Kuflink’s New features for July 2021. Stand Up with CTO

The Kuflink Tech Team has worked diligently to bring new features for July 2021 forward. Together, with your feedback, we are able to fulfil Kuflink’s purpose in ‘Connecting People to Financial Freedom’.

Quote for July 2021

“Mastermind Alliance: The Mastermind principle consists of an alliance of two or more minds working in perfect harmony for the attainment of a common definite objective. No person can become a permanent success without taking others long with them” – 2 of 17 Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

What’s New or on its way to the Kuflink Platform & Kuflink Mobile APP for July 2021

1) We are now working on a new feature that will allow IF ISA Transfers In to enter into ISA eligible Select Invest Deals – this means clients can decide which ISA eligible Select Invest deals they want their ISA transfer to go into.

2) A new segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started.

3) We are currently testing our payment facility using Open Banking on the investment platform in closed beta mode. This will allow our users to transfer funds to their e-wallet instantly using bank transfer. The facility will be available to our investor community shortly.

4) On the lending arm we are currently building the process, through Open banking, to add an additional layer of borrower verification in real time and building a process to ascertain income vs expenditure for a potential borrower across all accounts. This is a step forward in reducing paperwork and unnecessary communication thereby improving efficiency in the process. All in all we should, in theory, gain access to all necessary information through a simplified online process as opposed to numerous phone calls, email chasers etc.

5) Work on upgrading our proprietary deal risk / pricing tool in our CRM system by connecting to live data feeds, and allowing new fields to better assess the risk and price on deals is continuing. This is especially important in light of economic events like Brexit, the COVID-19 pandemic, and price hikes on raw materials (which will affect development appraisals). We are working with a ‘Royal Institution of Chartered Surveyors’ (‘RICS’) valuer and a seasoned developer / builder (both in our Credit committee), to further enhance the tool’s sensitivity to such events. We envisage to connect this information to our live loans on our platform to provide a timeline of any given loans risk.

6) We are working on upgrading our Dashboard. Live Charts, proprietary budget tools, links to other investments, accrued interest, etc. will be on display in a singular view.

7) Portfolio page will also show which Select Invest deals have been put into the ISA wrapper – development underway.

8) Kuflink responded to an FCA survey on High risk investments (submitted 1st July 2021) – FCA will update the rules at the end of this year.

We have taken the view that developments should not be treated as high risk, as all our development loan deals require a RICS approved valuer to produce a ‘Project monitoring Surveyors’ (PMS) report before each tranche of a loan is drawn. As an aside, we have started working on showing a ‘7 phases of Property Development’ bar which will move as the development continues per tranche. There will also be a guide to property development.

CTO thoughts for July 2021

Every organisation has unexpected chaotic situations. This could be a code release gone wrong, a critical bug in the system, system performance, or any other issue. When leaders enter the meeting, whether virtual or in house, team members expect at the end of the meeting, things will be more clear and there will be a well thought out plan that the team can follow. Our job is to reduce the chaos and bring more clarity. We have to simplify the problem by asking questions. This involves getting to the source of the issue and removing all unnecessary information associated with it. Leaders make the team think, by asking deep and broad questions. We create a small to do list with clear actions and assign owners to the tasks using our tech management system and monitor the progress through the build. At all times, we keep thinking and asking questions, searching for edge cases which will come, but may not be seen at the beginning. Most team members find it easy to incrementally add value once someone has done the initial effort. This means a lot of upfront deep thinking and learning is required before we hand over tasks to the team.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Airspace Development – All you need to know

Airspace developments are a great opportunity for property developers to build new housing in populated areas like London in a cost-effective way.

Airspace development has been making headlines in the world of property development. Do you know why? Let’s see what airspace development is, how it benefits us, and what is different about it.

The UK government in 2019 announced the relaxing of permitted development rules for buildings to add residential ‘top floors’. Furthermore, a new scheme was introduced by the housing secretary. The scheme relaxed the airspace development rules and allowed construction of up to two storeys on existing buildings without having to worry about the hassle of getting full planning permission – though a certificate of lawful use may still be needed.

Consequently, airspace developments have become a great opportunity for property developers to create new housing in densely populated areas like London in a profitable yet cost-effective way.

There are different opinions on this announcement. Many believe that airspace developments can resolve the UK housing crisis. At the same time, others fear that this step is a ‘race to the bottom’ with regards to standard, including light and space.

However, some have predicted that airspace development will result in up to 200,000 new houses in Greater London. So these types of development opportunities are an excellent step taken by the government.

So, what is airspace development?

A technique where developers use the rooftops of buildings for constructing new homes. With airspace development construction techniques, more homes can be created entirely off-site in factories. Plus, this type of construction can be done in a matter of days, making it time-efficient as well. Many are calling it an innovative solution for building houses that do not violate green belt land.

However, airspace development can only be successful when it fits well with the rest of the building and its surrounding area. So, it is important to make sure that any developmental changes are respectful of the existing architecture. This can be achieved by improving the communal areas and by enhancing the amenities such as cycle storage and lifts, which benefits the residents and brings the building up to safety and modern health standards.

Airspace development: How is it different?

There are no specific or unique requirements for airspace development. The required components, including land, funding, services and construction, are all there. But, the things that make it different are technical difficulties, potential design, the legalities regarding tenants or occupiers, like the right of light and access, or party walls. These additional considerations might make construction challenging and make funding a little tricky.

Advantages for Building Owners

- Upgrades to the building

- Cost savings on building maintenance and service charges

- Increase in value of property

- Extra income for freeholders

- Minimal disruption with an innovative construction method

Advantages to the wider community

- Less demolition and waste

- Preservation of existing buildings, communities and occupants

- Considerable increase in new houses

- Increase in housing with visual impact

Considerations

- Lease holder concerns

- Structural Capabilities

- Access routes for cranes

- Fire protection

- Maintenance

- Provision of services

- Quiet enjoyment by current tenants would be lost

- Tenants right of first refusal if the airspace is being sold or leased

- And so on

Why airspace development is an exciting area of development?

The opportunity to develop in London, the city where the property is at a premium, is a profitable and exciting prospect. By adding storeys to an existing building, a lot of new houses can be built with minimal disturbance to the residents and communities.

Moreover, airspace development is a sustainable method of building new houses since existing buildings get preserved and improved for saleability instead of falling into a state of disrepair.

How to Secure Funding for Airspace Development?

While the opportunity is large, the funding options may be limited. Many lenders do not understand the concept of airspace development and consequently may be reluctant to give loans for such projects because of project feasibility, the ‘non-standard’ nature or the amount of risk.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

0% Benefit in Kind Tax for Electric Cars Changes from 2020/21

Kuflink Green News! Company drivers for completely ‘Electric Vehicles’ (EV), have to pay 0% Benefit in Kind Tax in 2020/2021. Also, EV’s do not pay any road tax, and get a 100% discount on London’s Congestion Charge.

The UK government is trying to increase the number of Electric Vehicles (EV) on the road while also changing road tax for electric cars. This commitment comes from the efforts to meet climate change targets and enhance the cities’ overall air quality. Therefore, the government will impose a ban on the sales of vehicles (cars & vans) powered by diesel or petrol from 2030. However, there are going to be some exceptions to the ban, such as the plug-in hybrids, and some full hybrids will be sold until 2035.

Along with the ban, the government has also announced a £20 million fund for electric vehicles. This funding will help with the research and development for Electronic vehicles technology innovation. This fund will also be a support for zero-emission emergency vehicles, battery recycling and charging infrastructure.

According to the bank of England, during the course of lockdown, Britons have been able to save more than £100 billion.

One decision that most postponed last year was buying a new car. Despite the pandemic, over 76,000 battery-powered electric vehicles have been sold in the UK. This coming year more people will go with electric cars. And people buying these will be company owners and company drivers because of the EV tax benefits.

This is for information only. Please always seek professional advice before acting.

CHANGING BENEFIT IN KIND

.png?width=627&name=PIE%20CHART%20%20(1).png)

Zero Emission Cars Now Pay 0% BIK

Benefit in Kind

Employees get benefits in kind from their employment, but these are not part of their wages or salary. This covers items like company cars. Benefits in Kind (BIK) is payable on a company or business car if used for private use.

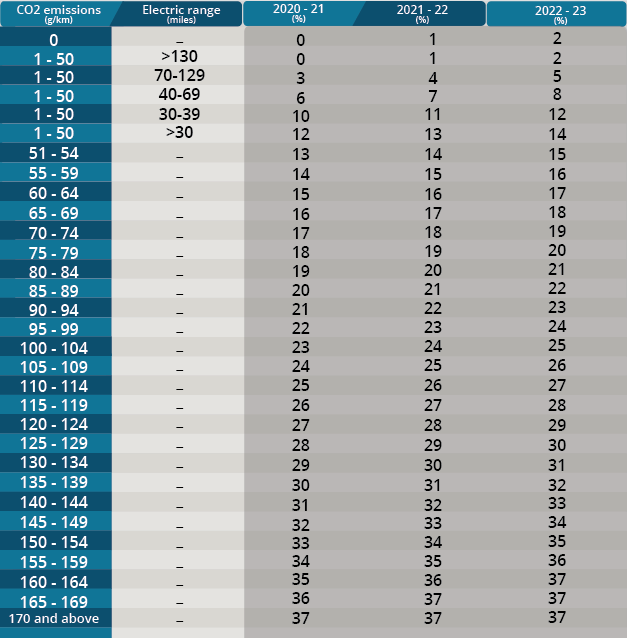

0% Benefit in Kind (BIK) Tax for Electric Cars Changes from 2020/21

Tax changes made by the government came into effect in 2020/2021, which helps in reducing company car tax bills, especially company drivers. From April 6th, completely electric cars have to pay 0% BIK Tax in 2020/2021. However, they will have to pay 1% in 2021/22 and 2% in 2022/23.

Additionally, the UK government has launched five new Company Car Tax bands for the plug-in hybrid cars, which only emit 1-50g of CO2 per km. This benefits the electric vehicles that drive with zero tailpipe emission. So, there is no better time than the present to change your business vehicles or fleet to electric.

BIK Tax: Electric Cars v Petrol/Diesel Cars

Someone who has got a new BMW petrol-fuelled company car (146g/km of CO2) in April 2020 has to pay a BIK tax of 32%, which will rise to 34% in 2022/23. Similarly, a Nissan Leaf E has 0% BIK tax for the current financial year, which will increase to 1% next year and 2% for the year after. So, if you do that calculation correctly, the BMW will cost you more than £13,000 more in tax over 3-years.

For employers, there are extra benefits. People who earn £100,000 to £125,000, lean towards buying electric company car because, with every £2 that you get over £100,000, you also lose £1 of your personal allowance. This way, your income tax comes to 60%. So, paying 0-2% in BIK tax is better if you are in that position. In addition, the overall cost of the electric car can be written off against the profit you earn in the first year. This cuts your corporation tax as well.

Running Costs : Electric Cars v Petrol/Diesel Cars

However, you don’t have to be a business owner to enjoy the benefit in kind tax on electric cars. These cars also can cost half as much compared to petrol and diesel, depending on the price of electricity and the time you charge the car batteries.

An average UK driver covers 7,400 miles in a year, and on average, the fuel consumption can be around 50 miles per gallon. So, a new car usually gets through 148 gallons of fuel in one year. If the average cost of one gallon is around £5.45, this means the ‘average’ electric car can help you save £400 in a year in fuel cost. Plus, you don’t even have to pay road tax which increases this saving by £150.

Furthermore, electric vehicle drivers get to take advantage of a 100% discount on London’s Congestion Charge. Do you know what that means? You get to save thousands that a daily commuter has to pay!

Even the UK government offers up to £2,500 for buying an Electric Vehicle (cars must cost less than £35,000 – RRP including VAT and Delivery fees) along with £350 for installing a charger at home. (Source: https://www.gov.uk/plug-in-car-van-grants)

Electric Vehicles Excise Duty

Fully EVs don’t have to pay the Excise duty. This encourages the drivers to choose the most environmentally friendly and cleanest vehicles. All cars with less CO2 emission than 75g/km have to pay less road tax in the first year. In addition, fully electric cars get exemption from the expensive car supplement until 2025, March 31st.

Salary Sacrifice on Electric Cars

With salary sacrifice, employees can exchange a part of their salary for non-cash benefits from their employer, like a company car. Salary sacrifice on electric vehicles is a hassle-free and cost-effective way of driving an electric vehicle, whether fully electric or hybrid.

Once you are enlisted on a scheme and have selected an electric car, a monthly payment covering leasing, maintenance and insurance is deducted directly from your salary, before national insurance and income tax. This way, both employer and employee save money. This means the employee will have to pay less tax on a lesser portion of their salary, while the employer has to make fewer National Insurance contributions while supporting more zero-emissions motoring.

Despite your role, salary sacrifice encourages the employees to drive an electric car while saving money at the same time. Just remember that with salary sacrifice, your pay is reduced, which can affect your mortgage applications or maternity pay.

Let’s see, how many types of electric cars are available?

If you don’t want to drive a fully electric car, then there are other environmentally friendly options for you:

- Hybrid Electric Vehicle (HEV): these cars produce their own electricity through a regenerative braking system. Hybrid cars have the capacity to alternate better fossil fuels and rechargeable batteries, depending on the usage.

- Plug-in Hybrid Electric Vehicle (PHEV): these cars are powered by two motors, one is a fuel-injected engine, and the other is an electric vehicle. The fuel engine is deployed when the driver needs more range and power.

- Battery Electric Vehicle (EV): these cars are fully electric and run only on rechargeable batteries. They can be charged either at home or at special charging points across the UK.

The Most Important Question, can you save money?

Want more? You got it. Electric vehicles don’t cost a lot in the long run as you save money on fuel and servicing. An electric car’s capacity is measured in kilowatt-hours which is how much energy the car stores. At public stations, you can get your car recharged for 35p per kWh, and if you charge during off-peak hours at home, then your cost will be as low as 5p per kWh. This means you can charge your car for just a few pounds compared to £30 or more on fuel.

New Bands and Tax Rates For Tax Years 2020 To 2023 For cars first registered from 6 April 2020

What is the Distance Electric Vehicles Can Travel?

The electric car with the longest range is the Tesla S, with a 405 miles range. With this kind of range, you can travel from Leeds to Cornwall with just a few miles left over. The car costs £80,000, but there are other affordable options available in the market.

Top 9 EV Options in the Market

| Car | Range |

| Hyundai Kona Electric | 300 miles |

| Jaguar I-Pace | 292 miles |

| Kia e-Nero | 282 miles |

| Mercedes-Benz EQC | 255 miles |

| Audi e-Tron | 252 miles |

| Renault Zoe R135 | 245 miles |

| Nissan Leaf e+ | 239 miles |

| Hyundai IONIQ | 193 miles |

| Volkswagen e-Golf | 144 miles |

How many charging stations are available across the UK?

According to Zap-Map, there are 15,398 locations with 24,128 charging stations with 41,537 connectors. The number of charging points are increasing rapidly. 7,000 new charging stations were added in 2020. The rapid increase of EV charging points has now outnumbered the 8,500 petrol stations in the UK.

How much does it cost to charge an electric car?

Full charge for a 60 kWh EV can cost up to £9.00. But, if you want to charge your electric car at a public rapid charger station it will cost more than £10.

The cost depends on the location, energy cost, tariff, charge level, battery capacity and charging speed. But one thing is certain, charging an electric car undercuts the cost for a fuel car.

So, is it worth buying an electric car?

There has never been a better time for buying an electric car with the rising fuel prices. Plus, you get to save money in the long run.

This is for information only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

Football and P2P

Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2021/07/Football-and-P2P-_-Peer2Peer-Finance-News.pdf

Below the surface

Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2021/07/Below-the-surface-_-Peer2Peer-Finance-News.pdf

Kuflink releases IFISA wrapper around some select invest deals

Copy the link below if the Read More link expires.