Kuflink’s New features for September 2021. Stand Up with CTO

The Kuflink Tech Team has continued to worked diligently to bring new features for September 2021 forward. Together, with your feedback, we are able to fulfil Kuflink’s purpose in ‘Connecting People to Financial Freedom’.

Quote for September 2021

“Going the Extra mile: When you go the extra mile, the Law of Compensation comes into play. Going the extra mile is the action of rendering more and better service than that for which you are presently paid. When you go the extra mile, the Law of Compensation comes into play.” – 4 of 17 Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

What’s New or on its way to the Kuflink Platform & Kuflink Mobile APP for September 2021

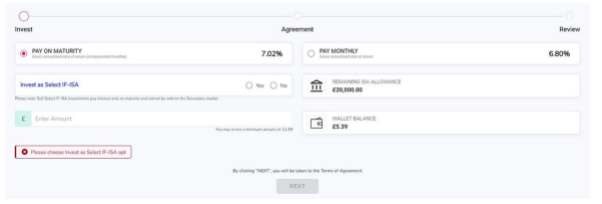

1) Released! Platform made simpler for Select IF-ISA

Our most recent improvement has been made to make it clearer for our investors when investing into our Select-Invest deals. We received a lot of feedback from people about making their Investment ISA eligible, saying it was easy to miss.

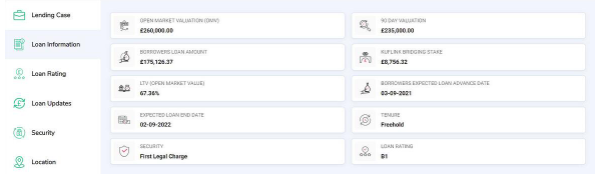

You will also see that as you click through the different scenarios of the deal, when investing (Lending case, Loan information, Loan rating etc.) we have made the information a lot clearer for our investors.

2) Released! Changes to the portfolio screen

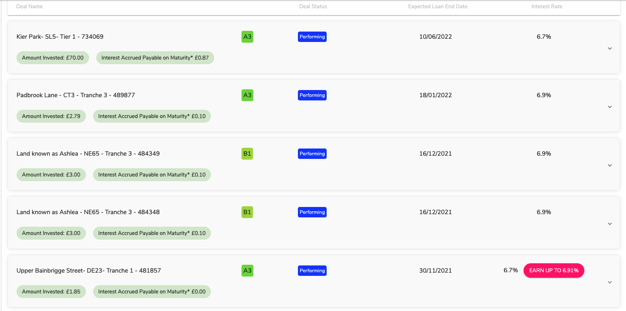

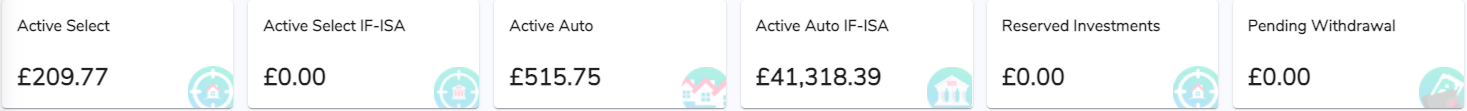

You are now able to see the amount you have invested along with the interest accrued without having to click on each of your investments.

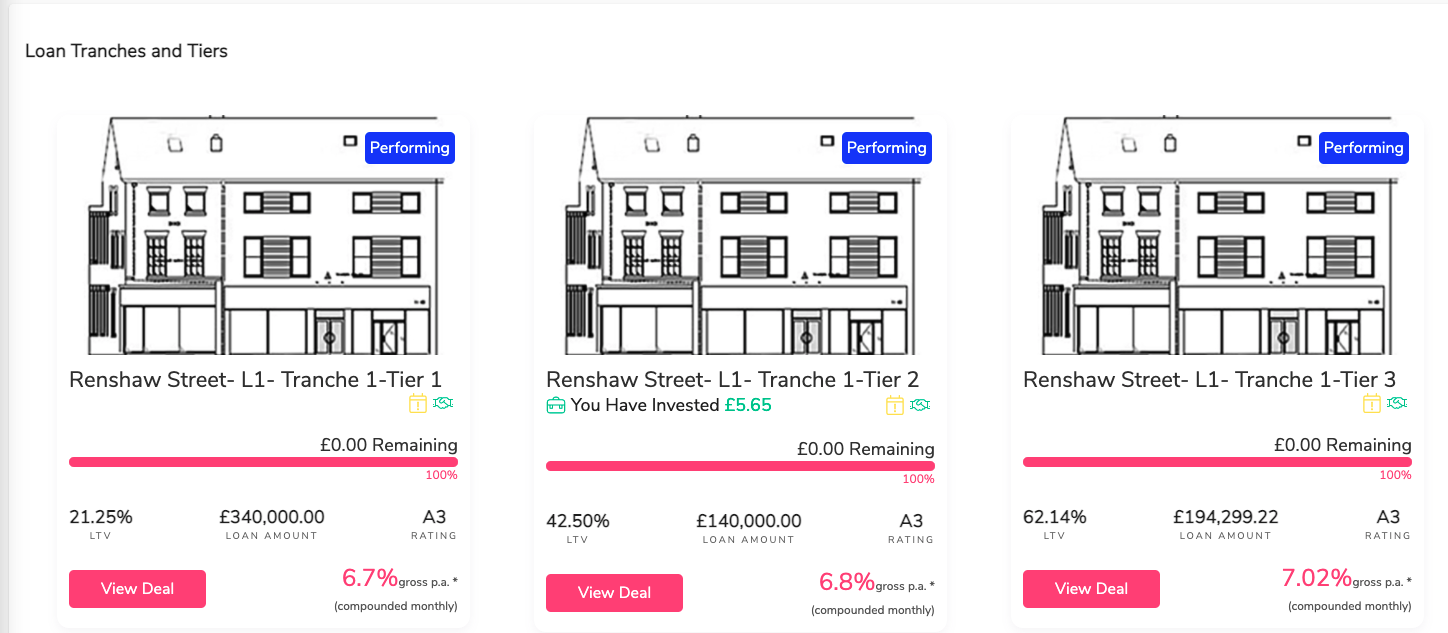

3) Released! The way we name deals has changed.

For “Land” deals, we have now put the road name first so that this will be easier for you to search your portfolio.

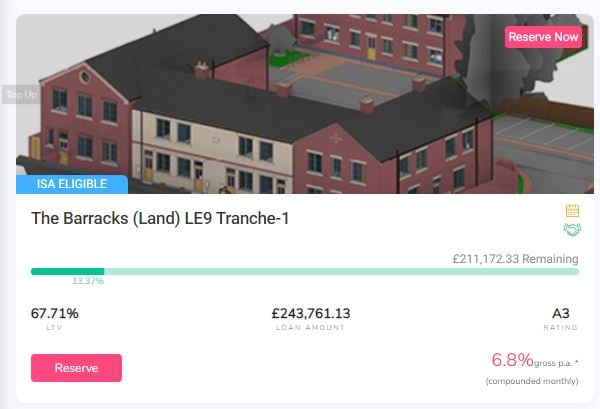

4) Released! The feature to show all other linked Tiers and Tranches in Select deals has now been introduced.

5) Released! You can now see a release of our new dashboard which shows you Select investments with or without an IF-ISA wrapper.

6) Coming Soon! We are now working on a new feature that will allow IF ISA Transfers In to enter into ISA eligible Select Invest Deals – this means clients can decide which ISA eligible Select Invest deals they want their ISA transfer to go into.

7) Coming Soon! A new segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started.

8) Coming Soon! A new feature showing borrowers who have links as individuals, shareholders or directors, to other loans already on the platform is being built. As an interim measure, we comment within the lending case if there is a link to another loan for the borrowers.

9) Coming Soon! A new feature showing where each development loan is in regards our new 7 phases of development – work is progressing.

10) Coming Soon! On the lending arm, we are currently building the process, through Open banking, to add an additional layer of borrower verification in real time and building a process to ascertain income vs expenditure for a potential borrower across all accounts. This is a step forward in reducing paperwork and unnecessary communication thereby improving efficiency in the process. All in all we should, in theory, gain access to all necessary information through a simplified online process as opposed to numerous phone calls, email chasers etc.

11) Coming Soon! Work on upgrading our proprietary deal risk / pricing tool in our CRM system by connecting to live data feeds, and allowing new fields to better assess the risk and price on deals is continuing. This is especially important in light of economic events like Brexit, the COVID-19 pandemic, and price hikes on raw materials (which will affect on-going Development appraisals). We are working with a ‘Royal Institution of Chartered Surveyors’ (‘RICS’) valuer and a seasoned developer / builder (both in our Credit committee), to further enhance the tool’s sensitivity to such events. We envisage connecting this information to our live loans on our platform to provide a timeline of any given loans risk.

12) Coming Soon! We are working on upgrading our Dashboard. Live Charts, proprietary budget tools, links to other investments, accrued interest, etc. will be on display in a singular view.

13) Coming Soon! A new feature to allow clients to re-term their Auto Invest / Auto IF-ISA investments.

CTO thoughts for September 2021

What is Fintech? This term in essence is about automating movement of funds in a simple and smooth way. Innovation is the key. Originally this would have been called the Barter System, which gradually moved to currency. Innovation is at the heart of how money is handled.

Fintech has an extra edge with technology. In our hearts we wish to “Serve our customers”, which fuels innovation. The urge of making lives simpler for our customer, understanding their pain points, quick query resolution and the need of automation together feeds our purpose.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.