How does a bridging loan work?

A bridging loan is a short-term loan that is borrowed to fulfil an immediate finance gap. With bridging loans, you can borrow large sums of money over a short period, anything between a week to a year (depending on the lender). Let’s get into some more detail of how these loans work.

What are bridging loans?

Bridging loans are secured loans that are used to purchase land, residential and commercial property. These loans are designed to ‘bridge’ a short term financial gap, such as buying a house before you have finalised the sale of your existing property or to buy property at auction within a limited time frame.

Bridging loans can be costly compared to other loans as they are taken out for a short periods and should only be seen as a short term fix and not a long term solution. However, the whole cost is still lower than taking out a mortgage over 20 to 25 years.

How can you use a bridging loan?

You can use bridging loans to do the following:

Buy a house- for instance, if you need to relocate immediately, but you haven’t sold your current property, you can use a bridge loan to act swiftly.

Buy property at an auction- when you buy a property at an auction, you have to make a 10% payment immediately with the balance paid within 28 days so a bridging loan could solve that issue for you.

Property development– a bridging loan can be used by property developers or landlords to finance the refurbishment and renovation of properties that are sold or refinanced when works have completed.

You can also use bridging loans to:

- Pay HMRC tax bills

- For Buy-to-let investments

- Make Mortgage settlements

How bridging loans work?

There are two kinds of bridging finance: open and closed bridging loans.

1. Open Bridging Loans

Open bridging loans don’t have a specific repayment date, but most loans have to be repaid within a time frame which is pre-agreed within the lender from the outset. These loans may be suitable if you want to refurbish or renovate your property to be sold quickly. A lender will only consider this if they feel there is a suitable exit of the loan.

2. Closed bridging loans

These types of loans have a fixed repayment date and a lender who is already lined up to exit the short term bridge loan. They are ideal to use if you know when you will be able to pay off the loan. For instance, if you haven’t sold your house, have signed the contracts, but the sale hasn’t been made.

First and Second charge bridging loans

When you take out a bridging loan, a ‘legal charge’ is placed on your property like a mortgage. This is done to secure the loan. A charge is a legal contract that sets the priority of which lenders will get repaid. Generally, there is no limit on how many charges you can list on a property.

A ‘first charge’ is taken when there is no previous borrowing taken out against the property and no other lender has registered a charge, this charge will be repaid first followed by a second charge and so on.

A ‘second charge’ is taken when a further loan is taken out by a client but there is already a lender ahead of them who has taken a first charge on the property. Usually, second charge providers will have to get the permission of the first charge lender before they are able to take their charge.

How much does a bridging loan cost?

A bridging loan is taken out for a typical period of 9-12 months; therefore, interest is charged monthly instead of yearly. You are also likely to have to pay a fee.

Bridging Loan Interest

The bridging loan annual percentage rate (APR) falls between 6.1% to 19.6%, which is higher compared to standard mortgages.

Like a mortgage, you can pick the way you will repay your bridging loan interest.

Fixed-rate bridging loan

With a fixed-rate bridging loan, you know the exact amount of interest you will have to pay during the term.

Variable-rate bridging loan

As the name suggests, interest rates on variable rate bridging loans can vary. The lenders set a rate according to the Bank of England base rate, meaning your payments may increase or decrease.

There are different ways to repay the interest, including:

Monthly: it’s paid as you pay the loan

Rolled up or Deferred: you pay the entire interest at the end of your loan.

A few lenders may let you payback your bridging loan interest with a blend of both.

How much can you borrow with a bridging loan?

Usually, bridging loans can be from £25,000 and go up to £100 million. The amount that you can borrow depends on the following:

- Value of the property you are using as security

- Your Credit Rating

- The deposit that you have in the property, most providers offer a loan to value of up to 75% of the property

- If you take out a first-charge loan, you will be able to borrow more than if you took out a second charge loan

- The interest rate you pay will be high compared to a standard home loan and fees, which means a bridging loan can be costly.

Bridging loan fees

You have to pay a fee if you take out a bridging loan. This is called an arrangement fee charged for setting up the loan and can be around 1 or 2% of the loan.

Other fees may include:

- Exit fees: some lenders may charge this; the charges can be up to 1% of the loan amount if you make early repayments

- Legal fees

- Valuation fees

- Broker or introducer fees

- Repayment or administration fees

How to take out a bridging loan?

To get a bridging loan, you have to prove that you can afford to pay it back.

The evidence includes:

- Proof of the property you are buying and the price you are paying for it

- Your plan for selling your current property or proof of an imminent sale

- You may need to provide proof that you have a backup plan to repay the loan amount if your current plan doesn’t come to fruition.Bridging loans have become valuable and useful for businesses and individuals looking for quick funding solutions. There are a lot of lenders available in the market, all providing different types of bridging finance. Some use high-risk assets as security like boats, jewellery or cars. In contrast, others mitigate the risk by securing the loans against property. Kuflink bridging loans are strictly secured against UK property. You can borrow from £50,000 up to £3 million with a max LTV of 75%.

We are fully authorised and regulated by the Financial Conduct Authority (FCA) and accept introductions from intermediaries that have FCA permissions. If you introduce a borrower to Kuflink you’ll receive 50% of the arrangement fee paid by the client. At present we do not offer regulated loans.

* Loans, interest rates and completion times are subject to underwriting criteria. Failure to meet the repayment criteria of a loan could result in the security being repossessed.

Best Investments for Young Adults and Asset Allocation Strategies

I am reminded of a simple job I was given when I was 16. Stand one metre behind a bucket and throw a ball into it. I got every ball into the bucket every time I threw it as I literally leaned over and dropped the ball. I did this a few times, before, without prompting, I moved back a metre. I threw the ball but this time it was a little harder. After another period, I stepped back again. This time the ball missed the bucket several times. Even then, I moved back again. The job got harder and harder as I moved back. In this little experiment we learn the fundamental lesson about Investing.

This is for information only. Please always seek professional advice before acting.

Making money should be boring as it should make you money while you sleep without giving you a thrill. However, we get easily bored and so we seek out a thrill to go alongside investing. We create or seek out challenges along the way to get the thrill. The answer is to keep it simple and keep doing what works, even though it’s boring. As in the bucket example, stick to dropping the ball into the bucket without stepping back. Remember, it’s boring because you have become good at it. Become an expert at something simple, and you will be successful, without the thrills.

Do you believe young people have to be told to invest? If yes, then I disagree. These people know that investment is beneficial, but they don’t necessarily prioritise it. Especially in a world where the focus is on surviving through the present. Despite the anxieties of today, it’s more important for the younger generation to invest, considering the obstacles that get in the way of a prosperous financial future. Investing is not a fantasy for many, but it’s a tool we can use to help people realise the significance of saving and investing.

Saving vs investing

Before jumping into the details of investing, let’s quickly learn about the difference between saving and investing.

Saving: When you start putting money aside gradually, this is saving. You might save for something you want to buy or for unforeseen circumstances. The most common means used for savings is the bank, where you put your money away and earn interest on your savings.

Investing: when you purchase things that you believe will increase in value and/or give you a return, this is called investing. This can be buying stocks or shares, running a business or renting a property. These investments carry their own specific risks, so please seek independent financial advice. With investments, you can make more money if things go right, but if they don’t, you might end up losing money. So, the rule of thumb is never invest more than you can afford to lose. Risk – Reward allocation is considered below.

Things you need to know before investing…

Before you start thinking about investing, it’s critical to clear any outstanding debt that you have.

You are charged more on loans and credit cards than the return you get from investments or savings accounts. So, it’s better to use your funds to clear any debt that you might have.

Here is what you need to do:

- List all your outstanding debt

- Figure out which debt is charging you the most

- Pay off the debt that has the highest interest rate first

- Re-evaluate why you went into debt and ensure you take steps to not repeat the same mistakes.

Check to see if there are restrictions on early repayments since you might have to pay early repayment fees, which can be high.

Set Financial Goals

You can make your investment decisions on the basis of whether your financial goals are short-term, medium-term or long-term.

- Short-term goals: these goals are the things you plan on achieving in the next five years.

- Medium-term goals: these are the things you plan on achieving in the next 5 to 10 years.

- Long-term goals: these goals include the things you want to achieve in over ten years.

So, it’s better to think about your goals ahead of your investment making decisions.

Knowing the best investment options can be difficult. But if you are comfortable in tying up your money for up to at least five years, then you can have a lot of investment options.

Remember that investing money can mean you are exposed to your capital being at risk.

Risk & Reward – Asset allocation Strategy

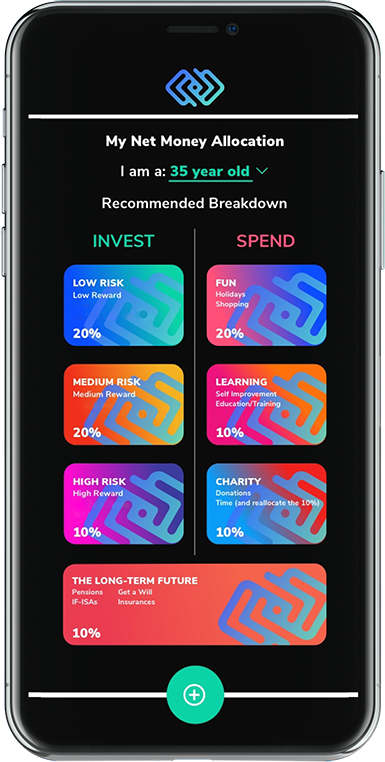

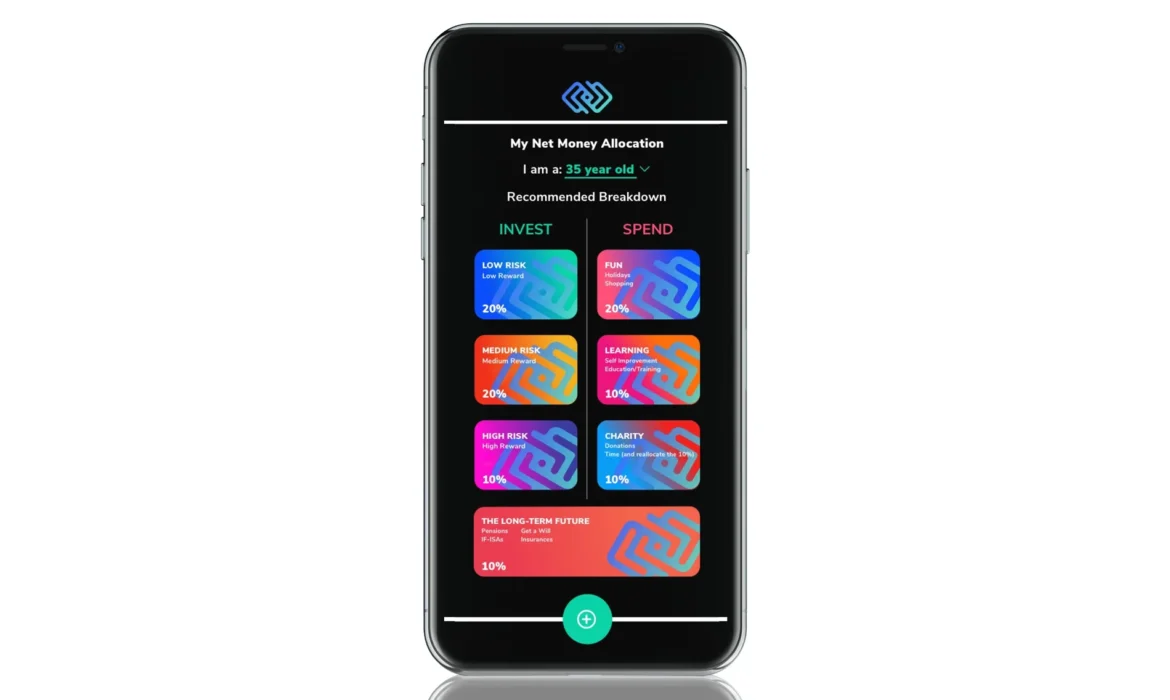

You can make your investment decisions on the basis of your risk tolerance, age, investment returns, risk of the asset class chosen, etc. We have chosen the following random percentages. The higher the age, the lower amount you should put in high risk buckets.

- Low risk – low return bucket (e.g. 20% allocation of surplus funds – remember all capital is at risk): choose an asset that maybe safe but has some level of reward above inflation, if possible. Slow and steady tends to win the race amongst these three asset allocation strategies.

- Medium risk – medium return bucket (e.g. 20% allocation of surplus funds – remember all capital is at risk): choose an asset that maybe of medium risk but that has a greater level of reward than the above strategy.

- High risk – high return bucket (e.g. 10% allocation of surplus funds – remember all capital is at risk ): choose an asset that may be of high risk but that has a greater level of reward than the above strategy.

- Long-term future bucket (e.g. 10% allocation of surplus funds): Choose an asset that will protect you in the future such as pensions, Insurance policies and Wills.

- Fun bucket (e.g. 20% allocation of surplus funds): choose to save funds in a bank that has FSCS protection. Here these funds are for enjoyment, cars, holidays, eating out, etc.

- Learning bucket (e.g. 10% allocation of surplus funds): choose to invest in yourself which could be an investment that keeps on giving.

- Charity bucket (e.g. 10% allocation of surplus funds): choose to help those who cannot help themselves. Remember, living with clean water, a roof over your head, and being surrounded by people that love you, is paradise to those who cannot get clean water.

There are several types of investment options available:

- Bonds

- cash / cash equivalents

- Stocks & shares

- Property

- Government bonds

- Businesses

- Peer to peer lending

- NS&I savings

- Pensions

- And much more.

Why should you consider investing?

- Compound interest

We understand it is not a great time to be a young person with all the student loans, low wages, tougher job market and higher property prices, along with a global pandemic, Brexit, and finances of 18 to 34 years-old in the UK been hit the hardest.

Fortunately, time is on your side. What does it mean? The more time invested in the market, the more room there is for your money to grow. It all comes down to compound interest. The beauty of it is that you will gain interest on the initial investment you make along with all of the subsequently generated interest. In simple words, it’s interest on interest and is a powerful tool for building wealth.

- Diversification

Another great benefit of investing is that now you can diversify. Because of so many investment possibilities, diversification is easily achievable now. You can do it by splitting your money across different investments. This way, you can manage the risk and earn better returns. Diversifying saves you from putting all your eggs in one basket. However, if you aren’t sure about investing, please always seek professional advice before acting.*

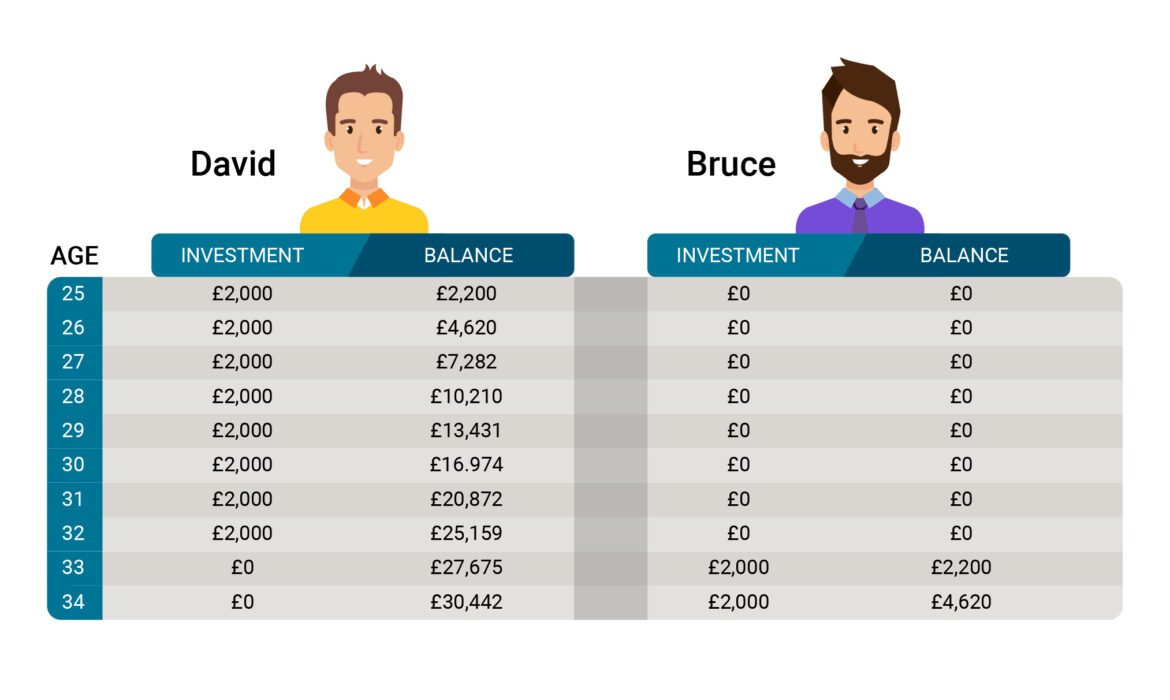

Let’s see how investing early can help you

This image illustrates the importance of investing at a young age. It demonstrates how you can yield more returns over 15 years compared to someone who started investing late. Not only does the young investor end up with a five-digit bankroll by 40, but they also invested less throughout their life compared to the counterpart.

Early savings can build a strong financial foundation for your life and how you live your life. Have you ever wondered how you are going to put down a deposit for your house? How will you raise a family in the future? Or why everyone insists that you start saving if you want an easy retirement. These pressures shouldn’t be ignored, and just having a basic income is no longer enough. Investing may look boring at first glance, but it’s your friend!

*This is for information only. Please always seek professional advice before acting.

**Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

Asset Allocation for Young Adults

Financial planning, it’s usually not the first thing on your mind when you are in your 20s. However, for parents, this can be a constant stress as they have to think about their kids’ graduation while navigating their own career. While having kids might be exciting, helping them get off to a good start as young adults is something every parent worries about.

Perhaps the most important thing that parents can do is help their children learn about good financial habits. Such habits aren’t just about spending wisely or saving but about investing for the future. By teaching children about the value of investing, we can help them set up a sound future. A good place to start is to learn about asset allocation.

What is asset allocation?

In simple words, asset allocation is how you invest your money between different asset classes. It is a technique that helps you in deciding which type of assets to invest in and in what proportion. With asset class allocation, you can create a good investment portfolio by striking the right balance between reward and risk. The right combination of investments can help you achieve better returns without taking a lot of risk.

Why should you pay attention to asset class?

Asset class is one of the most important concepts that you should learn as a new investor. A good asset allocation strategy ensures that you have a diversified investment portfolio, with high growth potential and minimum exposure to risk.

For example: if you don’t allocate the right amount of funds to equities, you may miss out on growth opportunities and may not be able to achieve your financial goals. If you allocate more funds to equities, you may be taking on more risk than you can tolerate, setting yourself up for a substantial loss of your savings without having the time to recover.

How it works?

An asset is something that has value. It may be real estate, cash or some collectable items like baseball cards. The universe of investment is wide and vast. You can mix and match to create different asset categories. However, when it comes to investing, most people know about only the basic three asset classes cash, stocks and bonds.

Every asset class has its own reward and risks, so you can decrease the risk of any asset class by creating your own mix of assets.

-

- Low risk – low return bucket (e.g. 20% allocation of surplus funds – remember all capital is at risk): choose an asset that maybe safe but has some level of reward above inflation, if possible. Slow and steady tends to win the race amongst these three asset allocation strategies.

- Medium risk – medium return bucket (e.g.20% allocation of surplus funds – remember all capital is at risk): choose an asset that maybe of medium risk but that has a greater level of reward than the above strategy.

- High risk – high return bucket (e.g. 10% allocation of surplus funds – remember all capital is at risk ): choose an asset that may be of high risk but that has a greater level of reward than the above strategy.

- Long-term future bucket (e.g. 10% allocation of surplus funds): Choose an asset that will protect you in the future such as pensions, Insurance policies and Wills.

- Fun bucket (e.g. 20% allocation of surplus funds): choose to save funds in a bank that has FSCS protection. Here these funds are for enjoyment, cars, holidays, eating out, etc.

- Learning bucket (e.g. 10% allocation of surplus funds): choose to invest in yourself which could be an investment that keeps on giving.

- Charity bucket (e.g. 10% allocation of surplus funds): choose to help those who cannot help themselves. Remember, living with clean water, a roof over your head, and being surrounded by people that love you, is paradise to those who cannot get clean water.

There are several types of investment options available:

- Bonds

- cash / cash equivalents

- Stocks & shares

- Property

- Government bonds

- Businesses

- Peer to peer lending

- NS&I savings

- Pensions

- And much more.

For example

Stocks: If you invest all your funds in stocks, you may be able to reach your investment goal sooner but, a steep drop in the stock market can adversely affect your chances of getting high returns.

Bonds: Putting money into bonds is a comparatively safer way, particularly when the equity market is volatile. But with bonds, you have to save more and start earlier if you wish to reach your long-term financial goals.

Remember that asset allocation is not a magical tool to generate growth or remove risks. But, it is a tried and tested method of creating an investment portfolio that can deliver you your intended goals. So, before investing, be clear on what your goals are, then start choosing the best assets mix for you.

*This is for information only. Please always seek professional advice before acting.

**Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

P2P outperformed UK stock market during the pandemic

Copy the link below if the Read More link expires.

Peer-to-peer lockdown: investors fear cash will be trapped for years

Copy the link below if the Read More link expires.