Fixed Income Investments: Exploring UK Property-Backed P2P Platform – Kuflink

Introduction to Fixed Income Investments

As an enthusiastic investor looking for fixed income opportunities, exploring the world of online Peer-to-Peer (P2P) platforms can be both exciting and overwhelming. P2P lending has emerged as an alternative investment option, providing the chance to invest in loans secured by UK properties. In this article, I will delve into the solutions for those interested in investing in P2P platforms with a focus on UK property-backed loans. I will also highlight Kuflink, a unique platform that goes the extra mile in ensuring consistent interest payments and managing default risks.

Understanding P2P Platforms

Before diving into the specifics, it’s essential to understand the concept of P2P platforms. These online platforms act as intermediaries, connecting investors with borrowers. Individuals or businesses seeking loans are matched with investors looking to earn fixed income through lending.

P2P platforms offer several advantages, including potentially higher returns compared to traditional fixed-income investments and the ability to diversify across multiple loans. However, investors should also be aware of the risks involved, such as the potential for borrower default and lack of regulatory protections.

Fixed Income Investing in UK Property-Backed P2P Platforms

One of the attractive options within the P2P space is investing in loans secured by UK properties. These investments provide an additional layer of security, as the property serves as collateral, reducing the risk for investors. Additionally, the UK property market has historically shown stability and potential for appreciation.

Analyzing the risks associated with property-backed investments and understanding how to mitigate them is crucial for making informed decisions in this niche.

Introducing Kuflink

Among the various P2P platforms available, Kuflink stands out as a platform that offers distinct advantages for investors. Kuflink specializes in loans backed by UK properties, providing a sense of security that many investors seek in fixed-income opportunities.

Reasons to Choose Kuflink for Fixed Income Investments

1. Continued Interest Payments in Default Situations

One of the standout features of Kuflink is its commitment to ensuring continued interest payments even in default situations. When a borrower is unable to make their loan repayment, Kuflink steps in and pays the interest from their own pocket. This unique approach helps to ensure that investors’ cash flow remains unaffected, even during challenging times.

2. Compensation and Default Interest

Kuflink takes on the risk of interest in default situations, which sets it apart from other platforms. However, in the event the borrower repays the loan or default interest is received, Kuflink is entitled to compensation, thus safeguarding their interests as well.

Getting Started with Kuflink:

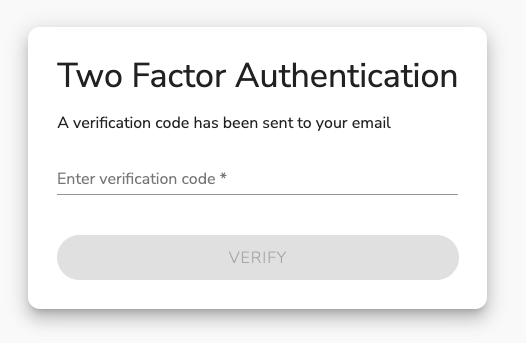

To begin investing with Kuflink, investors need to create an account and go through a verification process. Once registered, they can explore a range of available investment opportunities and choose those that align with their risk appetite and investment goals.

Tips for Maximizing Returns and Managing Risks

While Kuflink offers unique advantages, investors should still exercise prudence and make informed decisions. Some tips to consider include setting clear investment goals, understanding loan terms, and staying updated on the UK property market.

Customer Testimonials and Success Stories:

To gain further insight into the experiences of investors on the Kuflink platform, this section will showcase real customer testimonials and success stories. These firsthand accounts can help potential investors gauge the platform’s performance and reliability.

Conclusion

In conclusion, fixed-income investments through P2P platforms backed by UK property loans present an intriguing opportunity for investors seeking stable returns. Kuflink, with its exceptional approach to interest payments during defaults, stands out as a platform that offers investors an added layer of protection. By conducting thorough research, setting clear investment goals, and diversifying their portfolio, investors can maximize their chances of success while navigating the world of P2P lending.

FAQs:

- Is investing in P2P platforms risk-free? P2P investments come with inherent risks, such as borrower default. However, investing in UK property-backed loans on platforms like Kuflink can provide additional security.

- How does Kuflink manage default situations? Kuflink ensures continued interest payments even when borrowers default by covering the interest from their own pocket.

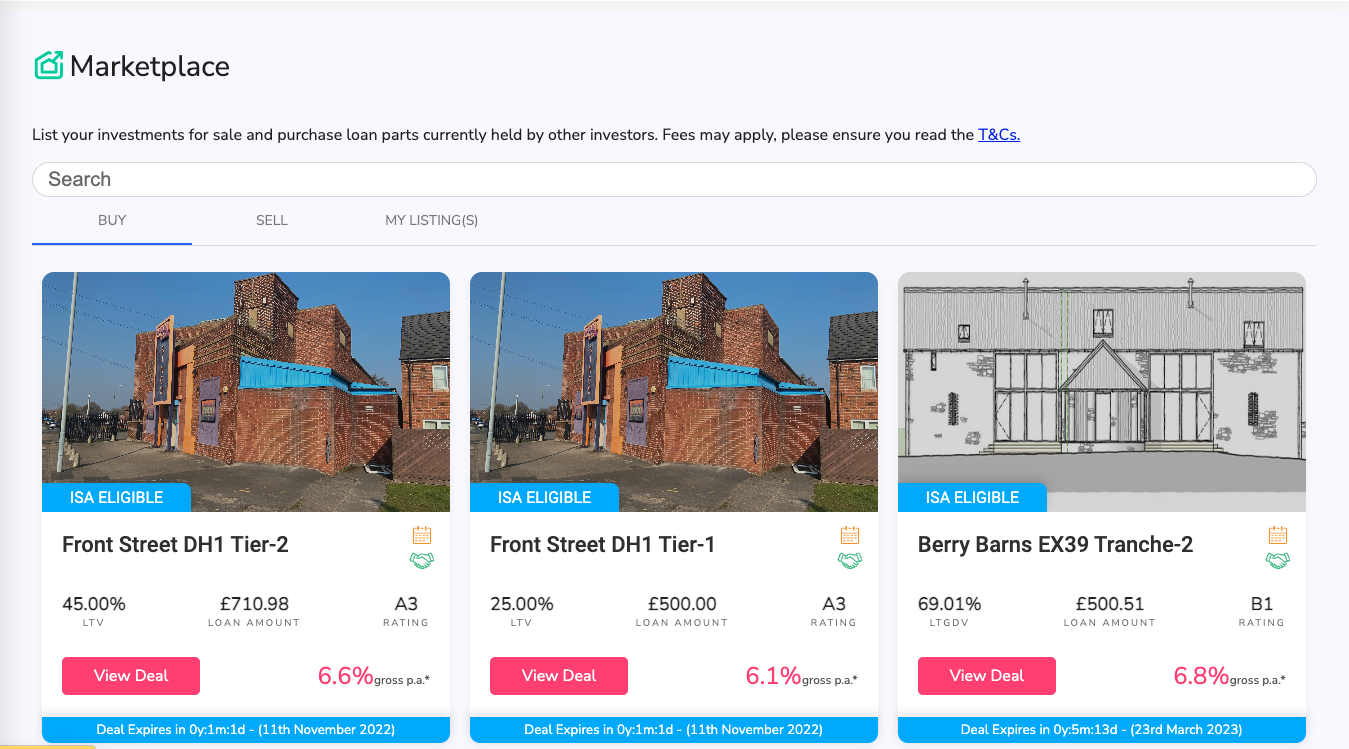

- Can I withdraw my investment before the loan term ends? Yes, you can usually sell your investment to other investors on the secondary market, subject to demand.

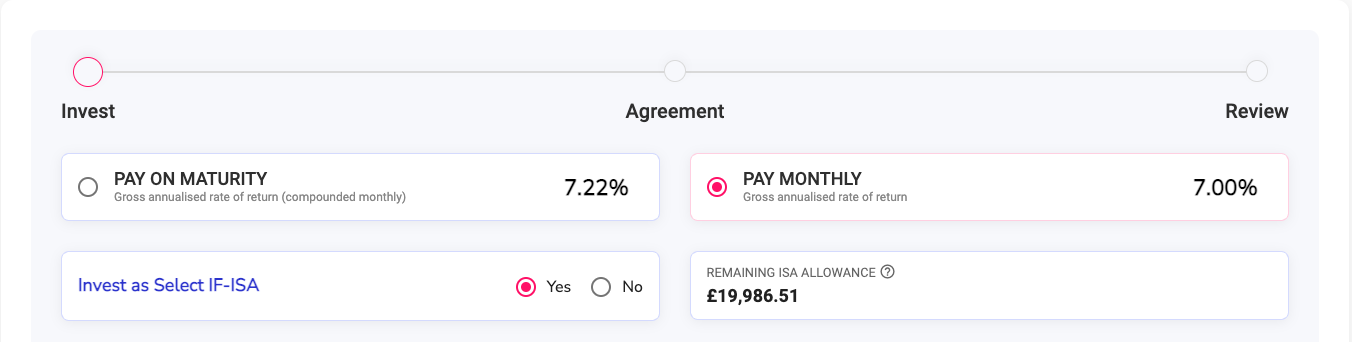

- What returns can I expect from Kuflink investments? Returns vary depending on the specific loans you invest in. Kuflink provides detailed information about potential returns for each opportunity.

- Is there a minimum investment amount on Kuflink? Yes, the minimum investment amount may vary based on the loan opportunity, but Kuflink typically has options to suit various budgets.

Property Development Finance Options

Let’s explore property development finance options so you can choose the right one according to your needs and circumstances.

Cash is the easiest way to finance property development if you have it. Instead of relying on loans, using cash can help you save money in terms of interest and keep development as cheap as possible. Therefore, it should be your priority when sourcing funds for a property development project. It might not be a suitable option when you are starting out, but you should bear it in mind for the future.

These are standard mortgage loans that you can take from the banks. Your loan application and approval depend on your ability to pay back and the value of the property you are purchasing.

You may find a variety of mortgage loans, such as variable and fixed-rate mortgages. In a variable-rate mortgage, the interest rate changes over time, while in a fixed-rate mortgage, the interest rate remains the same for a set amount of time.

Traditional mortgage loans are suitable for properties in which you are planning to live and are not suitable for properties you will be renting out or that are classified as uninhabitable.

There tend to be two common routes for property developers. They either renovate a property to sell it at a profit or purchase properties to rent out. A standard mortgage is not a suitable option if you are planning to buy a property to rent. Instead, you will need a buy-to-let mortgage. It has key differences from the standard mortgage, including the demand for a larger deposit.

In addition, recent changes to legislation make it harder to apply for a buy-to-let mortgage successfully. Borrowers also have to ensure that their expected rental income covers the mortgage instalments and the additional costs and taxes.

A commercial mortgage is similar to a high street mortgage, except that the property you are using as collateral is classed as commercial. It may include factories, shops, and offices.

Another significant difference is that instead of considering your personal income in the application process, the lender is more likely to consider your business assets and income. Lenders use these aspects to assess your ability to repay the loan amount.

A viable future business plan may also be required when applying, especially when you are a start-up or new venture.

Bridging loans are a useful funding source when you are thinking of borrowing for a short period of time. Property developers often use residential bridging finance as they are flexible and can be used for a number of purposes. Such loans are adaptable to many situations, even when a standard mortgage is not suitable. Instead of an annual interest rate, they usually come with monthly pricing.

Property developers usually use bridging loans during buying, selling or refurbishment work. It can also act as a bridge between two mainstream types of funding. For example, you can use a bridging loan to purchase a property when you are waiting for a long-term fund to become available.

Lenders grant you funds on the basis of your ability to repay, the value of your property and your exit strategy.

Similar to residential bridging finance, commercial bridging loans help you to buy or renovate a property. The difference is that the property you are using as security against a loan is a commercial one.

In this instance, any property in which 40% of the property’s value comes from commercial means is referred to as a commercial property. It can be a shop with a flat or a brownfield site. Commercial bridging loans can be a beneficial option and help you expand your business by buying new premises.

You might be eligible for funding from a private source offering specialised property loans. Other than high street mortgage companies, many other sources raise funds for residential and commercial property developments. Moreover, you can also get property development finance through an individual broker who can manage the transactions.

Although specialised property loans are usually handled privately, they are still subject to regulations from the Financial Conduct Authority (FCA). Otherwise, it can create fluctuations in the interest rates offered by private lenders.

Personal loans are also known as unsecured loans, as they are not secured against your property or any other asset. Such loans can offer you quick funding. However, you can only take a small amount through a personal loan. We can say that it is an option only when you need funds for light refurbishment and renovations. Repayments of personal loans tend to be fixed.

Property development finance comes in different forms. In a nutshell, it is a type of borrowing used for the development or significant refurbishment of a property. Mortgages and bridging loans are the two most common loans used by property developers. You may find numerous lenders with varying eligibility criteria. Acceptance and interest rate depend on your business plan’s strength and property development track record.

This is for information only. Please always seek professional advice before acting.

Top Banking Trends And Themes In 2022

Things have changed a lot in recent years due to the global pandemic, and so have the banking industry trends. The pandemic has been seen as a watershed in the evolution of banking. As a result, banks have become more proactive, adaptive and innovative. Instead of looking back at their progress, they are more likely to look forward to the opportunities ahead for a resilient future.

We have identified the top 10 trends and themes shaping the banking industry and building an exciting new future for banking.

Geopolitical Tensions

It is assumed that geopolitics is likely to dominate soon. So, the financial institutions must adjust according to the change in the sanction regime. Additionally, they need to build up their knowledge about second-order exposure (for example, many automotive firms are vulnerable because of their dependency on Ukrainian plants) and the long-term effects of this crisis on the economy (typically a fall in GDP and global trade).

When it comes to sanctions, banks need to focus more and more on the ultimate beneficial owner for collateral such as properties or other assets. Banks that do not understand this area could face significant regulatory penalties, reputational fallout or the moral dilemma of their involvement in this conflict.

Uncertainty In Macroeconomy

One of the most significant effects of global economic uncertainty is its impact on energy costs and increase in material inflation. Raise in fuel prices and supply chain issues are the two critical drivers of hyperinflation and are now more likely to be amplified.

The pandemic mainly affects banks in terms of revenue, but the impact on earnings may not last long. Many times, losses on lending did not crystallise mainly due to government support schemes. However, the future is less promising. The cost of living is increasing, and among other things, it also impacts banks and alters their earnings. Therefore, we expect an increase in loan loss provision and bank earnings volatility.

Interest Rates And Monetary Rules

Many businesses have not seen sustained inflation, and banks and the corporate sector must carefully assess their commercial impacts. In response to rising inflation, central banks are raising interest rates. The Bank of England has increased the base rate to 3%, and there could still be further rate rises. The increase in interest rate will continue as long as inflation is maintained. The current circumstances indicate that the quantitative easing and property price inflation of recent years are coming to an end.

Although the net interest margin (NIM) for banks increases with the increase in rates, it may be outweighed by the adverse financial impacts as customers and industries suffer. In addition, high credit rates also give rise to discussions of the cost of living that will impact individuals and businesses. Both might struggle to manage the new and rising costs, leading to default rise and delinquencies.

Fraud Risk and Payment Crime

Payment frauds are increasing, and criminals are developing new ways to target and get money from their victims. Authorised push payment fraud and card payment fraud are some common examples of payment fraud. Moreover, the scams of purchasing goods and services that are never delivered or materialised are also increasing.

There are technical and regulatory standards in the UK, such as strong customer authentication (SCA) and Pay. UK’s Confirmation of Payee (CoP) to ensure the security of customer funds and reduce payment fraud. However, these reforms and actions come with unique implementation challenges.

In 2021 regulatory authorities focused highly on payment fraud, and there were several high-profile fines regarding financial crime. Past failings by banks are still coming to light, and most financial institutions need to continue to invest in this to keep pace with regulatory expectations. Furthermore, with recent geopolitical events and the use of sanctions, the regulators are unlikely to take their foot off this particular pedal.

Value from Expenditure

Banks will seek to reduce inefficiencies, which can be highly challenging. Some may cut too quickly and easily, while others may fail to act sufficiently and broadly. Both can significantly impact operating models.

In recent years we have noticed explicit cost reduction targets. While this agenda continues to grow, we anticipate more focus on ‘value for money and ‘getting it right the first time. However, with the high cost of remediation, it is still not possible for most larger banks to put an end to their past mistakes.

Customer Duty

Every year, the Financial Conduct Authority (FCA) changes regulations, so this year it is moving the dial for financial service providers. Now Financial institutions do not only need to be fair, but they also have to work in the best interest of their customers and be able to evidence that

It may need only a few changes in larger organisations, such as a more diversified product range and income streams, but small and medium-sized banks may need to work hard to prove that their business model is in the best interests of customers.

Regulatory Requirements

Regulators are placing extreme pressure to make sure that the information they receive is accurate and reliable. Making regulatory reporting strong is an ongoing theme in the financial sector. As a result, firms need to keep up with the reporting requirements and ensure that their processes also fit the purpose.

The use of data and analytics to support reporting is a popular theme. Financial organisations should consider it an opportunity to modernise their regulatory reporting, risk and finance teams. The regulators have shown that they want to be more data-led, and the industry should support them in every possible way.

Customer journey and Value Chain

Traditional net interest margin (NIM) may no longer be the most significant revenue source for banks. Compared to traditional banking models, equity valuations for payment and those that own the customer interface are massive. In addition, value is now seen in those banking elements which affect the customer directly, and all other things become less important. Simply put, the value lies in controlling the customers coming to you.

Banks are focusing on making good customer relationships to make more money. Therefore, disintermediation is a significant risk starting to materialise, and banks must consider it. Furthermore, some non-banking firms are also starting to provide services in the space that can threaten banks’ market share.

Data Collecting and Improvement

Data collection and improvement are becoming increasingly popular in the financial services sector. Access to all the data can help banks support internal and external decisions. It also helps firms to justify their course of action and support information requirements from regulatory authorities.

The raw data must be robust enough to support broader business and investment in innovation. Banks should also consider and control who owns the data because different teams might have different opinions of what is and is not the correct data source.

ESG and Ethical Banking

Banks will need to take sustainable steps to decarbonise their loan portfolios. Corporations and financial service institutions focus on environmental, social and governance issues (ESG). Still, we see nuances concerning other issues beyond climate change, including biodiversity, sustainability, diversity, and inclusion.

Social (S) and governance (G) still rank second to the environment (E), but they are growing continuously. For instance, banks are increasingly pressured to change their lending habits and assess their services and investments’ ethics.

Conclusion

We have discussed some key themes that are becoming popular among the banking and payment sectors. Adapting these trends and themes will help them to ensure future resilience. With the growth of technology, digitalisation has become a significant part of the financial service sector. Banks are creating super apps and electronic payment methods to provide ease to their customers.

While staying on top of all the topics discussed in this article may seem challenging, banks have an opportunity to transform their processes and become more scalable, sustainable, and future-proof.

This is for information only. Please always seek professional advice before acting.

Kuflink Ltd is authorised and regulated by the Financial Conduct Authority (FCA) (Registration Number 724890). Kuflink Ltd has its registered office at 21 West Street, Gravesend, Kent, DA11 0BF, under company number 08460508. Kuflink Ltd has been approved by the Board of HM Revenue and Customs to act as an ISA manager in May 2017 to offer Innovative Finance ISAs – ISA manager No – Z1943.

The Importance of FinTech to the Business World

What was considered a novel way to manage finances, FinTech is now being used by millions of individuals and businesses worldwide. With more and more activities occurring online, the demand for digital finance and financial services technology has increased dramatically, providing a greater opportunity for the UK’s FinTech industry. The UK is already regarded as one of the leaders in the FinTech industry, with London being the key driver. Investors find this sector attractive as it provides simplified transactions and enhanced security.

The FinTech industry is critical for the UK economy because it empowers the development of new markets and makes finance more inclusive for the masses. By seeing these benefits, every sector is shifting towards FinTech to improve its customer experience. However, before digging into the importance of FinTech for businesses, first, let’s understand how FinTech works.

What is FinTech?

Financial technology or FinTech refers to providing financial services over the internet. This innovation includes everything from mobile banking to stock trading and payment apps. In other words, we can say that every business can include FinTech for their services to automate their work and procedure. Wondering how? Because with the use of technology, you can simultaneously offer exclusive services to consumers and businesses.

Over time FinTech has become the fastest-growing and most influential industry whose significance cannot be denied.

Reasons Why FinTech is So Important

As described above, FinTech is vital to the UK, with its value expected to triple in the next few decades. Here are some reasons that help you understand why FinTech is essential to the business world.

Improving Financial Inclusion

FinTech has made financial services accessible to everyone, using them anywhere at any time. It allows businesses to introduce new products and services to customers who have not been accessing traditional financial services. Through essential financial services like e-wallets, the FinTech industry is helping individuals and businesses to create a more financially inclusive world. It is made possible through the following:

- Providing innovative underbanked solutions.

- The provision of simple products at a lower cost.

- Providing funding accessible to small and medium-sized enterprises.

Cost-effective Option

Global payment services are indeed a blessing for several communities. But you may not know that these services can be costly, and not every business can afford them.

On the other hand, FinTech services offer the exact solutions at a lower price. As a result, you can avoid paying unnecessary fees and save money. In addition, you may find plenty of financial tools and no longer need to worry about hidden charges. In addition, you can send and receive money worldwide through mobile devices.

Companies using FinTech can save money by not having physical branches to service their customers. You can find stock trading apps without commissions and bank accounts with no fees, which means more money in your pocket.

Compliance and Security

Many of you may be concerned about the security of FinTech and think it could be more reliable in terms of security. However, this is not true. FinTech can be more secure and safer than traditional financial services. This is because traditional financial institutions and banks need to adopt new technology and cybersecurity measures faster.

Small and medium enterprises and retailers are more vulnerable to cyber-attacks, security breaches, and other online risks. For example, 74% of UK small businesses reported security breaches in 2015. As a result, multiple FinTech companies have introduced security features that help businesses detect fraud and manage compliance issues. Your customer data and personal information will remain protected by FinTech companies.

Empowering Small Businesses

Large businesses typically stay one step ahead when using advanced technological and financial tools; however, this is different now. Even start-up businesses use tools that big names in the industry use, including online payments and managing accounts online. Furthermore, innovative financial products help small businesses expand their services and operate more efficiently.

Enhancing Customer Experience

Every business wants to offer instant results and take care of customers. With the help of advanced technology, FinTech can offer personalised solutions and interactive communication options, ultimately improving customer engagement.

FinTech services make it possible to lend or borrow money in no time. Many platforms like Kuflink operate online and offer multiple financial products to their customers.

Increasing Transparency

Trust is the foundation of every business, and FinTech enables financial services companies to increase the transparency of services and products. Traditional financial institutions and banks are not always transparent, and customers may have to pay some hidden charges. While FinTech helps your business to offer transparent services, real-time updates, and tight security. You can provide a better customer experience and increase your productivity.

Enhancing Financial Capability

Whether it’s your personal or business finances, FinTech helps you manage your money. You can build your future using financial tools if you are a start-up business. This innovative technology also helps you to provide financial education to your customers with increased financial literacy, and people can reduce debts and understand the value of budgeting and investing.

How is FinTech Beneficial for Economic Growth?

Financial technology and innovation can make everything simple. According to a recent report by the IMF, countries that believe in investing in high levels of digital financial inclusion often have high annual GDP growth. The UK is the third largest destination for FinTech in the world and comprises 1600 firms, and this number is expected to double by 2030. Above all, the FinTech industry contributes an estimated amount of £7 billion and about 60,000 jobs to the UK economy.

In the UK, many FinTech investments have been made, especially after COVID, and this number is not slowing down.

Conclusion

The UK is an established and leading financial and business service centre and a global hub for FinTech. Fintech is essential to the UK economy and provides numerous benefits to businesses, including cost-effectiveness and improved customer experience. To sum up, we can say that the FinTech boom will not slow down anytime soon.

This is for information only. Please always seek professional advice before acting.

* Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

Kuflink’s new features for November 2022

August 22 to November 22 have been very intense months for us, with many new Feature releases and updates to our previous releases. We hope you enjoy them as much as we have enjoyed building them.

Quote for October 2022

“Pleasing Personality. Our personality is the sum total of our mental, spiritual and physical traits and habits. An attractive personality is assembled by controlling and guiding our emotions, practising courtesy and having a positive attitude..” – 13 of 17. Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success, please refer to previous CTO blogs).

Released – Online P2P Platform

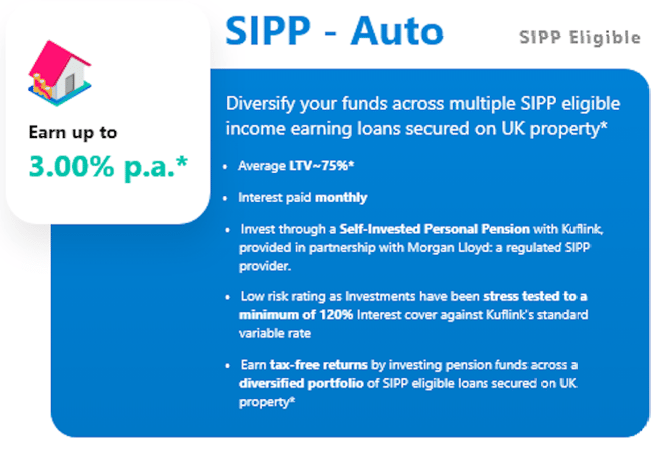

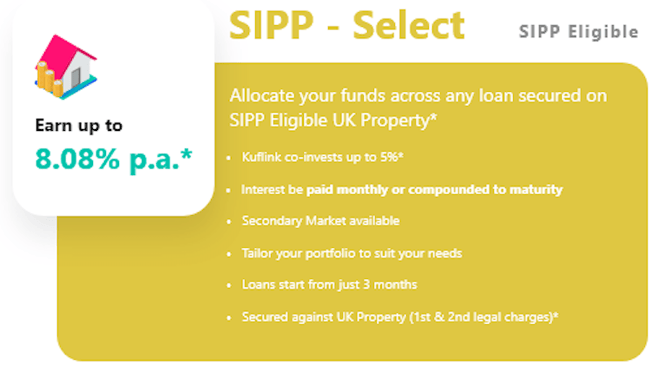

6) Released! A NEW SIPP-Auto Product is now live with its own SIPP wallet. A SIPP is a Self-Invested Personal Pension, which will be done in partnership with Morgan Lloyd (a Specialist in Self-Invested Pensions). The SIPP Pool will have SIPP-eligible property loans. To open a specific SIPP account with us, please reach out to us, and we will help you through the process.

Released! We have also released SIPP – Select deals as requested by many of our SIPP clients.

7) Released! New Updated releases for Mobile Apps for Android and Apple

Android. We have completely upgraded the APP this month so that you now see features on the desktop that are now available on the APP. This has been a long time in the making, and we are proud of the team of this Beta Release. Please ensure you download the latest version on the Play store.

Apple. We have completely upgraded the APP so that you now see features on the desktop that are now available on the APP. This has been a long time in the making, and we are proud of the team of this Beta Release. Please ensure you download the latest version on the APP store.

8) Released! NEW Environmental, Social and Governance (ESG) page has been built, to show some of Kuflink’s Key performance indicators (KPIs), energy performance certificates for the head office, Consumer survey results, Ongoing Management information: Profit & Loss, Balance sheet, Taxes paid, Green property developments funded, Governance committees, and much more.

Click here to view the ESG Page.

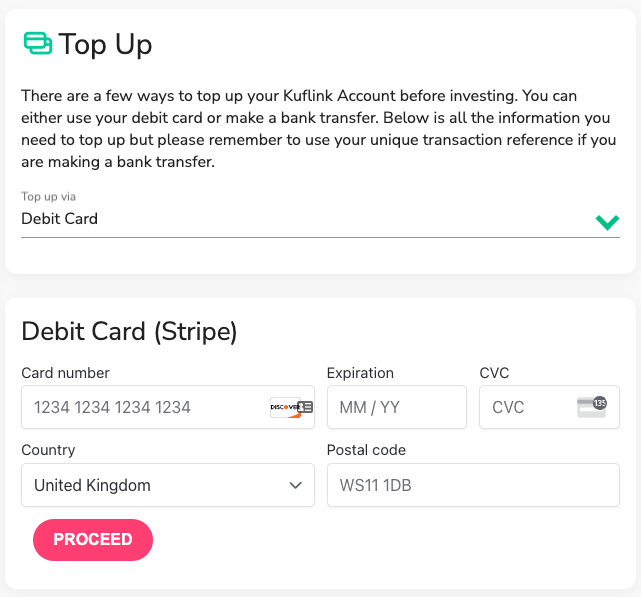

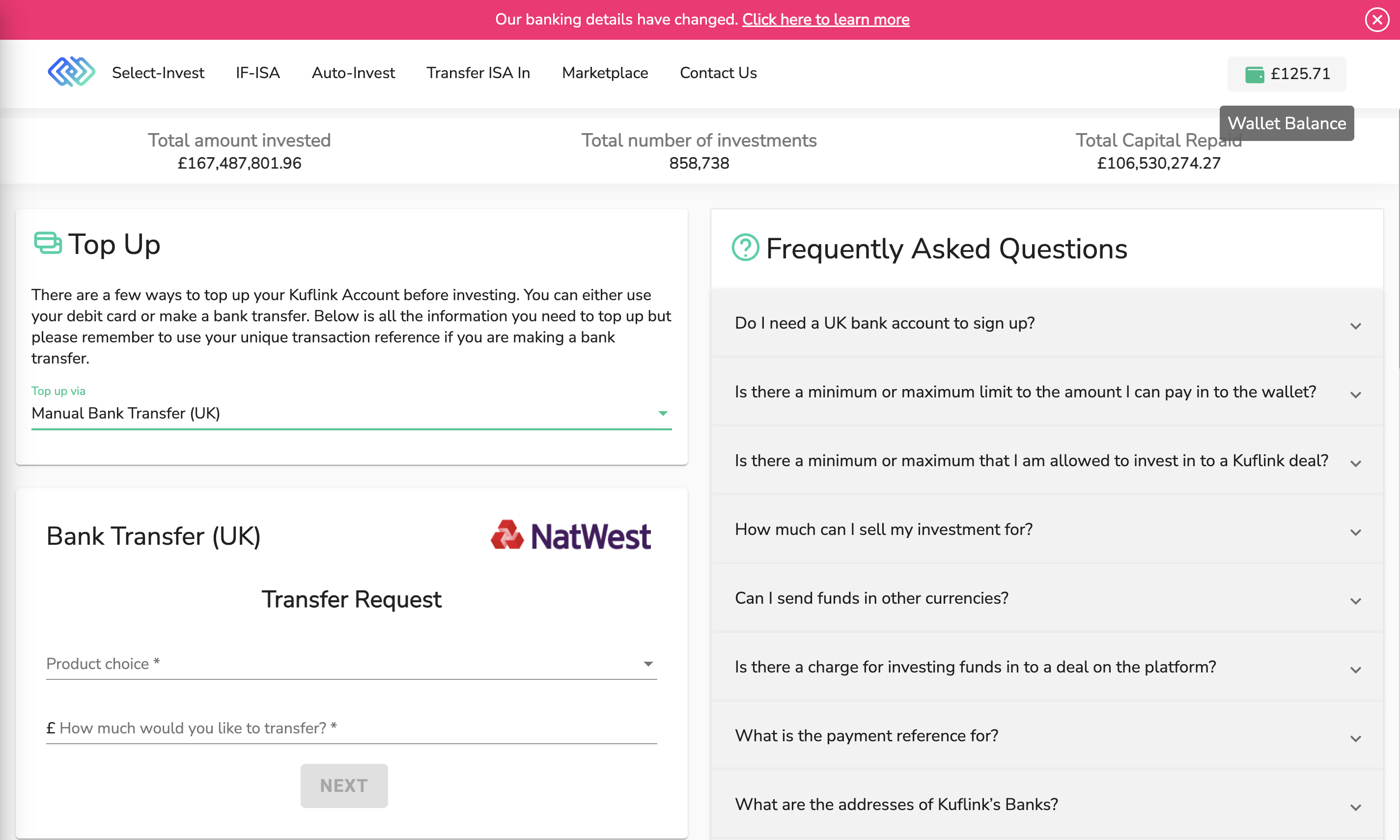

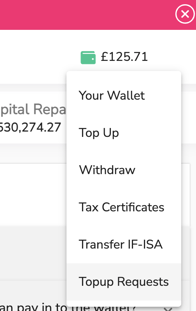

9) Released! New Notification System for Bank transfers to the Kuflink wallet. We have completed this system where you can advise us of any bank transfers you have made on the day or expect to make. This will assist us in updating our systems to expect funds from you. To get started, press the wallet image, go to Top Up, and then choose Manual Bank Transfer (UK) from the drop-down menu. Please note, on receipt of your transferred funds they will not automatically invest into your desired product; this is still solely your responsibility.

You can amend any notification by scrolling down to Topup Requests.

10) Released! The Audited Accounts page.

Our Management accounts up to August 2022 are available on the Kuflink ESG page.

In January 2022 we released our latest, 5th year of Independently Audited accounts for the platform, for the period ending 30th June 2021. We decided to upgrade the page for you with links to previously independently audited accounts for all the regulated companies and the main Group company. Click here to view the page.

Coming Soon! – Online P2P Platform

1) Coming Soon! We are in the final testing phase of allowing clients to automate the withdrawal of their monthly paid interest. This is a feature that some of our clients wanted as it was a repetitive task for them every month.

2) Coming Soon! We are working on introducing Select SIPP deals as requested by many of our SIPP clients.

3) Coming Soon! Some new Proprietary features based on your feedback.

Updates!

1) Update! We are excited to report that we have just changed our debit card service provider from MangoPay to Stripe, which is one of the biggest payment service providers in the world.

2) Update! We have connected our Open banking platform to our P2P Platform successfully to enable bank transfers to be immediately updated to Kuflink client wallets. We have built a proprietary solution to solve the NatWest to NatWest transfers which are working successfully. Thank you for your patience.

3) Update! On Thursday, 21st April 2022, we started protecting client money for Corporates as we do for Individual client money under FCA Client money rules (CASS 7).

4) Update! We have successfully passed our ISO27001 Audit (UKAS). Press here for a copy of the certificate.

5) Update! Some of our directors have successfully housed a family from Ukraine and are continuing to help in any way that they can to find some peace and normality in this traumatic crisis.

6) Update! At times, unexpected popularity can result in pool availability being sharply taken up, leaving clients without the pool option for their ISA investment before the Financial Year’s End. The good news is we have a solution that will enable you to allocate money to this Financial Year without losing any allowance. Simply transfer funds from the General Wallet to IF-ISA (Current); after clicking “transfer,” the amount you have transferred will be deducted from your general wallet and be used against this year’s allowance. You will then be able to invest these funds once we have further availability again.

7) Update! We have successfully internally passed the Bcorp Assessment, scoring significantly higher than the minimum (80 out of 100). BCorp assessors are now processing an Independent Audit and are hopeful we will have our BCorp certificate in the near future. We have released the assessment answers on our Kuflink ESG page.

8) Update! As part of our objectives of the Kuflink Foundation and the Kuflink Group, we are pleased to announce a new two-year deal with Ebbsfleet United with a long-term principal club sponsorship. We are committed to our local community and the support of Ebbsfleet United – through sponsorship and in-person at the club.

Chief Technical Officer’s (CTO) thoughts for November 2022

As we all said our final goodbye to our Late Queen, her values of dignity, duty, decency, integrity, humility, fortitude, stability, loyalty, and humour will endure. Kuflink has been tested through the Covid-19 Pandemic and recently the Financial headwinds from the Sept 2022 mini-Budget. Our systems held firm, and we worked with our borrowers and lenders to get through this. Our systems adapt to the market, and there are lessons to ensure any pain points are smoothed out for the future.

We have been lending money secured on property for 11 years (since 2011) and have operated an online electronic Peer to Peer platform for 6 years (since 2016). We launched an Open banking Platform for internal use this year (2022). Throughout this period, Kuflink has ensured no investor has lost a penny thanks to our:

In-House team

- Experienced Underwriting team;

- Experienced Credit Committees (as developers, valuers, and bankers);

- Experienced Accountants;

- Experienced Collections Team;

- Experienced Proprietary Software Developers;

- Experienced Board of Directors;

- Experienced Independent Non-Executive Directors

Third-Party Service providers

- Royal Institution of Chartered Surveyors – RICS approved valuers;

- AML/KYC: Onfido, MangoPay and Creditsafe;

- Debit Card Service Provider: Stripe;

- Credit Bureau Agencies: Experian, Equifax, TransUnion, and Cifas

- Solicitors Regulation Authority – SRA-approved Solicitors;

- Independent ISO27001 Auditors;

- Independent Auditors;

- Independent Bcorp Impact Assessment ESG Auditors;

- Independent Financial Conduct Authority

* Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.