Exchange of Contracts

What does ‘exchange of contracts’ mean?

When two solicitors representing the seller and the buyer swap the signed contracts and the buyer pays the deposit, this is called an exchange of contracts. Once the seller and the buyer exchange contracts, the agreement becomes legally binding, and no party can back out of the deal.

What is the significance of exchanging contracts?

This stage is significant as it marks the point at which both buying and selling parties are legally bound to complete the transaction. It can also set a date for completion and confirms that all the necessary paperwork is in place for completion. After the exchange, if either of the parties pull out of the deal, then there would be penalties.

What happens when you exchange contracts?

In the olden days’ solicitors used to physically meet for exchanging / completing contracts, but that practice is rarely being practised now. This normally happened on a Friday as solicitors would gather their papers and cheques to meet in the other sides firm, to conclude as many conveyancing matters as possible. The closer the other side was, the better. Now things are finalised by conducting verbal agreements over the phone.

During the exchange and completion of contracts, the solicitor reads out the contract over the phone, and that conversation is recorded. The solicitors ensure that the contracts are the same and then send them to each other.

What is completion?

Completion is the final phase of the property purchase/sale process. It happens when the ownership has been transferred successfully to the buyer. And when the seller’s solicitor ensures that the seller is in receipt of whole purchase monies. Upon completion, the buyer gets the vacant possession along with the keys by 1 pm of the completion day. On the completion day, the seller should leave the property by 1 pm, unless otherwise agreed.

Difference between Exchange and Completion

As the exchange word implies, it is an exchange of the contracts between the solicitors which legally binds the seller and the buyer. Completion is the day both parties transfer legal ownership, and the buyer moves in.

The buy/sell transaction is not legally binding until the exchange of contracts. Either party can withdraw before the exchange of contracts but there will be a penalty if it’s done after the exchange.

How long do exchange and completion take?

The exchange of contracts depends on the extent of the property chain but once complete, your solicitor then confirms the legal completion date to you.

The longest part of purchasing a home is an offer being accepted and exchanging contracts, as it can sometimes take several months. In order to speed things up, you have to be well organised, respond to all queries quickly and inform your solicitor and estate agent if you are travelling and unavailable. However, fortunately, when the contracts have been exchanged, the solicitors will agree a completion date.

Generally, people set completion dates for two weeks after exchange. However, this is only a guideline. If the buyer and seller are not in a hurry to move, then they can ask for more time. Sometimes people even complete in less than two weeks. If you set a date after two weeks, it can give you more time to organise everything and change your address information.

Does completion have to be on a Friday?

Most completions happen on a Friday which is a tradition dating back a number of years. People think moving in at the weekend is better as this way they won’t have to take any time off work. Most buyers prefer to move in on the last Friday of the month so their first mortgage payment coincides with their salary every month. However, there is no given rule, guidelines or law for completing on Friday. In fact, on the contrary, it is advised to avoid completing on a Friday.

Why completing on a Friday is not a good idea?

Even though completing on a Friday is the most popular option, there are a few drawbacks to it which you should absolutely know.

- Sometimes, banks money transfer system can get overloaded, which usually happens on the last Friday of the month. So your transfers should happen before Friday as you wouldn’t want to become homeless for a weekend.

- If you move during the week, then you have the advantage of telling your solicitor to resolve any issues occurring during the move.

- Many moves get delayed because the money doesn’t arrive in time. So this is one good reason to avoid completing on a Friday.

- Fridays are known to be peak time for conveyancing frauds, also called the “Friday afternoon scam“. This scam usually targets solicitors’ emails.

- Cybercriminals try to hack into solicitor’s email to divert their client’s funds. They are known to target Friday afternoon as it gives them time to avoid weekend detection.

- Furthermore, if you move and there is a problem, then it’s more difficult to hire anyone to fix it on a Friday or over the weekend.

- Another interesting fact is that most people move on a Friday so they can unpack over the weekend, but the reality is that it’s going to take a bit longer. This means that the moving company will be busier on Fridays compared to weekdays. This will only increase the cost of your move.

Buying and selling a house requires time and patience. You have to be careful and attentive during the whole buy/sell transaction. Make sure to do your own research about exchange and completion so you can decide on a completion date that is the best fit for you.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Kuflink’s New features for June 2021. Stand Up with CTO

Quote for June 2021

“Definiteness of Purpose: Definiteness of Purpose is the starting point of all achievement. Successful people move on their own initiative, but they know where they are going before they start.” – 1 out of 17 Napoleon Hill’s 17 Principles of Success.

What’s New or on its way to the Kuflink Platform & Kuflink Mobile APP for June 2021

1) We have released IF-ISA wrapper around some of our ISA eligible Select Invest Deals;

2) A new segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started;

3) We are working on our Open Banking Integration to allow instant top-up through Bank Transfer – testing underway;

4) We have been working on upgrading our proprietary deal risk / pricing tool in our CRM system by connecting to live data feeds, and allowing new fields to better assess the risk and price on deals. This is especially important in light of economic events like Brexit, the COVID-19 pandemic, and price hikes on raw materials (which will affect development appraisals). We are working with a ‘Royal Institution of Chartered Surveyor’ (‘RICS’) valuer and a seasoned developer / builder (both in our Credit committee), to further enhance the tool’s sensitivity to such events. We envisage to connect this information to our live loans on our platform to provide a time line of any given loan’s risk.

5) We are working on upgrading our Dashboard. Live Charts, proprietary budget tools, links to other investments, accrued interest, etc. will be on display in a singular view.

6) Portfolio page will also show which Select Invest deals have been put into the ISA wrapper – development underway.

CTO thoughts for June 2021

It is refreshing to have regulators in our sector. Great lessons can be passed on to platforms from past failures. The Regulators, Governing bodies, Independent Auditors, Industry Experts, stakeholders, forums, clients, affiliates, other platforms, advisers, work colleagues, friends, family, etc. all work together to ensure we provide a better service. We are here stronger because of those failings. There are many paths we can follow, and sometimes we get lucky, but generally, it is all of the above who make us better everyday. From the Kuflink team we are grateful to you all.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Back to the Office: Employers Responsibilities

The business sector has suffered a lot because of COVID-19. The biggest challenge for employers and employees has been working from home. While this is something that is not new but it wasn’t being practised on a huge level. However, remote working or working from home became our new norm.

The government has been providing constant guidelines during the pandemic to ensure the safety of employees. For instance, since march, businesses have been getting updates on how to keep their workplaces secure against the threat of the virus. So, now that we all are set to go back to the offices, as employers, we need to aware of the guidelines in place.

The UK government has decided to remove all legal limitation on social contact now that more than half the population has gotten vaccination. However, the variants of this virus may hinder governments plan, but we are optimistic that on 21 June, things go back to (some sort of) normal.

Keeping in mind the government regulations, there are four things that employers must do to ensure the health and safety of their employees.

Business Travel: Protect Your Team

This not only negatively affects the employee but also the company. After offices start functioning as before, many employers may be worried about potential compensation claims from staff who travel for business and contract COVID-19. These claims can be hard to pursue successfully.

As employers, we can protect our employees by:

- Conducting risk assessments for all business trips

- Documenting the steps necessary for safe travel

- Making sure the staff only travel with reputable operators

- Covering the cost for safe and clean hotels

- Empowering the employees with the right information about where they are travelling and whom they are meeting up with.

Know Where You Stand as Employer According to Law

There are different health and safety duties that employers are responsible for under the law. These duties applied before COVID-19, during the pandemic and will continue after it.

Employers must do the following:

- Take care of employees’ health and safety

- Provide a safe space and system for work

- In some circumstances, be liable for the negligence of employees

- Ensure where you stand as an employer

Establish Extra Safety Measures

Many workers will be concerned and nervous about returning to offices in June. Most will be worried about catching the Coronavirus.

So, as an employer, you need to:

- Get to know your workers’ concerns about returning to the office

- Take necessary precautions to make your team feel safe at work

- Reassure them by explaining how you have made the office COVID-secure

Have a Written Policy

As an employer, we are responsible for having a written health and safety policy. This is a legal duty that every workplace must implement to have a COVID-secure working environment.

Furthermore, as an employer, it is our duty to bring the written policy to the attention of all employees according to the health and safety at Work Act 1974.

A recent study has revealed that 29% of those who have suffered from COVID-19 develop Acute Respiratory Distress Syndrome (ARDS). It is thought that a third of coronavirus survivors may never fully return to work. This means that we should make sure that there is a personalised back to work plan that offers flexibility to employees in both the timing and structure of their working day.

What should be done for employees affected by the COVID-19?

As an employer, you should consider the following:

- Make sure all employees know the symptoms of the Coronavirus. They know what actions to take if they experience sickness, their sick pay entitlement and other necessary information; this all should be clear.

- For workers still based in their workplace, ensure that they follow the social distancing rules everywhere, including the rest areas. Always follow governments update of shift patterns to avoid peak travelling time and to lessen face-to-face contacts.

- Ensure everyone in the office has up to date knowledge and equipment to manage cleanliness at the workspace for post-infection management and prevention.

- Be aware of those classed as vulnerable to make sure the right actions are taken.

- Keep facilities easily available for employees to wash their hands regularly with soap. If possible also provide a hand sanitiser to encourage staff to use them at their workstations.

At Kuflink peer to peer lending, we are excited to work alongside the team in the office. However, we are putting in place every necessary step to ensure the security of our employees.

UK Crowdfunding Investments P2P Lending Statistics – April 2021

Copy the link below to see Apr 2021 Statistics.

https://www.kuflink.com/wp-content/uploads/2021/05/Screenshot-2021-05-20-at-13.57.22.png

Shifting sands

Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2021/05/Shifting-sands-_-Peer2Peer-Finance-News.pdf

4th Way backs Kuflink and reaffirms top rating after ‘auditor headache’

Copy the link below if the Read More link expires.

Kuflink Enacts Changes In Response To Auditor Concerns On Governance

A profitable property lending record since 2011 & highly satisfactory lending result.

Kuflink 5 Year Auto & IFISA received an Exceptional 3/3 4thWay PLUS Rating

Kuflink’s New features for May 2021. Stand Up with CTO

Quote for May 2021

“If we human beings rely only on material development, we can’t be sure of a positive outcome. Employing technology motivated by anger and hatred is likely to be destructive. It will only be beneficial if we seek the welfare of all beings. Human beings are the only species with the potential to destroy the world. Because of the risks of unrestrained desire and greed we need to cultivate contentment and simplicity” – Dalai Lama

Bit of fun for May 2021

Please view our teaser video showing the NEW IF-ISA wrapper offering around some of our Select Invest Deals.

What’s New or on its way to the Kuflink Platform & Kuflink Mobile APP for May 2021

1) You can now open each new Select Invest deal on separate tabs of your browser in the Market place (Secondary Market);

2) All loan tranches and tiers to show other tranched and tiered loans under each related Select Invest Loan. This is now live;

3) We are working on showing updated images and information of our Development Loans – development has started – release date in the next few weeks;

4) We have started works on providing an IF-ISA wrapper around some of our Select Invest Deals. Code has been released on the platform and is going through final testing. The release will be any day now;

5) Insights section is being enhanced to show other useful information to those keen on property investments. We will be showing information per region and maps never seen before showing specific property type price performances within regions;

6) IF-ISA Transfer IN Sign up process to be digitised is now ready for end to end development and release in the next few days;

7) Connect to our Open Banking App, which then means we do not require an uploaded bank statement, and gives the ability to make bank transfers in real-time – development is ongoing;

8) A New segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started – release in the next few weeks;

9) Works have started on Upgrading our NEW Dashboard. New live Charts, proprietary budget tools, links to other investments, accrued interest, etc. will be on display.

10) Proprietary loan management system has been linked to the Invest platform showing real-time borrower loan information tabulated, and charts showing the breakdown by property type, 1st charge versus 2nd charge, breakdown by Gross LTV, geographical split and historic lending Volumes (Statistics page).

11) We will be working on New Videos and specific pages (showing fast-forwarded investments with different results) to ensure clients get a further enhanced understanding of all of the risks and rewards in Peer to Peer investing. This will be implemented into the onboarding flow prior to possibly FCA introducing this next year.

12) Introduced the Kuflink.com footer with Products, Guides, About us, Blogs and Work with us links to the invest platform footer;

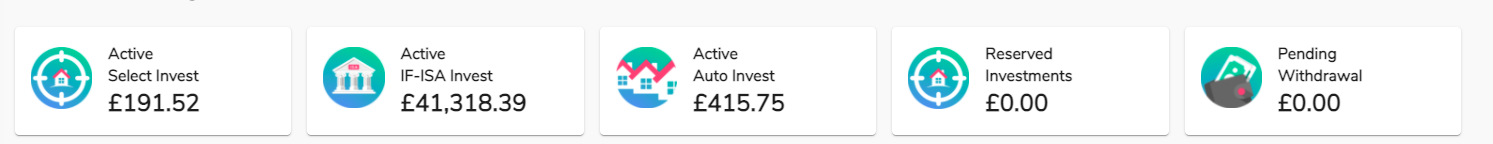

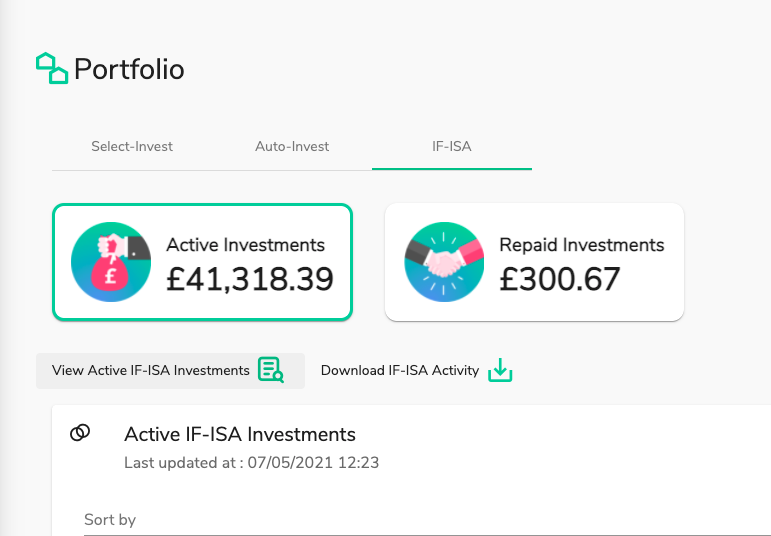

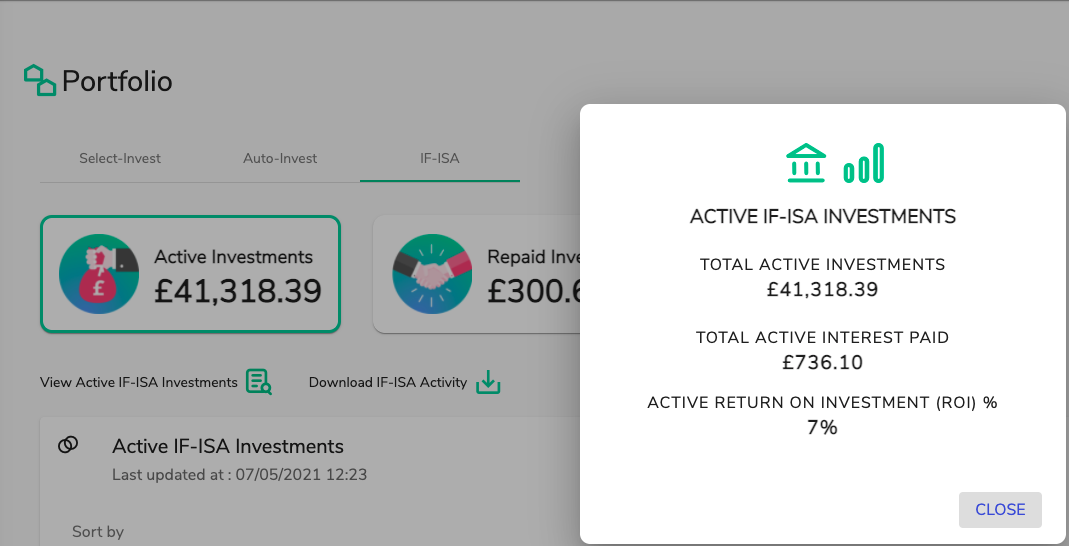

13) View Active Investments information has been put into a new section to enable the speed of the mobile apps and desktop versions to increase. This will also appear on the dashboard in the future. But please click on the links labelled (View Active IF-ISA Investments) in the Portfolio section. There are three links in Select Invest, Auto-Invest and IF-ISA as shown in the example below;

14) Please Download our Mobile APP using the links below; and

15) Much more coming.

CTO thoughts for May 2021

“Criticism may not be agreeable, but it is necessary. It fulfils the same function as pain in the human body. It calls attention to an unhealthy state of things.” – Winston Churchill.

This is why we went against the grain when it came to adopting our own Kuflink Default definition of one calendar month rather than the FCA Default definition of six calendar months. We react much quicker. We get in contact with borrowers many months before things go into one month default. Interestingly, our debt repayment during covid was substantial. This is mainly due to the Collections team, Underwriting and Credit committee decisions.

KUFLINK DEFAULT RATE.

A loan defaults when it is one calendar month past a missed payment, with this payment still outstanding. This may be a monthly servicing payment or the full repayment at the end of the term.

FCA DEFAULT DEFINITION

A loan defaults when the Borrower is past the contractual payment due date by more than 180 days. Which is approximately six calendar months.

We’ve had an amazing ISA season and our product development is expanding, especially in regards to the New offering with ISA wrapper around select invest allowing users to self select their opportunities. There are new products for Borrowers and Investors on the horizon (watch this space).

We continue to invite new users to the platform and strive to simplify the onboarding process to ensure clients understand risk and reward before investing. 12 months into the pandemic, the tech team’s contribution and dedication has been exemplary. The team’s tenacity is commendable whilst working remotely across various time zones. It’s been a massive effort by all.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.