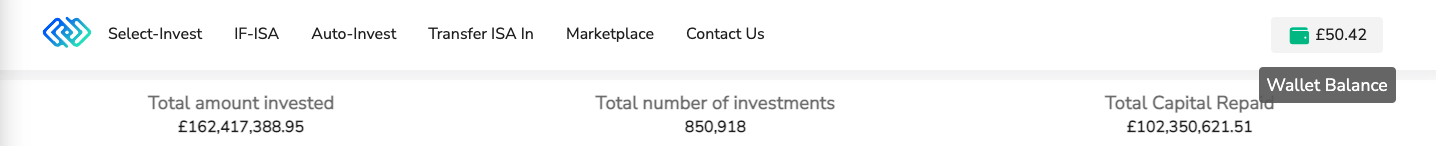

We have been lending money secured on property, for 10 years (since 2011), and have operated an online electronic Peer to Peer platform for 5 years (since 2016). We have just launched an Open banking Platform this year (2022) thanks to our:

In-House team

- Experienced Underwriting team;

- Experienced Credit Committees (as developers, valuers, and bankers);

- Experienced Accountants;

- Experienced Collections Team;

- Experienced Proprietary Software Developers;

- Experienced Board of Directors;

- Experienced Independent Non-Executive Directors

Third-Party Service providers

- Royal Institution of Chartered Surveyors – RICS approved valuers;

- Credit Bureau Agencies:

- Experian

- Equifax

- TransUnion

- Cifas

- Solicitors Regulation Authority – SRA approved Solicitors;

- Independent ISO27001 Auditors;

- Independent Auditors;

Kuflink adopted ‘The new Consumer Duty’ as demonstrated by the ‘Kuflink Consumer Surveys’ launched in January 2022. We have just issued our third Consumer Survey in June 2022 – please see it on the Kuflink ESG page. The Official Launch of the ‘New Consumer Duty’ by the Financial Conduct Authority will be in late July 2022. We are grateful to you for your approval of our high standards and your invaluable feedback, some of which we have already started developing.

Kuflink has implemented the new requirements to strengthen operational resilience in the Payment Services sector in March 2022. In particular, this is in regards to our Open Banking platform operated by Kuflink One Ltd. Furthermore, we have undertaken this task across the Whole Group.

In the last few months, we have made forward-thinking inroads into upcoming regulation requirements which we have found to be beneficial now rather than later, and introduced new features as requested by our client base. Together, we are furthering our purpose in connecting people to financial freedom.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Why are people investing in NFTs?

What are NFTs?

The acronym NFT means “Non-fungible Token.” By Non-fungible, we imply something distinct or one that stands out. Non-fungible items are made up of non-replaceable parts. In contrast to cryptocurrencies, NFTs contain only one unit. Therefore, they cannot be duplicated or exchanged in the same way that money can.

This is for information only. Please always seek professional advice before acting.

The uniqueness of NFTs is confirmed using blockchain technology. This guarantees that a forgery will be immediately detected.

There are a variety of reasons why investors purchase NFTs. Some people are desperate to get their hands on the underlying securities. Others may see the asset getting tokenized as valuable.

Investing in NFTs?

You’ve probably thought about investing if you know non-fungible tokens (NFTs). But have you ever wondered what the benefits and drawbacks are? Before investing in any asset category, it’s smart to educate yourself about it. To begin with, the term NFTs is misleading since they are not an asset.

The investing possibilities of NFTs are the most intriguing feature. First, you must go to a marketplace to buy an NFT. After that, you’ll have to make a digital wallet. Purchasing NFTs using blockchains is a way to diversify your portfolio. Similarly, lowering the cryptocurrency’s availability can add to the value of your NFT with time.

To digitally control non-fungible tokens employ blockchain-based technology. That isn’t to say that buying assets is a terrible idea. If you find assets that you like and can afford, you may consider purchasing them. If the assets are tokenized, you’ll almost certainly be able to take advantage of NFT.

However, be aware of the hazards associated with NFT investments. Additionally, selling NFTs is conceivable and potentially lucrative. However, once you acquire an NFT, you will probably not keep it forever.

The majority of marketplaces will charge a fee for storing and selling your NFT. Just before the asset is up for sales or auction, the markets must verify it. When it sells, the marketplace handles the transfer and distributes your part to you. Presumably, this will involve a hefty profit.

Some NFTs are extremely uncommon and precious.

But, making one does not necessitate being a master artist. Anyone can create an NFT. ‘Minting’ digital assets are the way of forming an NFT. After that, all you have to do is build digital wallets and post them on a platform.

Pros of NFTs

NFTs Improve Market Performance

NFTs’ most evident advantage is their ability to increase market efficiency. Converting a tangible asset to a digital one can speed up procedures, reduce middlemen, improve distribution networks, and increase security.

A perfect example is currently playing out in many corners of the art community. Artists can now communicate with their audiences owing to NFTs. As a result, expensive agents and time-consuming transactions are no longer necessary. Furthermore, digitizing artwork improves the verification system, expediting operations and lowering expenses.

NFTs also have uses outside of markets. For example, they may eventually become useful tools for managing and controlling critical data.

Fractionalization of Physical assets

Some assets, such as estate, artworks, and expensive jewellery, are difficult to fractionalize today. A computerized replica of a structure is better to split among several proprietors than an actual one.

Certain asset markets can be considerably expanded by digitization. As a result, there is more volatility and higher pricing. But, individually, it can transform the way economic portfolios are built. This enables more variety and accurate positioning.

The Blockchain Technology

NFTs are made with Blockchain technology. This is a method of storing data which is hard to hack, change, or destroy. It’s a transaction-tracking distributed ledger. It is reproduced and disseminated to all members of a peer-to-peer network.

The legitimacy and chain-of-ownership records for all NFTs maintained on the blockchain are unique. This ensures that they are not mishandled or stolen. In addition, data cannot be modified or removed once it has been annexed to the chain.

This ensures that the exclusivity and validity of each NFT are retained, encouraging a level of trust.

Diversification

NFTs are not the same as traditional assets like bonds and stocks. They have unique characteristics and provide advantages. However, ownership comes with its own set of risks. The risk level of NFTs is unlike that of typical asset types.

Consequently, by including NFTs in a portfolio, you may be able to increase their effectiveness. Essentially, this implies having a higher risk-reward ratio.

NFTs are open to everyone.

Everyone can participate in tokenized securities. As a result, ownership of assets that have been preprocessed into an NFT can be traded more accurately and quickly among persons worldwide.

Cons of NFTs

Liquidity and volatility

The marketplace for NFTs is not particularly liquid due to its youth. NFTs are not well-known. Therefore there are few possible sellers and buyers. As a result, trading NFTs can be challenging, particularly during times of stress. It also implies that NFT pricing is quite erratic.

NFTs are not always profitable.

NFTs have no earning potential for their owners. The return on NFT investments, like those on antiquity and other collections, are solely dependent on value increase. That’s not something you can rely on.

Fraud Can Be Perpetuated Using NFTs

While the trustworthiness of a blockchain cannot be questioned, NFTs can be utilized to deceive people. Indeed, several artists recently reported finding their works for auction as NFTs on digital sites without their permission.

This goes against the purpose of using NFTs to promote the selling of paintings. An NFT’s value proposition is that it uses a unique token to validate a tangible piece of artwork. This guarantees that whoever possesses the token also possesses the original piece of art.

Someone creating a digital replica of the actual piece, attaching a token to it, and selling it poses a severe concern. There is no reference to the actual work there. Instead, the token has been connected to a forged copy.

NFT production consumes a lot of energy

The Ethereum blockchain currently supports the majority of NFTs. However, proof of work is an energy-intensive operational protocol that it employs. A typical NFT transaction consumes around a day and a half’s worth of electricity.

What is the future of NFTs?

NFTs are a fascinating invention that is gaining popularity as their applications expand. Unfortunately, the attention-getting costs on certain NFTs are adding fuel to the flames. When considering purchasing these assets, wise investors must proceed with caution. This is due to the illiquidity and volatility of NFTs.

It’s not a good time to purchase them to get high price returns. The true significance of NFTs is in their ability to change the method markets work. They also help us better monitor and handle sensitive data. The possibilities are endless here.

Nonetheless, if you wish to join this digital revolution and view NFT possession as a viable option, please don’t forget to exercise caution. Try not to put too much money into NFTs, and always aim for low-cost options. You could end up in a social and financial bind if you don’t.

Conclusion

Overall, if you’re engaged in the world of art and want to take advantage of current financial trends, NFTs might be a terrific investment. They’ve been on the rise for about five years, and their worth has skyrocketed. Getting in the queue as soon as possible may give you a good opportunity of making the profits you desire.

Only because NFTs are popular does not imply that they won’t be phased out in the coming future. But, for the time being, they are a simple investment choice and a method to acquire original digital art.

NFTs offer advantages and disadvantages, but investing in any asset just because it is tokenized requires caution. Whether or not an asset’s possession is revealed by a blockchain, investment basics remain the same.

This is for information only. Please always seek professional advice before acting.

6 Most common loan scams and how to identify them

Whenever you decide to take a loan, you probably focus on factors such as interest rates or terms of repayment. Most of us fail to realise that what matters the most is the organisation’s legitimacy. Scammers often coax people into taking loans and taking advantage of their money needs.

It is not always easy to spot a scam, this is because scammers are experts at what they do and use convincing tones to persuade people. In this article, we will help you get familiar with the most common scams. Once you get familiar with them, you should have a better understanding of how to spot them.

Especially during the time of the Covid-19 pandemic, a sharp rise in cases was observed. This was primarily due to the sudden shift to virtual systems. Scammers formulated tricks and deceits to entice people in applying for loans.

A loan scam is a kind of deceitful action. The lending company gathers your personal information, but the loan is never provided.

Let’s now look at some of the loan scams.

-

Advance-fee loan scams

The scammer will reach you in this particular situation and offer a low-interest loan. This too in exchange for upfront fees. To make them sound legitimate, they might call it “Processing fee” or “Application fee”. When they successfully have your interest, they ask you to pay this amount in a somewhat non-traditional way.

If you deny giving the upfront fee, the lender will add this to your loan amount. Then a bogus electronic transfer will be made to your account. This is a sneaky strategy because credible lenders may also offer you to add up your fee to your loan.

What are the red flags?

- Requesting upfront amount: Do not give an ear to any email or call that promises you a quick loan in exchange for advanced payment. Make sure that you don’t reveal any of your banking information. The legal lenders will never demand any amount before loan approval.

- No credit checks: The sign of a legitimate lender is that they’ll thoroughly check the credit score and profile of the borrower. Such individuals that face debt issues are most likely to be targeted by scammers. This is because credible lenders might not entertain such personnel.

- The deal appears to be exceptional: Scammers usually acclaim special links and outstanding loan policies. Be wary if the loan credit limit or interest rate is above or below any other you’ve observed.

- Immediate decision-making pressure: Fraudulent lenders will often push you to quickly reach a decision. On the contrary, the legal ones will never force you into your decision and provide assurances.

-

Phishing scams

Phishing is technique scammers use to attain access to confidential data via email. This may include your usernames, security keys or banking information. The method employed is called “Social Engineering”. It is a method of conning people by manipulating their emotions.

Sometimes, this may entail coercing you into opening an email with attached malware. This will then automatically get installed on your computer.

Such emails are customised to make them look like the ones sent by legitimate lenders. In addition, they frequently use ominous dialects to titillate your interest. They can easily steal all of your data without you even realising what just happened.

What are the red flags?

- Unanticipated email attachments: Try not to open emails from anonymous sources. Scammers are skilled at impersonation rendering it easy for them to fool people.

- Inadequate grammar usage: In this day and age, it’s not uncommon to find a typing error in an email from a valid loan company. If the email contains grammatical errors or structural issues, this may be a sign.

- Familiarity with the sender’s address: Scammers know that if an email appears to have been sent by an entity you recognise, you will likely open it and trust the content. They accomplish this by tactfully modifying the sender’s email address’s domain name.

-

Scams involving government impersonators

Quite often calls or emails are made by people pretending to be from government agencies, they will persistently ask for confidential information and data. They also threaten you with consequences.

What are the red flags?

- Contact methods: The government would never send you money-related information via email, text, or social media. The emails will always contain a “gov” extension. You can search these addresses on the web to validate this yourself.

- Impersonating a law enforcement officer: Law enforcement personnel might never ask you for confidential material or fees. Law enforcement fraudsters use different methods to appear legitimate and frighten you into conformance. They even use badge numbers and real titles.

-

Scams involving forged cheques

Fake cheque fraud occurs when an individual or company approaches you and makes some requests. For example, they may ask you to transfer a cheque or a cash amount to your account. Then you are supposed to wire the funds back for payout. However, accepting this might lead to bouncing of the cheque.

What are the red flags?

- Offers of employment: You are likely to get a job offer from the scammer. Later, you will be provided with a forged cheque to deposit. They’ll give you directions to repatriate or deliver some of the cash in a specific form. This will be done disguised as job tasks.

- Sweepstakes and lotteries: You will get a forged cashier’s cheque for a fictitious international lottery win. Then they’ll ask you to send them money right away to fund taxes or fees.

- Overpayment: The scam artist will be interested in purchasing something you are selling on the internet. Then they will “inadvertently” deliver you an amount more than that of the item. Afterwards, they will request that you return the amount, and you might lose money.

-

Scams concerning debt consolidation

Debt management firms claim to be able to cancel or minimise your debts. They consult your lenders and persuade them into modifying contractual terms. These can also be deceitful and steal your cash, failing all promises.

What are the red flags?

- Requesting funds in advance: Untrustworthy debt settlement businesses will frequently require you to pay upfront amounts. This is not only ethically wrong but also unregulated.

- Ensured debt relief: Obtaining debt reduction or forgiveness from creditors is a negotiation, not a pledge. No company can ensure that all of your debts will be paid off.

- Instructing you to halt payments: Never place your faith in a corporation that guides you to quit paying your lenders or interacting with them. This will not help you with your liabilities and will only harm your credit.

-

Scams involving donations or charities

Among the most heinous fraud schemes are the ones perpetrated by opportunistic fraudsters. They pose as representatives of charity groups during trying situations. Nowadays, crowdfunding and newly formed genuine charities are prevalent. So, determining what is and isn’t valid can be more challenging than ever.

Spend the effort investigating any person or organisation requesting money from you.

General ways to spot a scammer

Aside from deceptive lenders demanding cash in advance, there are a few crucial methods of identifying a loan scam right away.

- Nothing is provided in writing by the lender.

Every loan proposal must be in written form. So, if they call you with a deal, you’ll know right away that you’re interacting with a loan scammer.

- The lender’s physical address is invalid.

If a creditor does not provide a valid physical address, that is a red flag. Even though the lender offers a location, enter it into Google Maps if you have any hesitations.

- The lender’s website is dubious.

A reliable creditor would have a safe, working website with company information. If they lack a webpage or if it’s unsecure, you should look somewhere else.

- The lender is unconcerned regarding your credit history.

Before making a loan, any credible creditor will need to know some basic information. It is a warning sign if they are indifferent towards your history.

- The loan terms are hazy.

All fees and loan information will always be disclosed upfront by trustable lenders. They will not request payment until you have been accepted. There’s a decent possibility the loan specifics are a scam if they’re too general or don’t provide actual figures.

Conclusion

In the article, we have informed you about several ways to recognise scammers and some techniques to deal with them. We hope that now you’ll be able to protect yourselves from such frauds.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Kuflink’s new features for April 2022

February and March have been busy months for us, with many new Feature releases and updates to our previous releases. We hope you enjoy them as much as we have enjoyed building them.

Quote for April 2022

“Accurate thinking. Accurate thought involves two fundamentals. First, you must separate facts from mere information. Second, you must separate facts into two classes – the important and the unimportant. Only by doing so can you think clearly and accurately.” – 11 of 17. Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

Released

1) Released! NEW Environmental, Social and Governance (ESG) page has been built, to show some of Kuflink’s Key performance indicators (KPIs), energy performance certificates for the head office, Consumer survey results, Ongoing – Profit & Loss, Balance sheet, Taxes paid, Green property developments funded, Governance committees, and much more.

Click here to view the ESG Page.

2) Released! New Notification System for Bank transfers to the Kuflink wallet. We have completed this system where you can advise us of any bank transfers that you have made on the day or expect to make. This will assist us in updating our systems to expect funds from you. To get started, press the wallet image, go to Top Up, and then choose Manual Bank Transfer (UK) from the drop-down menu. Please note, on receipt of your transferred funds they will not automatically invest into your desired product, this is still solely your responsibility.

You can amend any notification by scrolling down to Topup Requests.

3) Released! New Wallet Balance transfer option between Wallets.

Due to the release of new wallets:

i) General Wallet;

ii) ISA Current Wallet; and

iii) ISA Previous wallet

We have updated the top right wallet balance to now include the total of all wallets.

4) Released! New Updated releases for Mobile App for Android and Apple

We updated investments and portfolios so clients can make investments, including, Select, Select IF-ISA, Auto, Auto IF-ISA and marketplace.

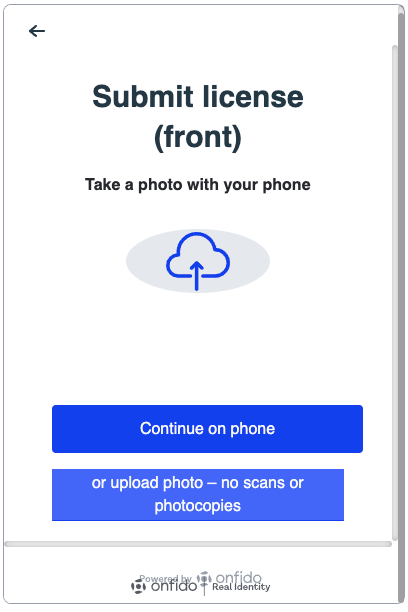

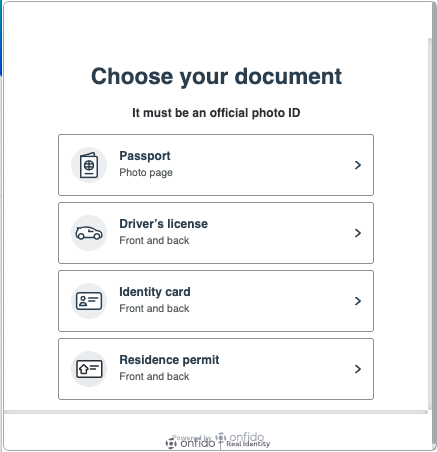

5) Released! Upgrade to our AML/KYC software

We work closely with our AML/KYC partners and have just released a new version for “Know Your Client” checks. Please note that you can either upload your ID documents via an SMS link through your mobile or UPLOAD documents via Desktop.

Now we also accept Residence Permits

6) Released! Dashboard Totals

Due to client requests, we have just released a new “Total Investments” figure, a new “Total Reserve” figure to include Select Invest Reserve and Select IF-ISA Reserve totals, and a “Select IF-ISA Reserve” figure.

7) Released! You can re-term your Auto and IF-ISA investments on the platform before they expire

You can now re-term your IF-ISA and Auto-investments up to 190 days prior to their expiry. When multiple investments mature close together, especially at the end of the financial year, it can be a hectic time so you can now re-term early and know that your investments will continue to earn you interest. It takes just a few mouse clicks.

8) Released! Pool Investment Live loan Amount Break-down has been upgraded.

The real-time Pool “Breakdown” per Auto or Auto IF-ISA investment which showed unallocated cash, loan updates, default section, now has a downloadable report function, in the Portfolio section.

Breakdown

9) Released! View which deals are compounded

You can now see, at a glance, which deals you have compounded and which you have not in your portfolio. Simply head to your Portfolio to view.

10) Released! Buy and sell IF-ISA on the secondary market.

You’ve always been able to sell your Select Invest loan parts on the secondary market, should you wish to (for more detail, visit the marketplace here). But now, you are also able to buy and sell Select IF-ISA loans too.

11) Released! The Audited Accounts page has had a face-lift.

In January 2022 we released our latest, 5th year of Independently Audited accounts for the platform, for period-ending 30th June 2021. We decided to upgrade the page for you with links to previously independently audited accounts for all the regulated companies and the main Group company. Click here to view the page.

Coming Soon!

1) Coming Soon! We are in the process of showing images of how our development loans are progressing.

This is part of the new features to show where each development loan is in regards to our new 7 phases of development – work has started.

3) Coming Soon! A NEW segregated SIPP wallet – development has started. A SIPP is Self Invested Personal Pension, which will be done in partnership with Morgan Lloyd (a Specialist in Self-Invested Pensions).

4) Coming Soon! A NEW Buy to Let Pool Product – development has started. A new pool product will be coming soon where you can invest in long term income-earning Buy to let loans.

Updates!

1) Update! We have completed our Second Consumer Duty Survey (to our retail clients) and the results were amazing again. Please see the Kuflink ESG page to see the results. We are most grateful to all those who took part, as together we are fulfilling our purpose to “connect people to financial freedom”.

2) Update! We have connected our Open banking platform to our P2P Platform successfully, to enable bank transfers to be immediately updated to Kuflink client wallets. We are still working with NatWest in regards to NatWest to NatWest transfers which are still manually uploaded. We have found another way to update these automatically and so will be implementing this soon.

3) Update! On Thursday 21st April 2022 we will protect client money for Corporates as we do for Individual client money under FCA Client money rules (CASS 7).

4) Update! We have successfully passed our ISO27001 Audit (UKAS). Press here for a copy of the certificate.

5) Update! This week two of Kuflink’s staff members visited a local school’s “Careers” day. We provided the pupils with an insight into the business and investing world, which so many were keen to learn and understand. They especially loved the freebies.

6) Update! At times, unexpected popularity can result in pool availability being sharply taken up, leaving clients without the pool option for their ISA investment before the Financial Year End. The good news is we have a solution that will enable you to allocate money to this Financial Year without losing any allowance. Simply transfer funds from the General Wallet to IF-ISA (Current), after clicking “transfer” the amount you have transferred will be deducted from your general wallet and be used against this year’s allowance. You will then be able to invest these funds once we have further availability again.

Chief Technical Officer’s (CTO) thoughts for April 2022

We have been lending money secured on property, for 10 years (since 2011), and have operated an online electronic Peer to Peer platform for 5 years (since 2016). We have just launched an Open banking Platform this year (2022) thanks to our:

- Experienced Underwriting team;

- RICS approved valuers;

- SRA approved Solicitors;

- Credit committees (with developers, valuers, and bankers’ experience);

- Experienced Collections Team; and

- Experienced Board of Directors.

Sustainability and ESG are important to understand as TECH can help accelerate the implementation of many of these features, as we have demonstrated on the Kuflink ESG page. Some of the following are ESG examples. We have made tremendous leaps in moving into the cloud and minimising the need for paper in the office. We have ensured the platform has a global reach and helps on a societal basis by offering our platform to countries, which may not have access to such opportunities locally. We have a diverse workforce, which improves performance by 12% and intent to stay by 20% (source Gartner research). ESG was always engrained throughout the Group before it will become a requirement in August 2022, and we are thankful to all our stakeholders who have made this a reality for us all.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Why you should celebrate Women’s history month?

Women’s history month is dedicated to educating and empowering women by uncovering, documenting, and applauding the lives and accomplishments of women. We envision bringing forth a diverse society where everyone’s efforts are equally celebrated and acknowledged.

So, how did this day evolve? This day grew out of celebrations over a whole week pertaining to International Women’s Day. It is now feted in several states as an acknowledgement of the historical role of women.

How did it all begin?

International Women’s Day (IWD) arose from the labour movement and is now officially recognized as an annual festival by the United Nations. In 1908, 15,000 women marched across New York, demanding fairly short work hours, increased salaries, and the entitlement to vote.

The Socialist Party of America proclaimed the first National Woman’s Day a year afterwards. Clara Zetkin, a communist activist and proponent of female rights, proposed the establishment of an international day. In 1910, she presented her concept to an International Conference of Working Women in Copenhagen, and 100 women from 17 countries concurred.

In 1911, Austria, Denmark, Germany, and Switzerland observed International Women’s Day for the first time. The centennial was marked in 2011, so this year marks the 111th. It became official when the United Nations began celebrating the day in 1975. “Celebrating the Past, Planning for the Future” was the first motif implemented (in 1996).

International Women’s Day is now a day to rejoice in how far women have come in societal structure, world affairs, and economics, whereas the day’s ideological roots mean that conflicts and mass demonstrations are structured to inform people of ongoing disparity.

Why March 8?

There was no set date for Clara’s notion for International Women’s Day. It was not formally established until a wartime attack in 1917 when Russian women started demanding “bread and peace”; four days into the strike, the tsar was ousted from power, and the interim government provided women with the right to vote. The strike started on March 8, becoming International Women’s Day.

Let’s honour the women in Finance

In honour of Women’s History Month, we’re honouring some of the financial industry’s female leaders who cracked the social barriers. But, the real clincher is this: Until the 1960s, women were unable to open a new account. Discover how they paved the way for subsequent generations of female financiers.

1. Abigail Adams – first known female investor.

Abigail Adams lacked the legal right to own assets, but it did not deter her from investing money and taking economic decisions for the family. Her husband, President John Adams, was preoccupied with his political activity. Abigail was in charge of the father’s wealth. According to some researchers, she saw a 400% profit. She also actively urged John to use his power and control for good by advocating for women’s rights, and he treated her as an equivalent.

2. Victoria Woodhull and Tennessee Claflin – Wall Street’s first female stockbrokers.

Victoria Woodhull and Tennessee Clafin were sisters who began their careers as travelling tent revival soothsayers. Ensuring a dream, they travelled to New York and encountered Cornelius Vanderbilt, an entrepreneur who was intrigued by them.

He later assisted them in establishing their finance company, Woodhull, Claflin & Company (the first in female history). The ladies supported the female suffragette movement, and Victoria was the first woman to run for the U.S. president.

3. Madam C.J. Walker – The first African-American woman to become a self-made millionaire

Better called Madam C.J. Walker, Sarah Breedlove, transformed an issue into a profitable enterprise. But, what exactly is the issue? She was balding. Madam C.J. looked everywhere for remedies before taking the situation into her own grip and developing Madam Walker’s Wonderful Hair Grower, her Black hair care commodity.

She gathered a team and amassed a fan base of satisfied customers. As a result, Madam C.J. became the first self-made Black female millionaire thanks to the “Walker System.” She, along with many other Black financial innovators, intended to build business potential for her society by employing Black employees, attempting to make philanthropic efforts, and offering scholarships.

4. Muriel Siebert – The New York Stock Exchange’s first female member.

Muriel Siebert was unafraid of being the only female in space, and she placed her eyes on the New York Stock Exchange (NYSE) at a young age. Muriel switched careers several times in order to earn the same salary as her male coworkers. However, it took ten tries for her to find investors for her NYSE application.

She, on the other hand, did not give up. Muriel was the only woman on the stock market out of 1,365 men for ten years. She was known as “The First Woman of Finance.” And, have it, there were no women’s restrooms anywhere in the building. As a result, she altered it as well.

5. Lauren Simmons – The New York Stock Exchange’s youngest female trader

Our journey takes us from the first female trader on the NYSE to the youngest female merchant on Wall Street. And the world’s second Black woman trader. Lauren Simmons graduated from Kennesaw State University with a degree in genetics. She cleared her investment test and was hired by Rosenblatt Securities at the age of 22, making history.

6. Adena Friedman – The first female CEO of a global stock exchange.

Adena Friedman is an American-Jewish businesswoman and the President and CEO of NASDAQ. She credits her strength in a male-dominated sector to joining an all-girls school, where she had never been reluctant to raise her arm and pose a question.

Adena began her career at NASDAQ as a business consultant, eventually rising to be the first woman to lead a global stock exchange company. Adena has made a conscious effort all through her professional life to espouse women in leadership and financial education for children.

Female Finance Professionals’ Future

Did you know that women make investments up to 90% of their income in their family and community? Yet, ever since the disease outbreak, half of all women say they are happier to invest, and seven out of ten say they wish they had started sooner.

We can end up writing a history that enables more female financial executives like the ones we just met by creating a bunch of financially savvy children. So, let’s get to collaborate on a bright economic future for all of us.

Let’s debunk some financial myths!

There are many ways to get advice on being smart with money— how you can make money, increase income and manage it thanks to personal finance websites, finance experts, money gurus on television, and feedback from your family, friends, and neighbours. But the information you get from such sources can sometimes make it difficult to separate facts from fiction.

We have gathered some well known financial myths that we will debunk today!

All of the below is for information only. Please always seek professional advice before acting.

We hope the following information will allow you to get a new perspective on your current financial situation.

Myth: Buying is better than renting

Reality: It is a famous myth that buying is better than renting. Renting can have a negative stigma attached to it, with the view that people who rent are wasting their money by paying mortgages of someone else instead of building equity in the property.

But you might not know that changes in the real estate market and taxes can make it hard to own a home. Also, owning a home has less flexibility and comes with many other additional costs, including household insurance, taxes, repairs, interest and more. Therefore, we are here to tell you that buying is not always better than renting.

Myth: Investing is only for rich people

Reality: it is one of the biggest misconceptions that exist. You can make more money when you invest more, and everyone can benefit by investing when they adopt a long term mindset and invest wisely. Just make sure to always focus on the interest rate, your risk appetite, and time to get maximum benefits when it comes to investing.

Myth: You should have 3 – 6 months of income in an emergency reserve.

Reality: The rule of three to six months’ savings has been around for years. However, the fact is that you need enough money to fulfil your financial needs in case of an emergency, such as when you are looking for a job.

Depending on the circumstances, it can take more than six months to find a job. Based on this reality, you may need larger emergency reserves.

Myth: Larger debts should be tackled first.

Reality: Financial advisers all over the country preach the importance of paying off large debts with higher interest rates first. While paying off larger loans is a good idea, there is a need to talk about paying off small debts. According to Harvard Business Review research, people get motivated by seeing modest balances vanish. In addition, paying off small loans can significantly influence one’s sense of accomplishment.

Myth: Money doesn’t buy happiness

Reality: we have often heard that money doesn’t buy happiness. It turns out it does, especially for individuals with low and middle incomes. According to a Princeton University study, individuals’ views on life improved as their financial status improved. In addition, an increase in income also improves the quality of life and overall emotional well being.

Myth: Credit cards are the gateway to debt.

Reality: Credit cards can cause problems for overspenders; therefore, the idea of avoiding them is reasonable. But credit cards are not always bad. On the contrary, you can use them to achieve your financial goals, such as paying off debt and improving your credit score. To prevent interest, you should always make payments on time and in full each month.

In addition, some credit card providers offer loyalty programmes and rewards through which you can earn points when you use them. As a result, credit cards can be a good funding source when you use them wisely and make repayments on time.

Myth: You can save for retirement later.

Reality: Most young adults, especially those in their twenties, do not prioritise savings because of the fact that there is a long time to retire. However, it is never too early to start planning for retirement. You can even start with 5% of your salary. One good rule of investment is that the longer you invest money, the more time it has to develop and earn you more.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

How P2P can help solve the housing crisis

Peer-to-peer lending platforms can help solve the ongoing housing crisis by financing good quality loans and supporting small- and medium-sized enterprise (SME) housebuilders.