Kuflink’s new features for April 2022

February and March have been busy months for us, with many new Feature releases and updates to our previous releases. We hope you enjoy them as much as we have enjoyed building them.

Quote for April 2022

“Accurate thinking. Accurate thought involves two fundamentals. First, you must separate facts from mere information. Second, you must separate facts into two classes – the important and the unimportant. Only by doing so can you think clearly and accurately.” – 11 of 17. Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

Released

1) Released! NEW Environmental, Social and Governance (ESG) page has been built, to show some of Kuflink’s Key performance indicators (KPIs), energy performance certificates for the head office, Consumer survey results, Ongoing – Profit & Loss, Balance sheet, Taxes paid, Green property developments funded, Governance committees, and much more.

Click here to view the ESG Page.

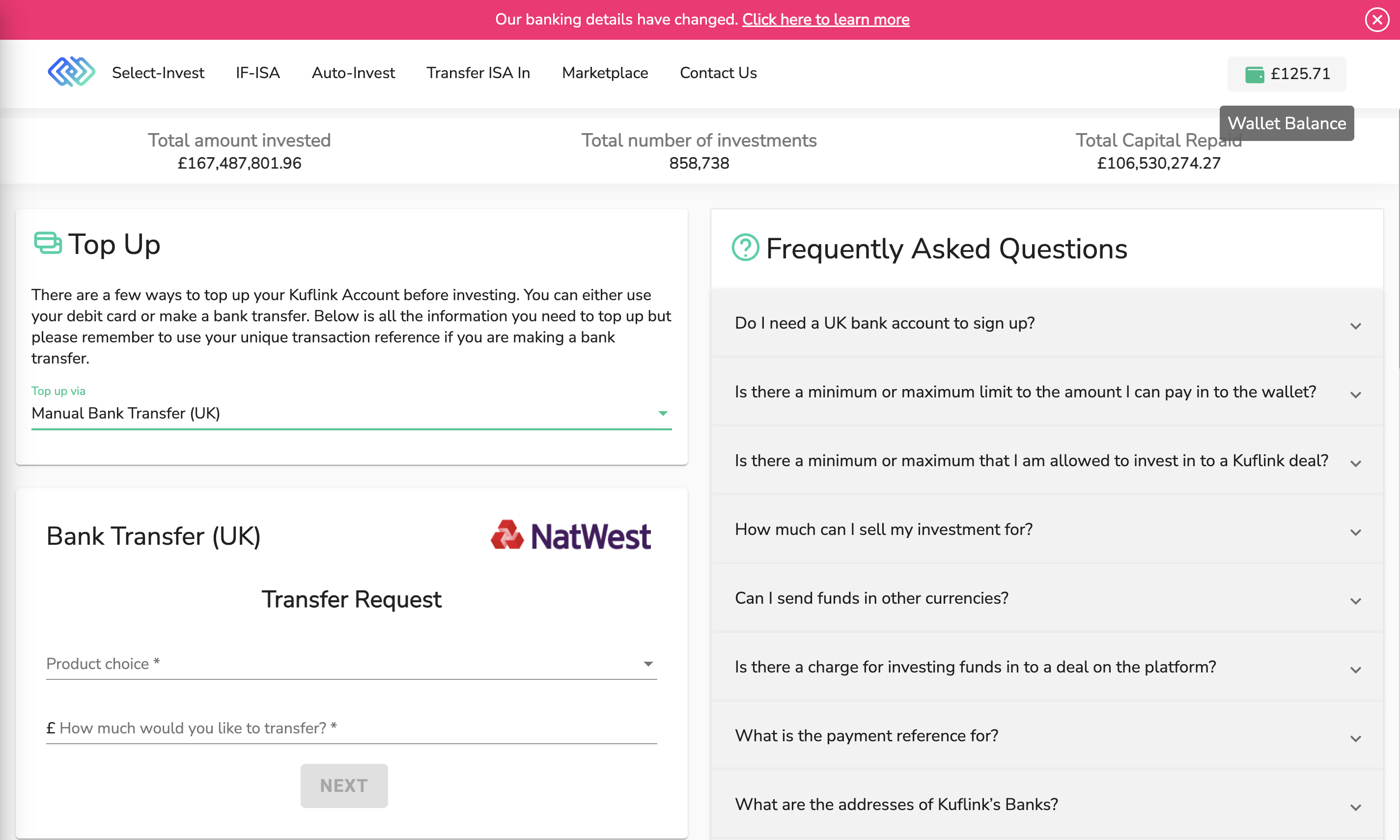

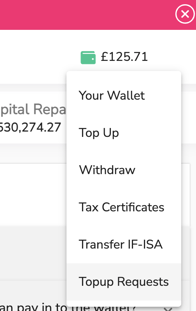

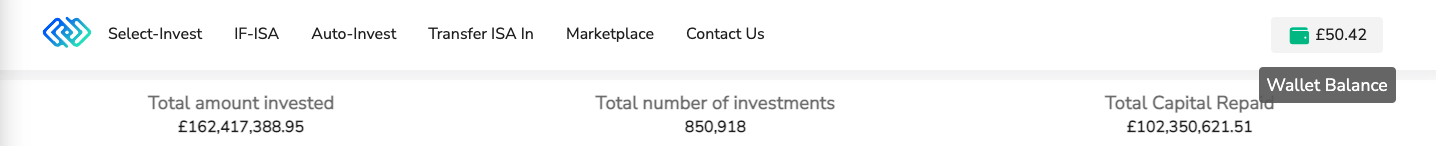

2) Released! New Notification System for Bank transfers to the Kuflink wallet. We have completed this system where you can advise us of any bank transfers that you have made on the day or expect to make. This will assist us in updating our systems to expect funds from you. To get started, press the wallet image, go to Top Up, and then choose Manual Bank Transfer (UK) from the drop-down menu. Please note, on receipt of your transferred funds they will not automatically invest into your desired product, this is still solely your responsibility.

You can amend any notification by scrolling down to Topup Requests.

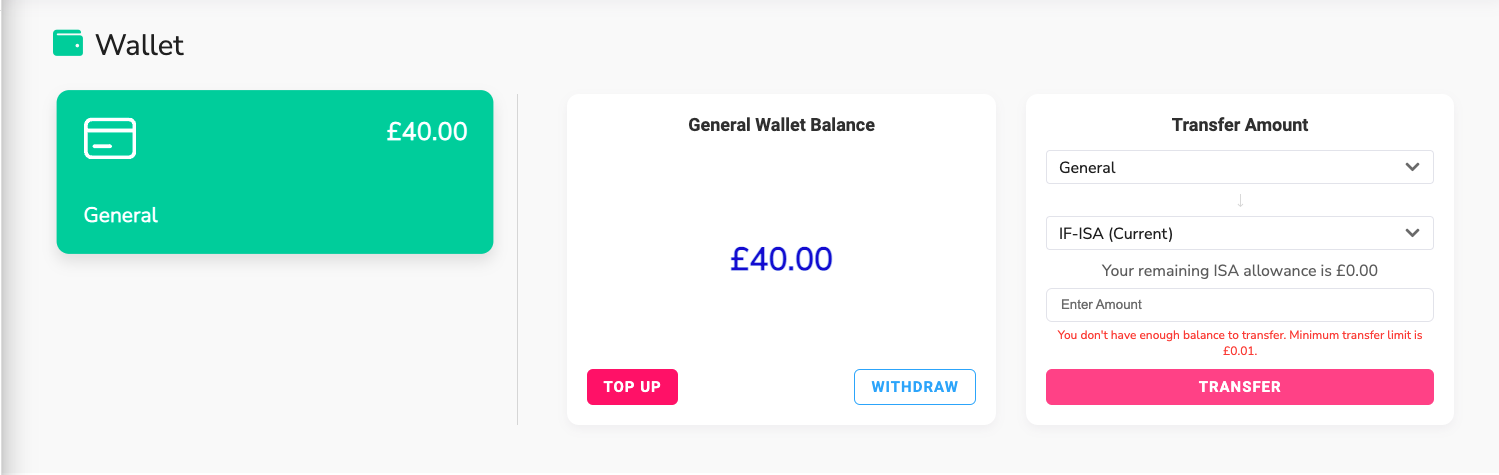

3) Released! New Wallet Balance transfer option between Wallets.

Due to the release of new wallets:

i) General Wallet;

ii) ISA Current Wallet; and

iii) ISA Previous wallet

We have updated the top right wallet balance to now include the total of all wallets.

4) Released! New Updated releases for Mobile App for Android and Apple

We updated investments and portfolios so clients can make investments, including, Select, Select IF-ISA, Auto, Auto IF-ISA and marketplace.

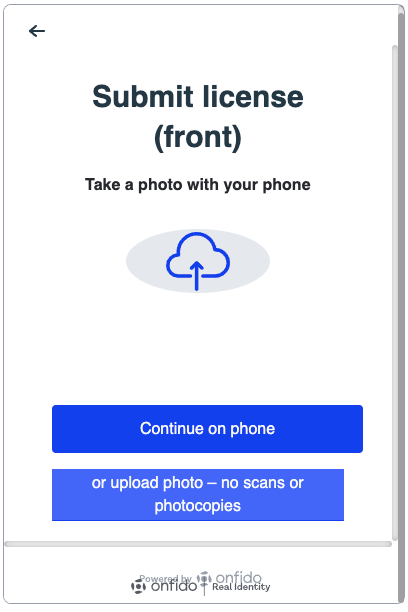

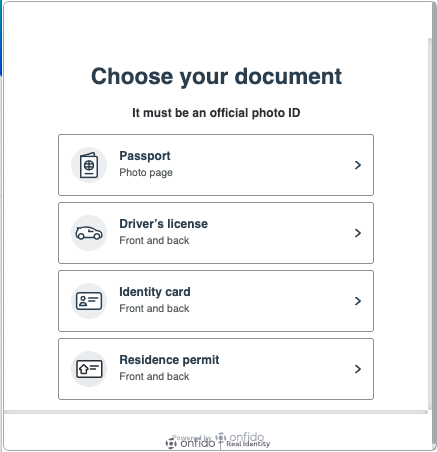

5) Released! Upgrade to our AML/KYC software

We work closely with our AML/KYC partners and have just released a new version for “Know Your Client” checks. Please note that you can either upload your ID documents via an SMS link through your mobile or UPLOAD documents via Desktop.

Now we also accept Residence Permits

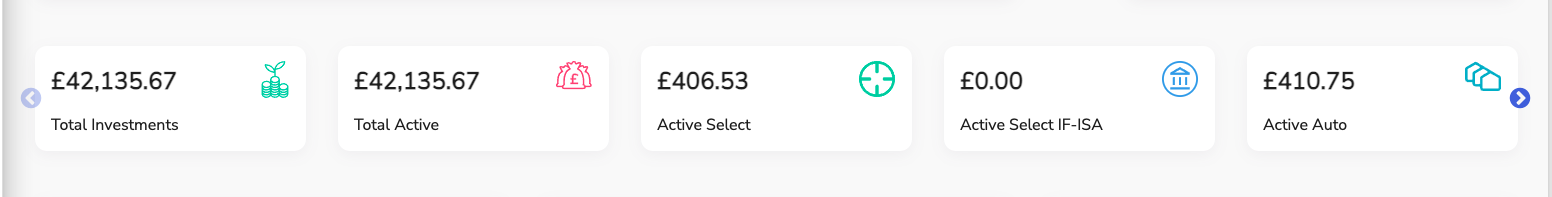

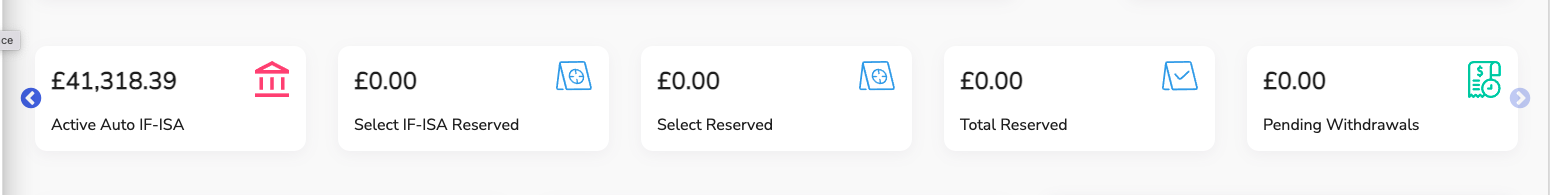

6) Released! Dashboard Totals

Due to client requests, we have just released a new “Total Investments” figure, a new “Total Reserve” figure to include Select Invest Reserve and Select IF-ISA Reserve totals, and a “Select IF-ISA Reserve” figure.

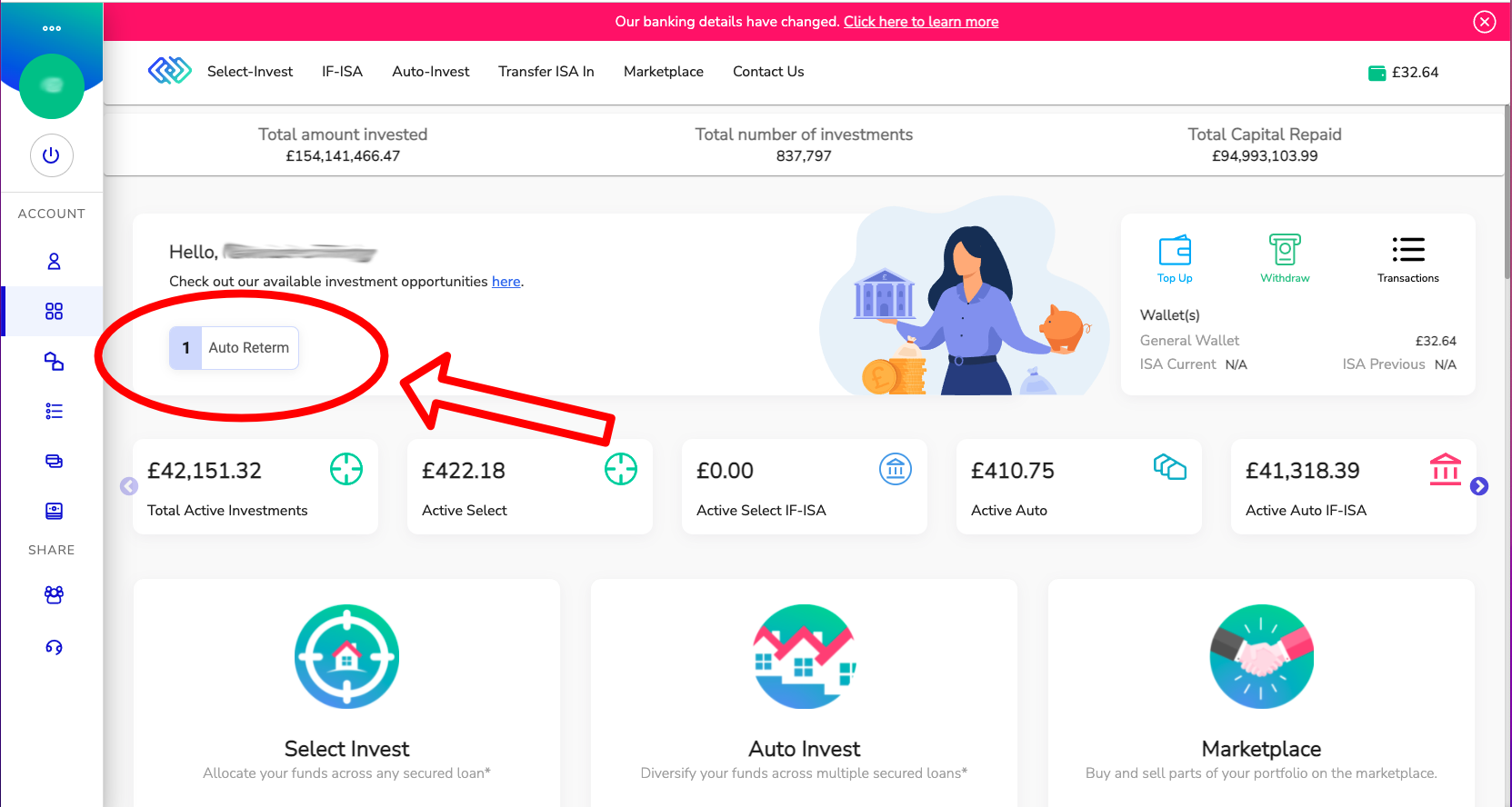

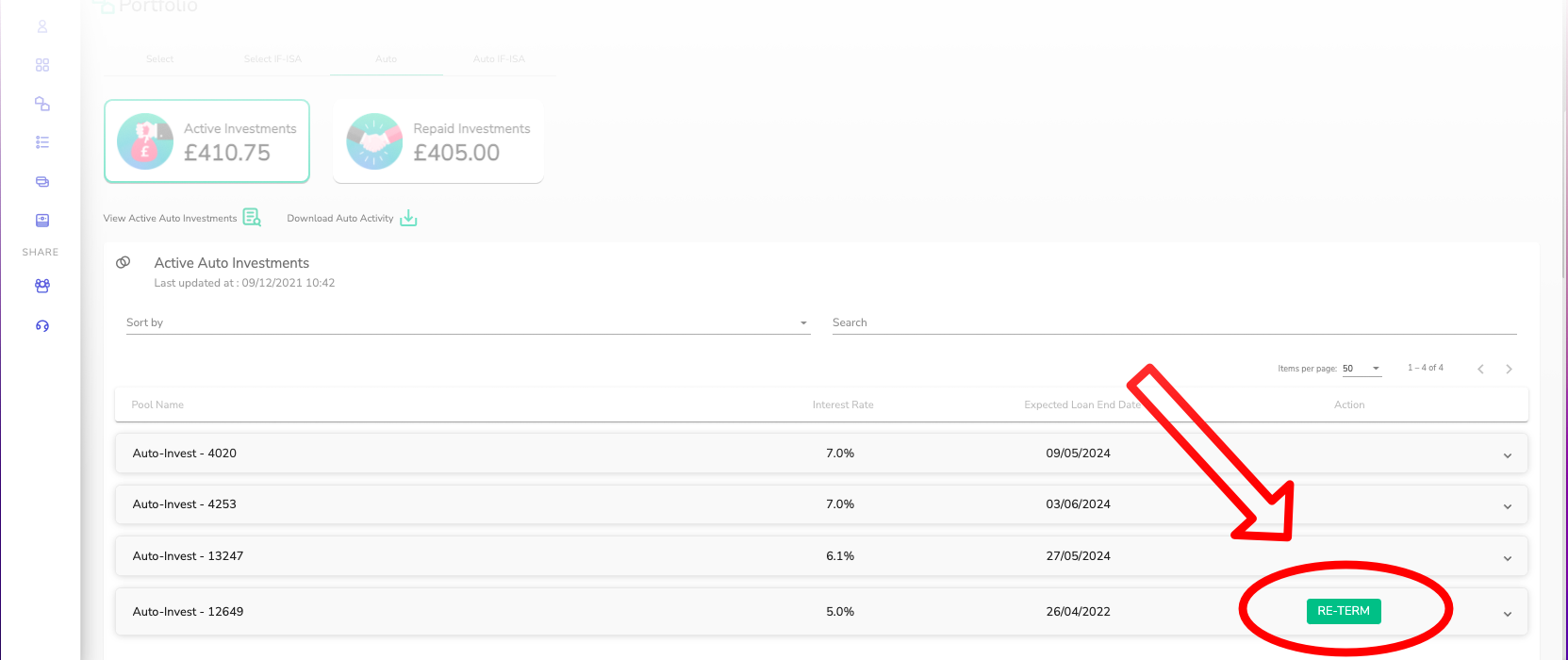

7) Released! You can re-term your Auto and IF-ISA investments on the platform before they expire

You can now re-term your IF-ISA and Auto-investments up to 190 days prior to their expiry. When multiple investments mature close together, especially at the end of the financial year, it can be a hectic time so you can now re-term early and know that your investments will continue to earn you interest. It takes just a few mouse clicks.

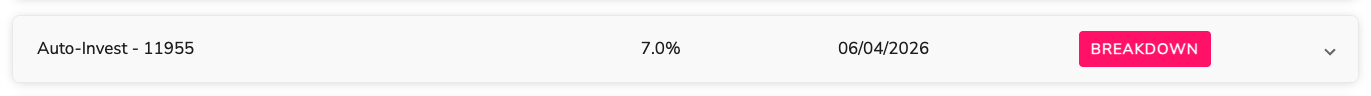

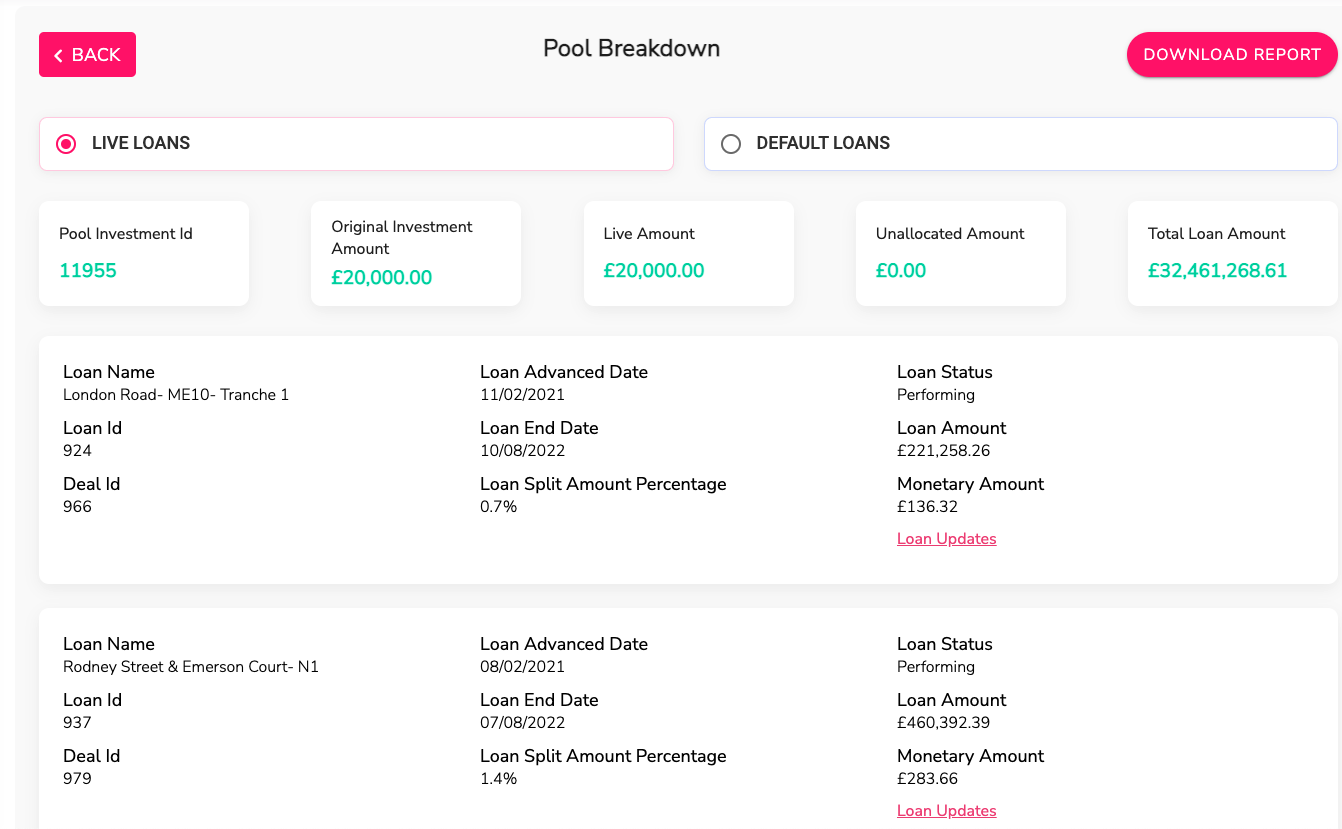

8) Released! Pool Investment Live loan Amount Break-down has been upgraded.

The real-time Pool “Breakdown” per Auto or Auto IF-ISA investment which showed unallocated cash, loan updates, default section, now has a downloadable report function, in the Portfolio section.

Breakdown

9) Released! View which deals are compounded

You can now see, at a glance, which deals you have compounded and which you have not in your portfolio. Simply head to your Portfolio to view.

10) Released! Buy and sell IF-ISA on the secondary market.

You’ve always been able to sell your Select Invest loan parts on the secondary market, should you wish to (for more detail, visit the marketplace here). But now, you are also able to buy and sell Select IF-ISA loans too.

11) Released! The Audited Accounts page has had a face-lift.

In January 2022 we released our latest, 5th year of Independently Audited accounts for the platform, for period-ending 30th June 2021. We decided to upgrade the page for you with links to previously independently audited accounts for all the regulated companies and the main Group company. Click here to view the page.

Coming Soon!

1) Coming Soon! We are in the process of showing images of how our development loans are progressing.

This is part of the new features to show where each development loan is in regards to our new 7 phases of development – work has started.

3) Coming Soon! A NEW segregated SIPP wallet – development has started. A SIPP is Self Invested Personal Pension, which will be done in partnership with Morgan Lloyd (a Specialist in Self-Invested Pensions).

4) Coming Soon! A NEW Buy to Let Pool Product – development has started. A new pool product will be coming soon where you can invest in long term income-earning Buy to let loans.

Updates!

1) Update! We have completed our Second Consumer Duty Survey (to our retail clients) and the results were amazing again. Please see the Kuflink ESG page to see the results. We are most grateful to all those who took part, as together we are fulfilling our purpose to “connect people to financial freedom”.

2) Update! We have connected our Open banking platform to our P2P Platform successfully, to enable bank transfers to be immediately updated to Kuflink client wallets. We are still working with NatWest in regards to NatWest to NatWest transfers which are still manually uploaded. We have found another way to update these automatically and so will be implementing this soon.

3) Update! On Thursday 21st April 2022 we will protect client money for Corporates as we do for Individual client money under FCA Client money rules (CASS 7).

4) Update! We have successfully passed our ISO27001 Audit (UKAS). Press here for a copy of the certificate.

5) Update! This week two of Kuflink’s staff members visited a local school’s “Careers” day. We provided the pupils with an insight into the business and investing world, which so many were keen to learn and understand. They especially loved the freebies.

6) Update! At times, unexpected popularity can result in pool availability being sharply taken up, leaving clients without the pool option for their ISA investment before the Financial Year End. The good news is we have a solution that will enable you to allocate money to this Financial Year without losing any allowance. Simply transfer funds from the General Wallet to IF-ISA (Current), after clicking “transfer” the amount you have transferred will be deducted from your general wallet and be used against this year’s allowance. You will then be able to invest these funds once we have further availability again.

Chief Technical Officer’s (CTO) thoughts for April 2022

We have been lending money secured on property, for 10 years (since 2011), and have operated an online electronic Peer to Peer platform for 5 years (since 2016). We have just launched an Open banking Platform this year (2022). Throughout this period, Kuflink has ensured no investor has lost a penny thanks to our:

- Experienced Underwriting team;

- RICS approved valuers;

- SRA approved Solicitors;

- Credit committees (with developers, valuers, and bankers’ experience);

- Experienced Collections Team; and

- Experienced Board of Directors.

Sustainability and ESG are important to understand as TECH can help accelerate the implementation of many of these features, as we have demonstrated on the Kuflink ESG page. Some of the following are ESG examples. We have made tremendous leaps in moving into the cloud and minimising the need for paper in the office. We have ensured the platform has a global reach and helps on a societal basis by offering our platform to countries, which may not have access to such opportunities locally. We have a diverse workforce, which improves performance by 12% and intent to stay by 20% (source Gartner research). ESG was always engrained throughout the Group before it will become a requirement in August 2022, and we are thankful to all our stakeholders who have made this a reality for us all.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Guide to ISA Transfers

The Innovative Finance ISA (IFISA) is attracting the attention of savers looking to get high-interest rates from peer to peer lending while protecting their returns from the tax.

IFISA provides you with an opportunity to invest all your annual ISA allowance (£20,000) in P2P loans to individuals and businesses and earn interest within a tax-free wrapper. If you want to take advantage of IFISA but already have savings in other types of ISAs, here are a few things you should know about transfers.

How do IFISA Transfers work?

Only Cash Transfers Allowed

You can only transfer cash to IFISA. For example, if you have peer to peer loans and want to transfer them to an IFISA, HMRC rules do not allow you to transfer them directly. Instead, you have to sell them and then transfer the cash.

Transfer within the same provider or choose a new one

Similarly, if you have stocks and shares ISA, you have to convert your holdings into cash by selling them. Although cash ISA transfers are straightforward, they can be a lengthy process. The transfer can be with the same provider, or you can also transfer your existing IFISA to another provider.

Don’t forget to learn about the transfer fees.

Always check whether your provider allows partial transfers if you do not want to transfer your whole investment, as not all providers do. Remember to check the fees you may have to pay for transferring in or out.

Want more than one IFISA account?

- You can have more than one IFISA account, but new contributions must all go in the same one per tax year.

- If you are not earning expected returns from other ISAs, you can transfer them to an IFISA and let your money work harder for you.

- You can transfer money from Cash ISA, stocks and shares ISA and your previous years’ IFISAs into any number of IFISAs. As you are using your previous year’s allowance, the limit of £20,000 does not apply here, and you can transfer as much as you want.

- However, if you want to make new contributions in a single tax year, you cannot invest in more than one IFISA, and the limit of £20,000 applies here.

- You can spread your allowance across different ISAs but can not invest more than £20,000.

The tax year is going to end on the 5th of April, so be quick and think about how you can invest your annual allowance to make the best returns out of it.

How can you transfer into Kuflink’s IFISA?

Important Information To Get Started

1. Have your NI number handy and read through our terms

First, you have to read and agree to our IFISA declaration and provide us with your National Insurance Number as per Government requirements.

2. Download, complete and sign your transfer form

Once you are satisfied that your details are correct, sign and date your transfer authority form. Please keep in mind that any wrong information or errors can cause a delay in the transfer.

3. Post the signed form to us

Once you post your signed form, we will handle the process from here and let you know once the transfer is complete.

Which ISAs can you transfer?

You can transfer cash ISA, stocks and shares ISAs and even IFISAs you have with any other provider. Your previous year’s transfers do not count in the annual allowance, so there is no limit on how much you can transfer. However, the current year’s transfer counts towards ISA allowance, and you can not exceed the limit, i.e. £20,000.

Once your existing provider has received your completed Transfer Authority Form, they’ll have 30 days to transfer your ISA to Kuflink. We will credit your account on the same day we receive cleared funds and a completed Transfer History Form.

Transfer your ISA into Kuflink

- Kuflink Innovative Finance ISA (IF-ISA) – up to 7.0%* gross per annum Tax-free

- Earn up to 7%* gross per annum Tax-free in the Auto IF-ISA Pool.

- Earn up to 7.44%* gross per annum Tax-free in Select Invest IF-ISA.

- Transfer All your Previous / Current Cash ISA, Stock & Shares ISA, Lifetime ISA or IF-ISA.*

- Interest can be paid Annually or compounded to maturity

-

Diversify your funds across multiple loans secured on property*.

-

Blended LTV & LTGDV circa 63%

- Security is 1st or 2nd Charge on UK Properties*

- Over £10m in ISA Transfers into Kuflink from Major ISA Providers

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Why you should celebrate Women’s history month?

Women’s history month is dedicated to educating and empowering women by uncovering, documenting, and applauding the lives and accomplishments of women. We envision bringing forth a diverse society where everyone’s efforts are equally celebrated and acknowledged.

So, how did this day evolve? This day grew out of celebrations over a whole week pertaining to International Women’s Day. It is now feted in several states as an acknowledgement of the historical role of women.

How did it all begin?

International Women’s Day (IWD) arose from the labour movement and is now officially recognized as an annual festival by the United Nations. In 1908, 15,000 women marched across New York, demanding fairly short work hours, increased salaries, and the entitlement to vote.

The Socialist Party of America proclaimed the first National Woman’s Day a year afterwards. Clara Zetkin, a communist activist and proponent of female rights, proposed the establishment of an international day. In 1910, she presented her concept to an International Conference of Working Women in Copenhagen, and 100 women from 17 countries concurred.

In 1911, Austria, Denmark, Germany, and Switzerland observed International Women’s Day for the first time. The centennial was marked in 2011, so this year marks the 111th. It became official when the United Nations began celebrating the day in 1975. “Celebrating the Past, Planning for the Future” was the first motif implemented (in 1996).

International Women’s Day is now a day to rejoice in how far women have come in societal structure, world affairs, and economics, whereas the day’s ideological roots mean that conflicts and mass demonstrations are structured to inform people of ongoing disparity.

Why March 8?

There was no set date for Clara’s notion for International Women’s Day. It was not formally established until a wartime attack in 1917 when Russian women started demanding “bread and peace”; four days into the strike, the tsar was ousted from power, and the interim government provided women with the right to vote. The strike started on March 8, becoming International Women’s Day.

Let’s honour the women in Finance

In honour of Women’s History Month, we’re honouring some of the financial industry’s female leaders who cracked the social barriers. But, the real clincher is this: Until the 1960s, women were unable to open a new account. Discover how they paved the way for subsequent generations of female financiers.

1. Abigail Adams – first known female investor.

Abigail Adams lacked the legal right to own assets, but it did not deter her from investing money and taking economic decisions for the family. Her husband, President John Adams, was preoccupied with his political activity. Abigail was in charge of the father’s wealth. According to some researchers, she saw a 400% profit. She also actively urged John to use his power and control for good by advocating for women’s rights, and he treated her as an equivalent.

2. Victoria Woodhull and Tennessee Claflin – Wall Street’s first female stockbrokers.

Victoria Woodhull and Tennessee Clafin were sisters who began their careers as travelling tent revival soothsayers. Ensuring a dream, they travelled to New York and encountered Cornelius Vanderbilt, an entrepreneur who was intrigued by them.

He later assisted them in establishing their finance company, Woodhull, Claflin & Company (the first in female history). The ladies supported the female suffragette movement, and Victoria was the first woman to run for the U.S. president.

3. Madam C.J. Walker – The first African-American woman to become a self-made millionaire

Better called Madam C.J. Walker, Sarah Breedlove, transformed an issue into a profitable enterprise. But, what exactly is the issue? She was balding. Madam C.J. looked everywhere for remedies before taking the situation into her own grip and developing Madam Walker’s Wonderful Hair Grower, her Black hair care commodity.

She gathered a team and amassed a fan base of satisfied customers. As a result, Madam C.J. became the first self-made Black female millionaire thanks to the “Walker System.” She, along with many other Black financial innovators, intended to build business potential for her society by employing Black employees, attempting to make philanthropic efforts, and offering scholarships.

4. Muriel Siebert – The New York Stock Exchange’s first female member.

Muriel Siebert was unafraid of being the only female in space, and she placed her eyes on the New York Stock Exchange (NYSE) at a young age. Muriel switched careers several times in order to earn the same salary as her male coworkers. However, it took ten tries for her to find investors for her NYSE application.

She, on the other hand, did not give up. Muriel was the only woman on the stock market out of 1,365 men for ten years. She was known as “The First Woman of Finance.” And, have it, there were no women’s restrooms anywhere in the building. As a result, she altered it as well.

5. Lauren Simmons – The New York Stock Exchange’s youngest female trader

Our journey takes us from the first female trader on the NYSE to the youngest female merchant on Wall Street. And the world’s second Black woman trader. Lauren Simmons graduated from Kennesaw State University with a degree in genetics. She cleared her investment test and was hired by Rosenblatt Securities at the age of 22, making history.

6. Adena Friedman – The first female CEO of a global stock exchange.

Adena Friedman is an American-Jewish businesswoman and the President and CEO of NASDAQ. She credits her strength in a male-dominated sector to joining an all-girls school, where she had never been reluctant to raise her arm and pose a question.

Adena began her career at NASDAQ as a business consultant, eventually rising to be the first woman to lead a global stock exchange company. Adena has made a conscious effort all through her professional life to espouse women in leadership and financial education for children.

Female Finance Professionals’ Future

Did you know that women make investments up to 90% of their income in their family and community? Yet, ever since the disease outbreak, half of all women say they are happier to invest, and seven out of ten say they wish they had started sooner.

We can end up writing a history that enables more female financial executives like the ones we just met by creating a bunch of financially savvy children. So, let’s get to collaborate on a bright economic future for all of us.

Let’s debunk some financial myths!

There are many ways to get advice on being smart with money— how you can make money, increase income and manage it thanks to personal finance websites, finance experts, money gurus on television, and feedback from your family, friends, and neighbours. But the information you get from such sources can sometimes make it difficult to separate facts from fiction.

We have gathered some well known financial myths that we will debunk today!

All of the below is for information only. Please always seek professional advice before acting.

We hope the following information will allow you to get a new perspective on your current financial situation.

Myth: Buying is better than renting

Reality: It is a famous myth that buying is better than renting. Renting can have a negative stigma attached to it, with the view that people who rent are wasting their money by paying mortgages of someone else instead of building equity in the property.

But you might not know that changes in the real estate market and taxes can make it hard to own a home. Also, owning a home has less flexibility and comes with many other additional costs, including household insurance, taxes, repairs, interest and more. Therefore, we are here to tell you that buying is not always better than renting.

Myth: Investing is only for rich people

Reality: it is one of the biggest misconceptions that exist. You can make more money when you invest more, and everyone can benefit by investing when they adopt a long term mindset and invest wisely. Just make sure to always focus on the interest rate, your risk appetite, and time to get maximum benefits when it comes to investing.

Myth: You should have 3 – 6 months of income in an emergency reserve.

Reality: The rule of three to six months’ savings has been around for years. However, the fact is that you need enough money to fulfil your financial needs in case of an emergency, such as when you are looking for a job.

Depending on the circumstances, it can take more than six months to find a job. Based on this reality, you may need larger emergency reserves.

Myth: Larger debts should be tackled first.

Reality: Financial advisers all over the country preach the importance of paying off large debts with higher interest rates first. While paying off larger loans is a good idea, there is a need to talk about paying off small debts. According to Harvard Business Review research, people get motivated by seeing modest balances vanish. In addition, paying off small loans can significantly influence one’s sense of accomplishment.

Myth: Money doesn’t buy happiness

Reality: we have often heard that money doesn’t buy happiness. It turns out it does, especially for individuals with low and middle incomes. According to a Princeton University study, individuals’ views on life improved as their financial status improved. In addition, an increase in income also improves the quality of life and overall emotional well being.

Myth: Credit cards are the gateway to debt.

Reality: Credit cards can cause problems for overspenders; therefore, the idea of avoiding them is reasonable. But credit cards are not always bad. On the contrary, you can use them to achieve your financial goals, such as paying off debt and improving your credit score. To prevent interest, you should always make payments on time and in full each month.

In addition, some credit card providers offer loyalty programmes and rewards through which you can earn points when you use them. As a result, credit cards can be a good funding source when you use them wisely and make repayments on time.

Myth: You can save for retirement later.

Reality: Most young adults, especially those in their twenties, do not prioritise savings because of the fact that there is a long time to retire. However, it is never too early to start planning for retirement. You can even start with 5% of your salary. One good rule of investment is that the longer you invest money, the more time it has to develop and earn you more.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.