Kuflink’s new features for April 2022

February and March have been busy months for us, with many new Feature releases and updates to our previous releases. We hope you enjoy them as much as we have enjoyed building them.

Quote for April 2022

“Accurate thinking. Accurate thought involves two fundamentals. First, you must separate facts from mere information. Second, you must separate facts into two classes – the important and the unimportant. Only by doing so can you think clearly and accurately.” – 11 of 17. Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

Released

1) Released! NEW Environmental, Social and Governance (ESG) page has been built, to show some of Kuflink’s Key performance indicators (KPIs), energy performance certificates for the head office, Consumer survey results, Ongoing – Profit & Loss, Balance sheet, Taxes paid, Green property developments funded, Governance committees, and much more.

Click here to view the ESG Page.

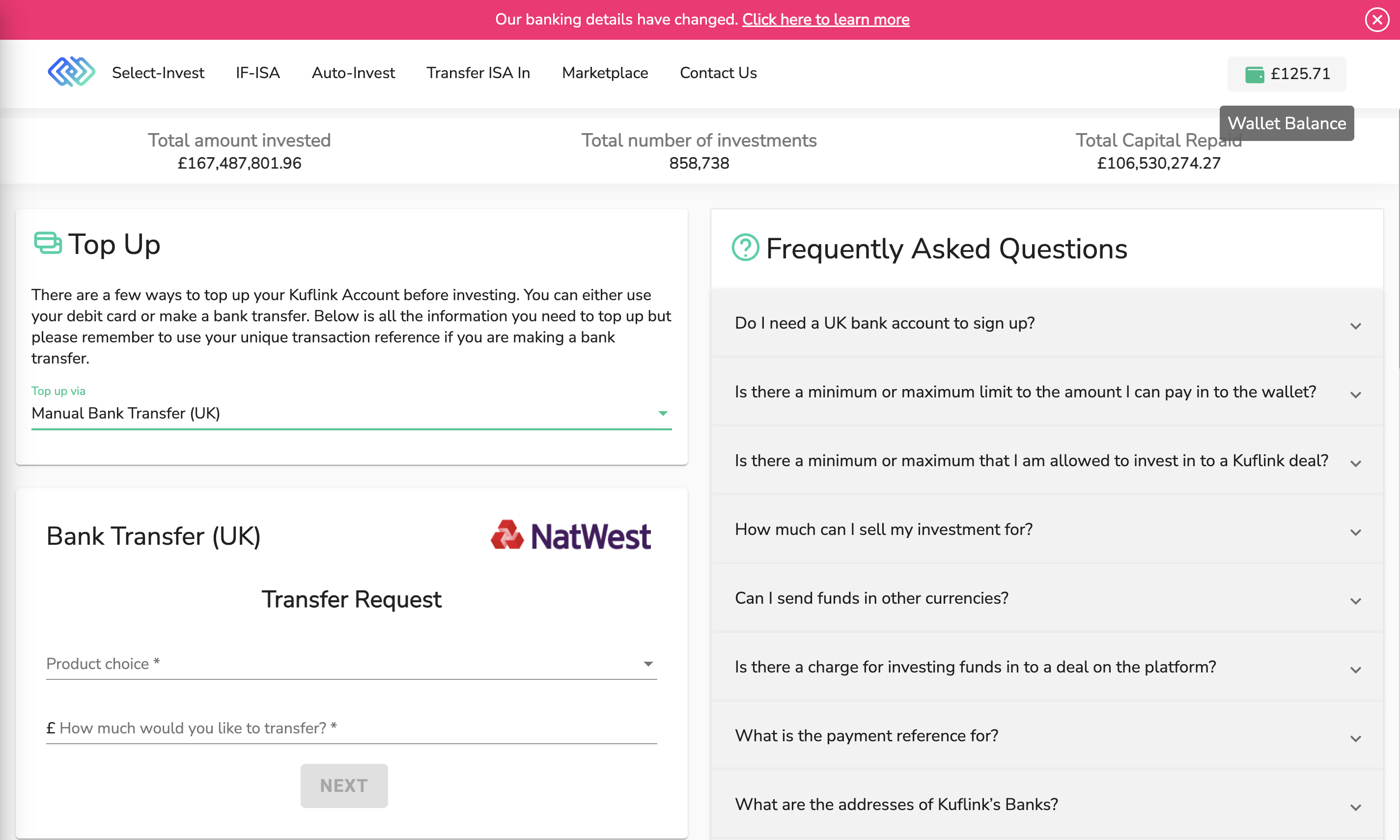

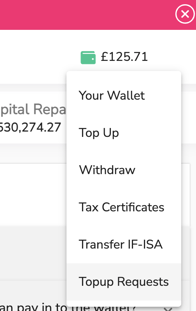

2) Released! New Notification System for Bank transfers to the Kuflink wallet. We have completed this system where you can advise us of any bank transfers that you have made on the day or expect to make. This will assist us in updating our systems to expect funds from you. To get started, press the wallet image, go to Top Up, and then choose Manual Bank Transfer (UK) from the drop-down menu. Please note, on receipt of your transferred funds they will not automatically invest into your desired product, this is still solely your responsibility.

You can amend any notification by scrolling down to Topup Requests.

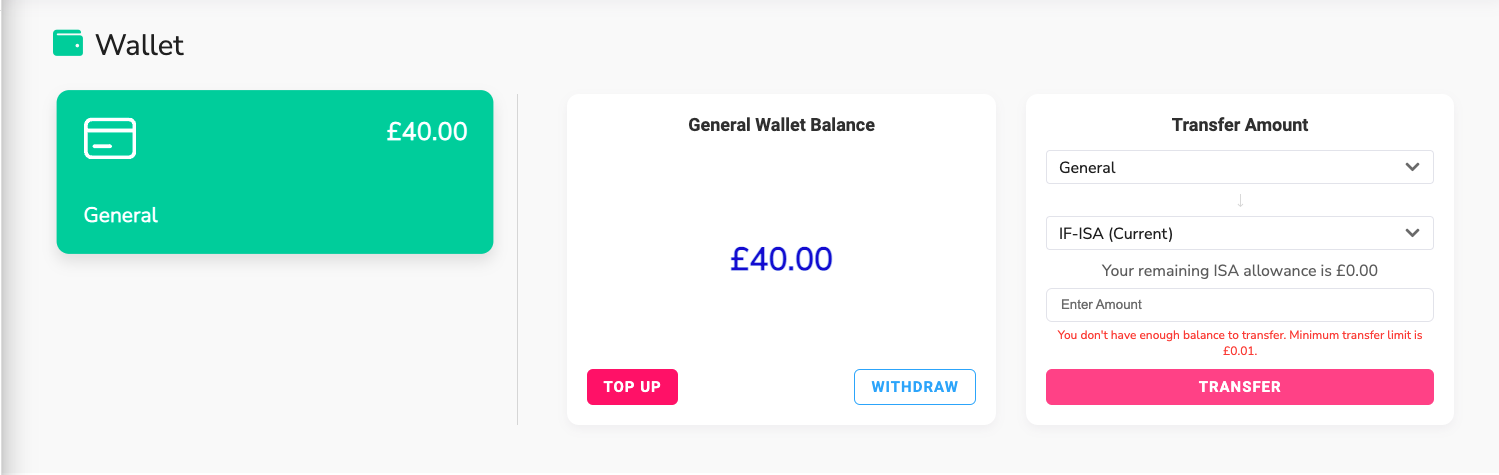

3) Released! New Wallet Balance transfer option between Wallets.

Due to the release of new wallets:

i) General Wallet;

ii) ISA Current Wallet; and

iii) ISA Previous wallet

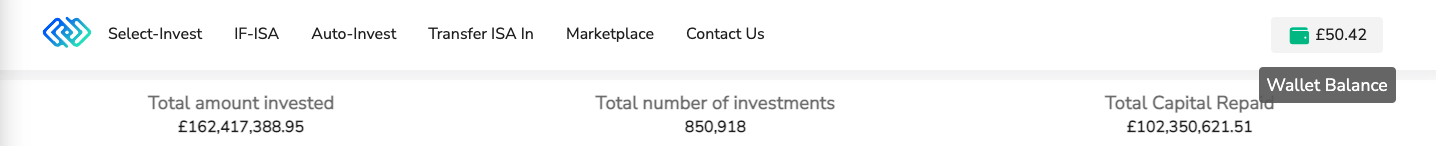

We have updated the top right wallet balance to now include the total of all wallets.

4) Released! New Updated releases for Mobile App for Android and Apple

We updated investments and portfolios so clients can make investments, including, Select, Select IF-ISA, Auto, Auto IF-ISA and marketplace.

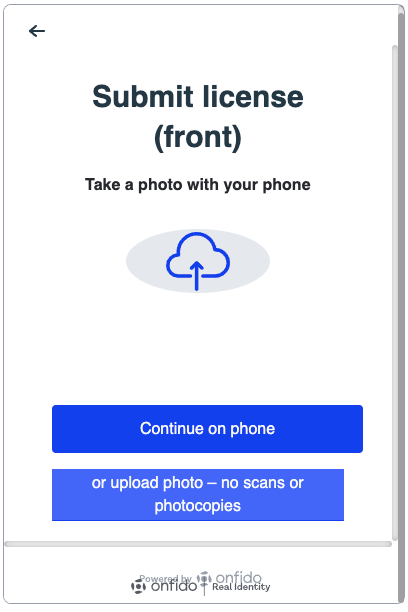

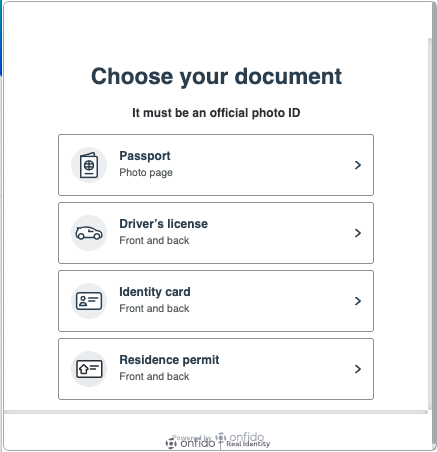

5) Released! Upgrade to our AML/KYC software

We work closely with our AML/KYC partners and have just released a new version for “Know Your Client” checks. Please note that you can either upload your ID documents via an SMS link through your mobile or UPLOAD documents via Desktop.

Now we also accept Residence Permits

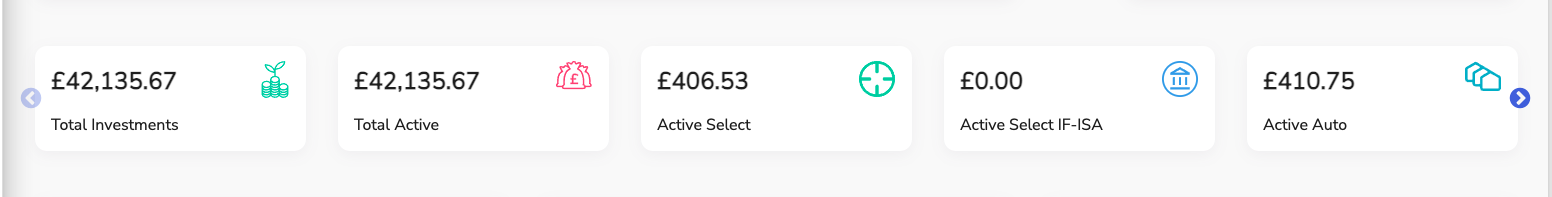

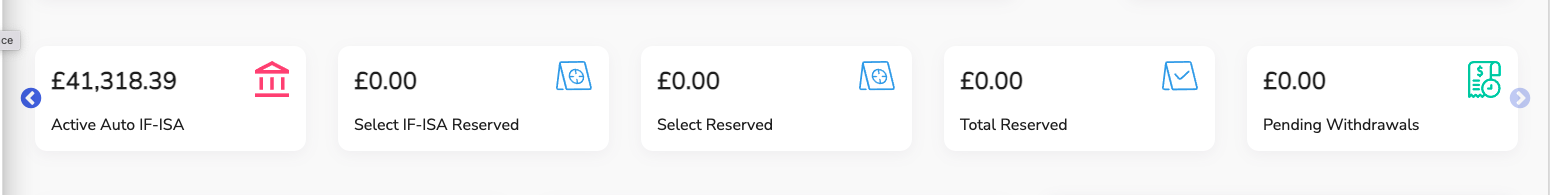

6) Released! Dashboard Totals

Due to client requests, we have just released a new “Total Investments” figure, a new “Total Reserve” figure to include Select Invest Reserve and Select IF-ISA Reserve totals, and a “Select IF-ISA Reserve” figure.

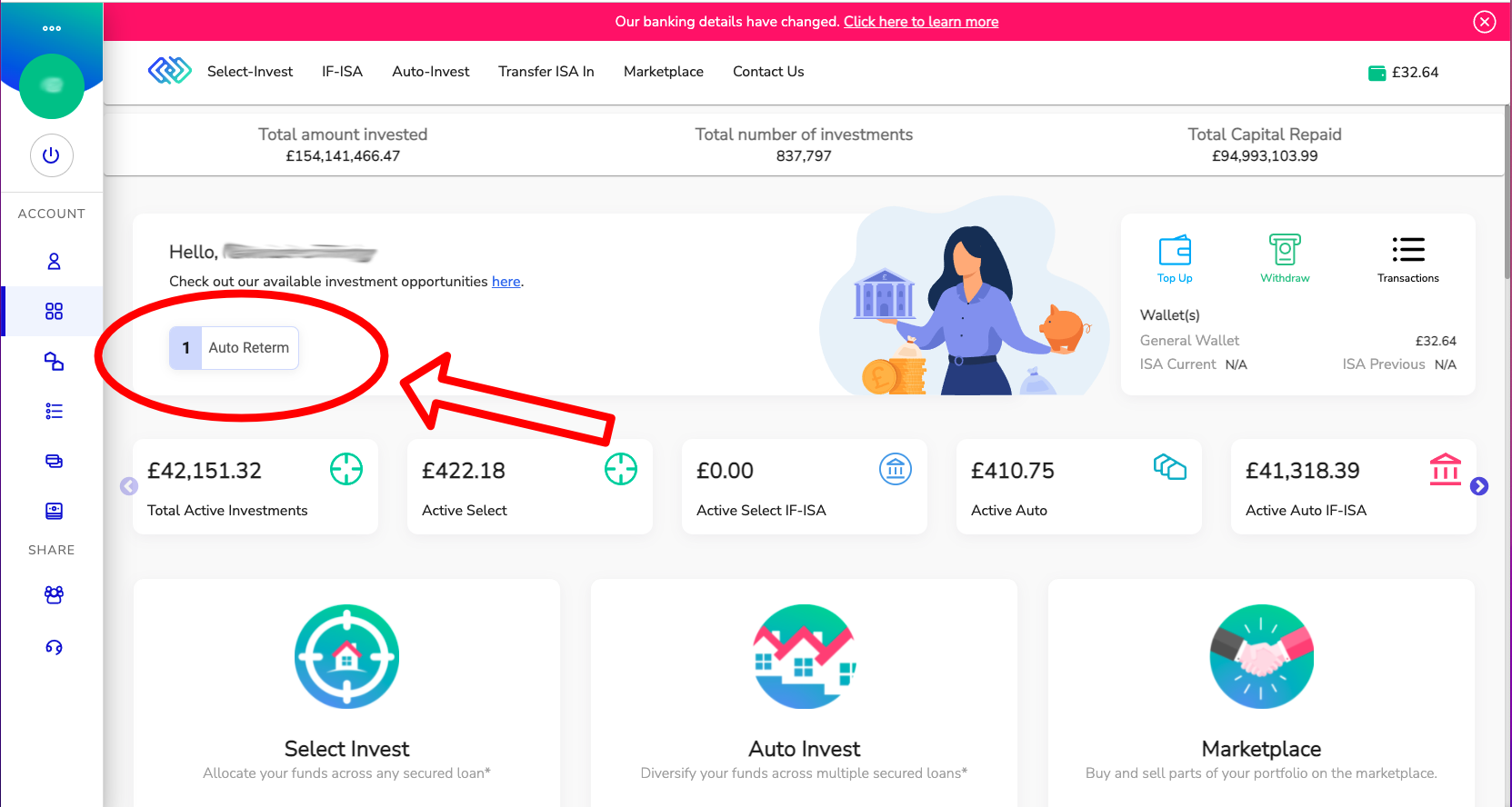

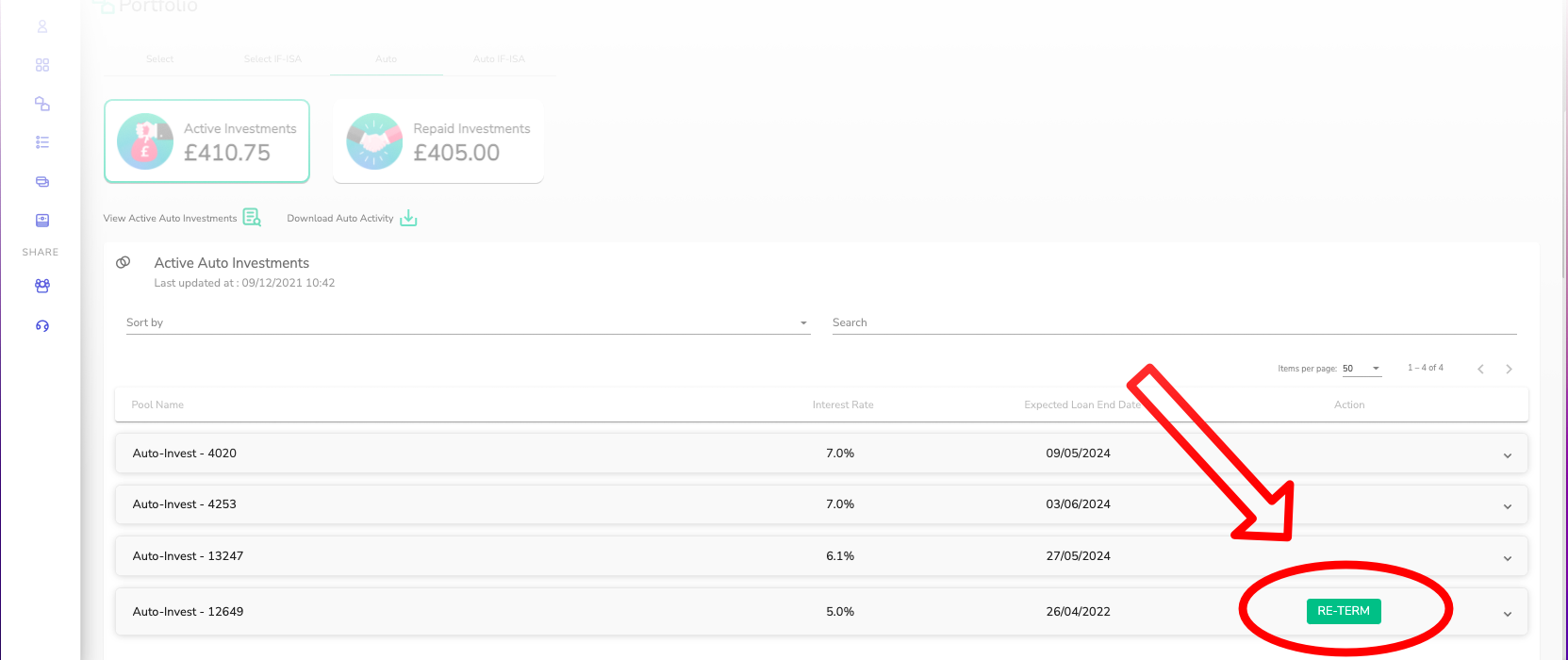

7) Released! You can re-term your Auto and IF-ISA investments on the platform before they expire

You can now re-term your IF-ISA and Auto-investments up to 190 days prior to their expiry. When multiple investments mature close together, especially at the end of the financial year, it can be a hectic time so you can now re-term early and know that your investments will continue to earn you interest. It takes just a few mouse clicks.

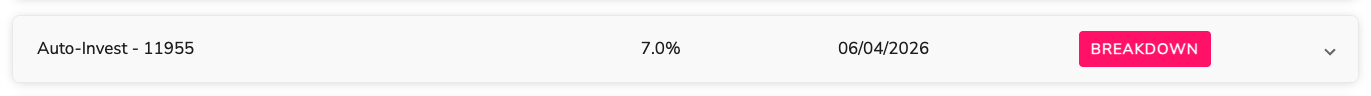

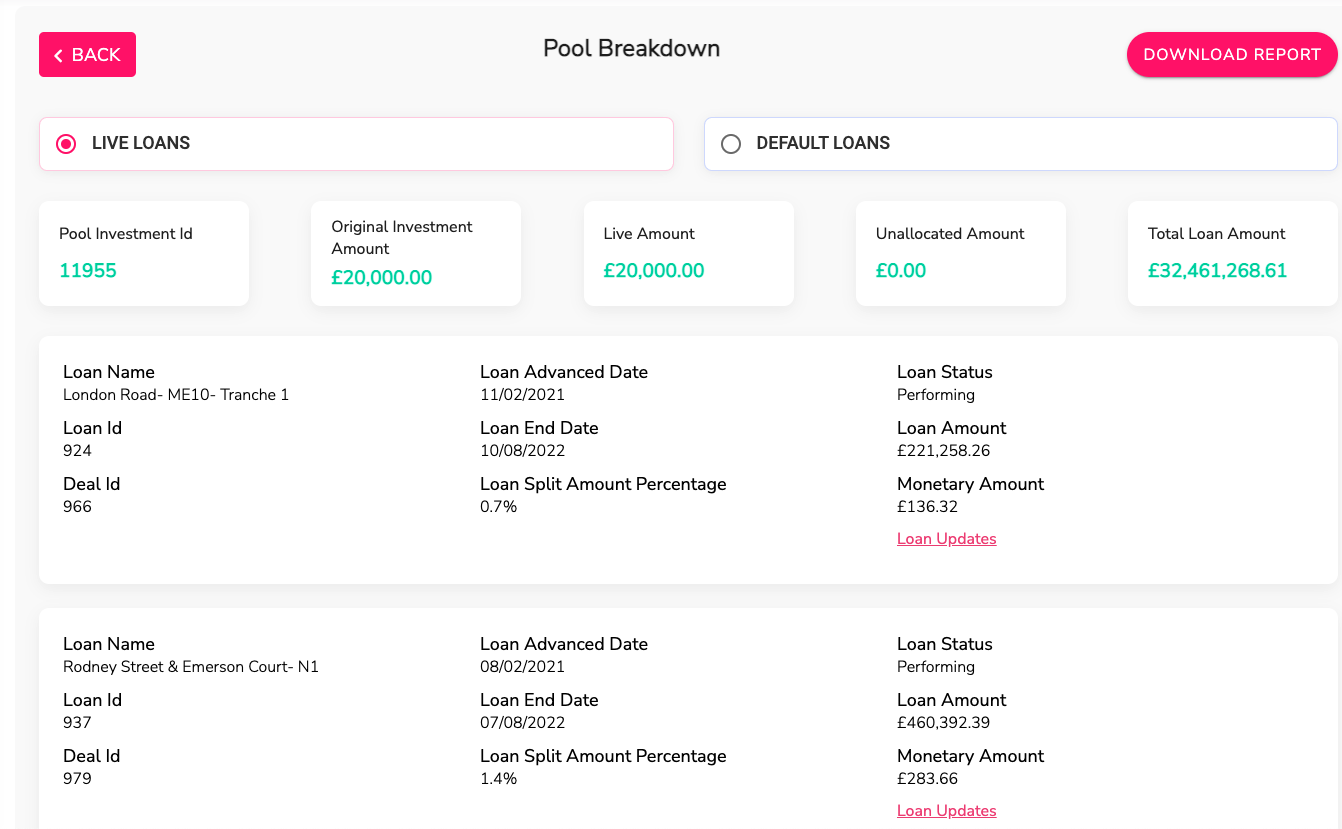

8) Released! Pool Investment Live loan Amount Break-down has been upgraded.

The real-time Pool “Breakdown” per Auto or Auto IF-ISA investment which showed unallocated cash, loan updates, default section, now has a downloadable report function, in the Portfolio section.

Breakdown

9) Released! View which deals are compounded

You can now see, at a glance, which deals you have compounded and which you have not in your portfolio. Simply head to your Portfolio to view.

10) Released! Buy and sell IF-ISA on the secondary market.

You’ve always been able to sell your Select Invest loan parts on the secondary market, should you wish to (for more detail, visit the marketplace here). But now, you are also able to buy and sell Select IF-ISA loans too.

11) Released! The Audited Accounts page has had a face-lift.

In January 2022 we released our latest, 5th year of Independently Audited accounts for the platform, for period-ending 30th June 2021. We decided to upgrade the page for you with links to previously independently audited accounts for all the regulated companies and the main Group company. Click here to view the page.

Coming Soon!

1) Coming Soon! We are in the process of showing images of how our development loans are progressing.

This is part of the new features to show where each development loan is in regards to our new 7 phases of development – work has started.

3) Coming Soon! A NEW segregated SIPP wallet – development has started. A SIPP is Self Invested Personal Pension, which will be done in partnership with Morgan Lloyd (a Specialist in Self-Invested Pensions).

4) Coming Soon! A NEW Buy to Let Pool Product – development has started. A new pool product will be coming soon where you can invest in long term income-earning Buy to let loans.

Updates!

1) Update! We have completed our Second Consumer Duty Survey (to our retail clients) and the results were amazing again. Please see the Kuflink ESG page to see the results. We are most grateful to all those who took part, as together we are fulfilling our purpose to “connect people to financial freedom”.

2) Update! We have connected our Open banking platform to our P2P Platform successfully, to enable bank transfers to be immediately updated to Kuflink client wallets. We are still working with NatWest in regards to NatWest to NatWest transfers which are still manually uploaded. We have found another way to update these automatically and so will be implementing this soon.

3) Update! On Thursday 21st April 2022 we will protect client money for Corporates as we do for Individual client money under FCA Client money rules (CASS 7).

4) Update! We have successfully passed our ISO27001 Audit (UKAS). Press here for a copy of the certificate.

5) Update! This week two of Kuflink’s staff members visited a local school’s “Careers” day. We provided the pupils with an insight into the business and investing world, which so many were keen to learn and understand. They especially loved the freebies.

6) Update! At times, unexpected popularity can result in pool availability being sharply taken up, leaving clients without the pool option for their ISA investment before the Financial Year End. The good news is we have a solution that will enable you to allocate money to this Financial Year without losing any allowance. Simply transfer funds from the General Wallet to IF-ISA (Current), after clicking “transfer” the amount you have transferred will be deducted from your general wallet and be used against this year’s allowance. You will then be able to invest these funds once we have further availability again.

Chief Technical Officer’s (CTO) thoughts for April 2022

We have been lending money secured on property, for 10 years (since 2011), and have operated an online electronic Peer to Peer platform for 5 years (since 2016). We have just launched an Open banking Platform this year (2022). Throughout this period, Kuflink has ensured no investor has lost a penny thanks to our:

- Experienced Underwriting team;

- RICS approved valuers;

- SRA approved Solicitors;

- Credit committees (with developers, valuers, and bankers’ experience);

- Experienced Collections Team; and

- Experienced Board of Directors.

Sustainability and ESG are important to understand as TECH can help accelerate the implementation of many of these features, as we have demonstrated on the Kuflink ESG page. Some of the following are ESG examples. We have made tremendous leaps in moving into the cloud and minimising the need for paper in the office. We have ensured the platform has a global reach and helps on a societal basis by offering our platform to countries, which may not have access to such opportunities locally. We have a diverse workforce, which improves performance by 12% and intent to stay by 20% (source Gartner research). ESG was always engrained throughout the Group before it will become a requirement in August 2022, and we are thankful to all our stakeholders who have made this a reality for us all.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.