Asset Allocation for Young Adults

Financial planning, it’s usually not the first thing on your mind when you are in your 20s. However, for parents, this can be a constant stress as they have to think about their kids’ graduation while navigating their own career. While having kids might be exciting, helping them get off to a good start as young adults is something every parent worries about.

Perhaps the most important thing that parents can do is help their children learn about good financial habits. Such habits aren’t just about spending wisely or saving but about investing for the future. By teaching children about the value of investing, we can help them set up a sound future. A good place to start is to learn about asset allocation.

What is asset allocation?

In simple words, asset allocation is how you invest your money between different asset classes. It is a technique that helps you in deciding which type of assets to invest in and in what proportion. With asset class allocation, you can create a good investment portfolio by striking the right balance between reward and risk. The right combination of investments can help you achieve better returns without taking a lot of risk.

Why should you pay attention to asset class?

Asset class is one of the most important concepts that you should learn as a new investor. A good asset allocation strategy ensures that you have a diversified investment portfolio, with high growth potential and minimum exposure to risk.

For example: if you don’t allocate the right amount of funds to equities, you may miss out on growth opportunities and may not be able to achieve your financial goals. If you allocate more funds to equities, you may be taking on more risk than you can tolerate, setting yourself up for a substantial loss of your savings without having the time to recover.

How it works?

An asset is something that has value. It may be real estate, cash or some collectable items like baseball cards. The universe of investment is wide and vast. You can mix and match to create different asset categories. However, when it comes to investing, most people know about only the basic three asset classes cash, stocks and bonds.

Every asset class has its own reward and risks, so you can decrease the risk of any asset class by creating your own mix of assets.

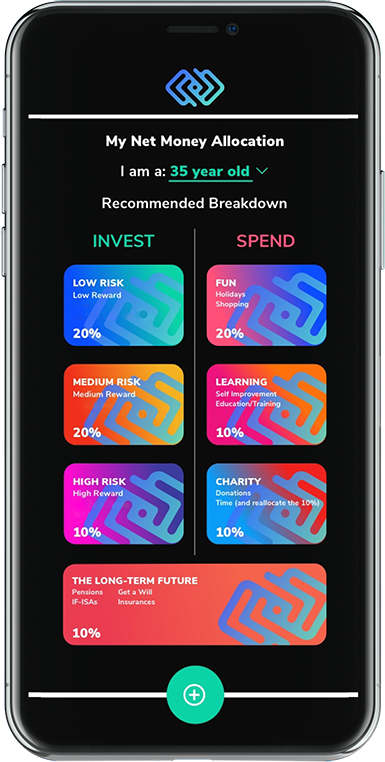

-

- Low risk – low return bucket (e.g. 20% allocation of surplus funds – remember all capital is at risk): choose an asset that maybe safe but has some level of reward above inflation, if possible. Slow and steady tends to win the race amongst these three asset allocation strategies.

- Medium risk – medium return bucket (e.g.20% allocation of surplus funds – remember all capital is at risk): choose an asset that maybe of medium risk but that has a greater level of reward than the above strategy.

- High risk – high return bucket (e.g. 10% allocation of surplus funds – remember all capital is at risk ): choose an asset that may be of high risk but that has a greater level of reward than the above strategy.

- Long-term future bucket (e.g. 10% allocation of surplus funds): Choose an asset that will protect you in the future such as pensions, Insurance policies and Wills.

- Fun bucket (e.g. 20% allocation of surplus funds): choose to save funds in a bank that has FSCS protection. Here these funds are for enjoyment, cars, holidays, eating out, etc.

- Learning bucket (e.g. 10% allocation of surplus funds): choose to invest in yourself which could be an investment that keeps on giving.

- Charity bucket (e.g. 10% allocation of surplus funds): choose to help those who cannot help themselves. Remember, living with clean water, a roof over your head, and being surrounded by people that love you, is paradise to those who cannot get clean water.

There are several types of investment options available:

- Bonds

- cash / cash equivalents

- Stocks & shares

- Property

- Government bonds

- Businesses

- Peer to peer lending

- NS&I savings

- Pensions

- And much more.

For example

Stocks: If you invest all your funds in stocks, you may be able to reach your investment goal sooner but, a steep drop in the stock market can adversely affect your chances of getting high returns.

Bonds: Putting money into bonds is a comparatively safer way, particularly when the equity market is volatile. But with bonds, you have to save more and start earlier if you wish to reach your long-term financial goals.

Remember that asset allocation is not a magical tool to generate growth or remove risks. But, it is a tried and tested method of creating an investment portfolio that can deliver you your intended goals. So, before investing, be clear on what your goals are, then start choosing the best assets mix for you.

*This is for information only. Please always seek professional advice before acting.

**Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.