Best Investments for Young Adults and Asset Allocation Strategies

I am reminded of a simple job I was given when I was 16. Stand one metre behind a bucket and throw a ball into it. I got every ball into the bucket every time I threw it as I literally leaned over and dropped the ball. I did this a few times, before, without prompting, I moved back a metre. I threw the ball but this time it was a little harder. After another period, I stepped back again. This time the ball missed the bucket several times. Even then, I moved back again. The job got harder and harder as I moved back. In this little experiment we learn the fundamental lesson about Investing.

This is for information only. Please always seek professional advice before acting.

Making money should be boring as it should make you money while you sleep without giving you a thrill. However, we get easily bored and so we seek out a thrill to go alongside investing. We create or seek out challenges along the way to get the thrill. The answer is to keep it simple and keep doing what works, even though it’s boring. As in the bucket example, stick to dropping the ball into the bucket without stepping back. Remember, it’s boring because you have become good at it. Become an expert at something simple, and you will be successful, without the thrills.

Do you believe young people have to be told to invest? If yes, then I disagree. These people know that investment is beneficial, but they don’t necessarily prioritise it. Especially in a world where the focus is on surviving through the present. Despite the anxieties of today, it’s more important for the younger generation to invest, considering the obstacles that get in the way of a prosperous financial future. Investing is not a fantasy for many, but it’s a tool we can use to help people realise the significance of saving and investing.

Saving vs investing

Before jumping into the details of investing, let’s quickly learn about the difference between saving and investing.

Saving: When you start putting money aside gradually, this is saving. You might save for something you want to buy or for unforeseen circumstances. The most common means used for savings is the bank, where you put your money away and earn interest on your savings.

Investing: when you purchase things that you believe will increase in value and/or give you a return, this is called investing. This can be buying stocks or shares, running a business or renting a property. These investments carry their own specific risks, so please seek independent financial advice. With investments, you can make more money if things go right, but if they don’t, you might end up losing money. So, the rule of thumb is never invest more than you can afford to lose. Risk – Reward allocation is considered below.

Things you need to know before investing…

Before you start thinking about investing, it’s critical to clear any outstanding debt that you have.

You are charged more on loans and credit cards than the return you get from investments or savings accounts. So, it’s better to use your funds to clear any debt that you might have.

Here is what you need to do:

- List all your outstanding debt

- Figure out which debt is charging you the most

- Pay off the debt that has the highest interest rate first

- Re-evaluate why you went into debt and ensure you take steps to not repeat the same mistakes.

Check to see if there are restrictions on early repayments since you might have to pay early repayment fees, which can be high.

Set Financial Goals

You can make your investment decisions on the basis of whether your financial goals are short-term, medium-term or long-term.

- Short-term goals: these goals are the things you plan on achieving in the next five years.

- Medium-term goals: these are the things you plan on achieving in the next 5 to 10 years.

- Long-term goals: these goals include the things you want to achieve in over ten years.

So, it’s better to think about your goals ahead of your investment making decisions.

Knowing the best investment options can be difficult. But if you are comfortable in tying up your money for up to at least five years, then you can have a lot of investment options.

Remember that investing money can mean you are exposed to your capital being at risk.

Risk & Reward – Asset allocation Strategy

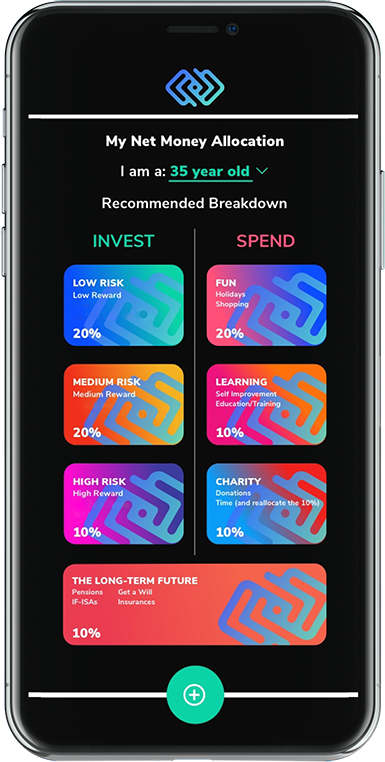

You can make your investment decisions on the basis of your risk tolerance, age, investment returns, risk of the asset class chosen, etc. We have chosen the following random percentages. The higher the age, the lower amount you should put in high risk buckets.

- Low risk – low return bucket (e.g. 20% allocation of surplus funds – remember all capital is at risk): choose an asset that maybe safe but has some level of reward above inflation, if possible. Slow and steady tends to win the race amongst these three asset allocation strategies.

- Medium risk – medium return bucket (e.g. 20% allocation of surplus funds – remember all capital is at risk): choose an asset that maybe of medium risk but that has a greater level of reward than the above strategy.

- High risk – high return bucket (e.g. 10% allocation of surplus funds – remember all capital is at risk ): choose an asset that may be of high risk but that has a greater level of reward than the above strategy.

- Long-term future bucket (e.g. 10% allocation of surplus funds): Choose an asset that will protect you in the future such as pensions, Insurance policies and Wills.

- Fun bucket (e.g. 20% allocation of surplus funds): choose to save funds in a bank that has FSCS protection. Here these funds are for enjoyment, cars, holidays, eating out, etc.

- Learning bucket (e.g. 10% allocation of surplus funds): choose to invest in yourself which could be an investment that keeps on giving.

- Charity bucket (e.g. 10% allocation of surplus funds): choose to help those who cannot help themselves. Remember, living with clean water, a roof over your head, and being surrounded by people that love you, is paradise to those who cannot get clean water.

There are several types of investment options available:

- Bonds

- cash / cash equivalents

- Stocks & shares

- Property

- Government bonds

- Businesses

- Peer to peer lending

- NS&I savings

- Pensions

- And much more.

Why should you consider investing?

- Compound interest

We understand it is not a great time to be a young person with all the student loans, low wages, tougher job market and higher property prices, along with a global pandemic, Brexit, and finances of 18 to 34 years-old in the UK been hit the hardest.

Fortunately, time is on your side. What does it mean? The more time invested in the market, the more room there is for your money to grow. It all comes down to compound interest. The beauty of it is that you will gain interest on the initial investment you make along with all of the subsequently generated interest. In simple words, it’s interest on interest and is a powerful tool for building wealth.

- Diversification

Another great benefit of investing is that now you can diversify. Because of so many investment possibilities, diversification is easily achievable now. You can do it by splitting your money across different investments. This way, you can manage the risk and earn better returns. Diversifying saves you from putting all your eggs in one basket. However, if you aren’t sure about investing, please always seek professional advice before acting.*

Let’s see how investing early can help you

This image illustrates the importance of investing at a young age. It demonstrates how you can yield more returns over 15 years compared to someone who started investing late. Not only does the young investor end up with a five-digit bankroll by 40, but they also invested less throughout their life compared to the counterpart.

Early savings can build a strong financial foundation for your life and how you live your life. Have you ever wondered how you are going to put down a deposit for your house? How will you raise a family in the future? Or why everyone insists that you start saving if you want an easy retirement. These pressures shouldn’t be ignored, and just having a basic income is no longer enough. Investing may look boring at first glance, but it’s your friend!

*This is for information only. Please always seek professional advice before acting.

**Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.