Kuflink maintains its losses at zero

Copy the link below if the Read More link expires. Copy the link below if the Read More link expires.

Kuflink releases ISA wallet

Copy the link below if the Read More link expires. Copy the link below if the Read More link expires.

Nattalie and Hari chat with Laurence from Financial Thing

Recently, Hari (CTO) and Nattalie (Director of Collections) joined an online interview with Laurence Samuels at Financial Thing. The conversation was live on YouTube, with questions coming in from those watching, as well as from Laurence himself.

The Financial Thing blog is an unbiased reviewer and DIY investor – check out his latest YouTube video – “Kuflink Livestream with Hari (CTO) & Nattalie (Director of Collections) – YouTube”. He has reviewed Kuflink for the last three years and awarded Kuflink a fantastic 4 stars on 28th January 2021.

Some of the key points discussed by Hari, Nattalie and Laurence were…

- Can alternative finance remove the need for banks? According to Nattalie, who worked in traditional banking for 30 years, there will always be the need for banks. However, they have to become more agile with the changing demands of users. Change in traditional banking is extremely slow, while in an alternative finance company like Kuflink, we take every opportunity to change for a better user experience.

- How does Kuflink handle collections? We will always use UK solicitors, ensure our borrowers get legal advice, review valuations and monitor surveyors reports making sure our investors’ money is secured.

- How does Kuflink handle defaults? We engage with borrowers early and throughout the loan term and will always try to come to a workable solution at the end of the term if they are struggling to repay. We want what is best for our borrowers and investors and so we don’t consider recovery until we have exhausted every possible option.

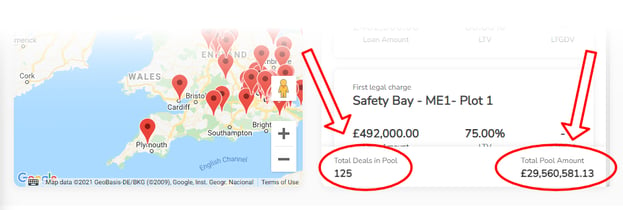

- What’s new in the Kuflink interface? We value our customer’s feedback; hence we have worked on the user-friendliness of the dashboard and profile. We are planning on creating a more secure user experience by creating two-factor authentication. We are also working on segregated wallets so users can see their current and past wallets. For 2022, we are planning on allowing people to sell parts of their loans on the secondary market.

- How does Kuflink retain its customer’s trust? Recently, many Peer to Peer companies have exited the market resulting in people losing trust in P2P lending. However, we have been able to retain our customer’s trust by doing the right thing.

- Why have p2p companies exited the market? Hari shines a light on the pattern among the failure of these p2p companies. These businesses lacked due diligence, clear underwriting and easy access to funds. Overall a lack of responsible lending. However, that reiterates the importance of following the right processes and performing due diligence.

- How is inflation going to affect Kuflink’s rates? Lending rates follow the base rates, so if the base rates are going up and banks are lending at higher rates, Kuflink will slowly follow the trend. However, if we are charging more, we will pay more.

It’s been overwhelming to see the support from the viewers. We got to answer many questions and received a lot of love and support. Head over to the Financial Thing YouTube channel to watch the video.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Kuflink’s New features for November 2021

The Kuflink Tech Team continue to bring new features to the platform. If you have any suggestions for products or features you’d like to see, do get in touch. Together, with your feedback, we are able to fulfil Kuflink’s purpose of ‘Connecting People to Financial Freedom’.

Quote for November 2021

“Applied Faith: Faith is a state of mind which may develop by conditioning your mind to receive Infinite Intelligence. Applied faith is the adaptation of the power received from Infinite Intelligence to a definite major purpose” – 7 of 17. Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

What’s new or on its way to the Kuflink Platform for November 2021

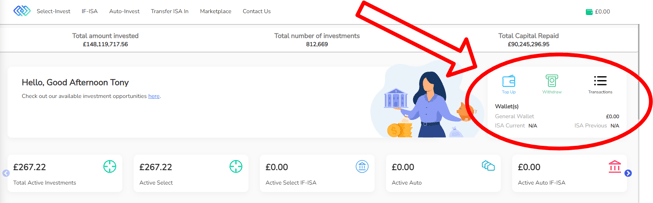

1) Released! Kuflink ISA Wallets

Significant new functionality is brought to you with our new Kuflink ISA Wallets. Separating your current year’s ISA allowance with your previous year’s, and allowing you to invest directly in our ISA-Eligible deals, you now have much greater control over your IF-ISA.

You can read the detail in our FAQ, explaining each wallet’s purpose, available here.

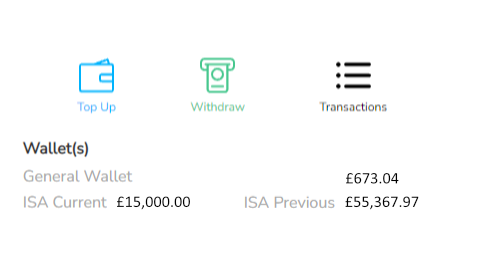

2) Released! Investment Screen Updates

In line with our update of Kuflink ISA wallets, we’ve given you greater control over which funds you use when investing. We’ve included tips when you hover your mouse over each wallet, to guide you through.

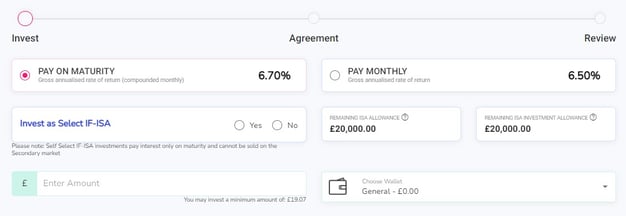

3) Released! Pool total deals and total value.

You are now able to see both the total value of our pool (the amount invested across our diversified range of loans in our Auto-Invest product), as well as the total number of loans.

Simply go to your Auto-Invest dashboard, and scroll down to the bottom to see.

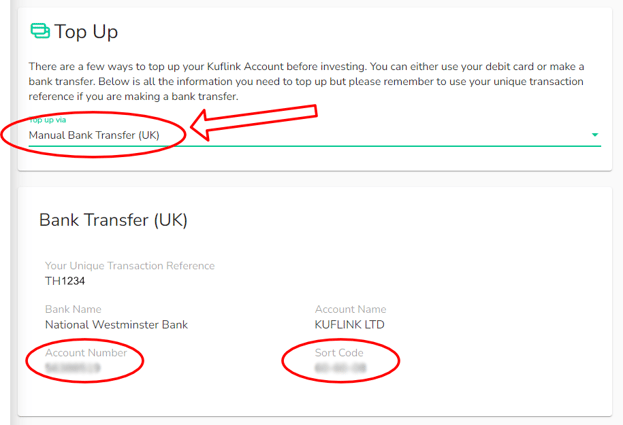

4) Released! Our banking details have changed.

We’ve mentioned it in a few other places, but worth reiterating here also; if you send us money via direct transfer or standing order, our bank details have changed. We’ve put in place some reminders around our platform, but you can find out more about the change here.

8) Coming Soon! On the lending arm, we are currently building the process, through Open banking, to add an additional layer of borrower verification in real-time and building a process to ascertain income vs expenditure for a potential borrower across all accounts. This is a step forward in reducing paperwork and unnecessary communication thereby improving efficiency in the process. All in all, we should, in theory, gain access to all necessary information through a simplified online process as opposed to numerous phone calls, email chasers etc.

9) Coming Soon! Work on upgrading our proprietary deal risk/pricing tool in our CRM system by connecting to live data feeds, and allowing new fields to better assess the risk and price on deals is continuing. This is especially important in light of economic events like Brexit, the COVID-19 pandemic, and price hikes on raw materials (which will affect ongoing Development appraisals). We are working with a ‘Royal Institution of Chartered Surveyors’ (‘RICS’) valuer and a seasoned developer/builder (both in our Credit committee), to further enhance the tool’s sensitivity to such events. We envisage connecting this information to our live loans on our platform to provide a timeline of any given loans risk.

CTO thoughts for November 2021

“You can’t connect the dots looking forward. You can only connect them looking backwards, so you have to trust that they will somehow connect in your future.” – Steve Jobs.

Constant development takes effort. It’s easy to develop, stand back and admire. But what sets us apart, what keeps Kuflink moving forward, is our drive for continued updates and continued improvement. That’s something I do my very best to share with the team. The flexibility of creating our own, proprietary software, gives us huge scope. It brings challenges – of course. Constant browser updates, security patches, language improvements, but are far outweighed by the unique ability to respond directly to our customer’s needs and wants. It’s a wonderful challenge, with great, constantly evolving, products.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Rising Interest Rates – UK Banks Pulling Cheapest Mortgage Deals Off-market

The Banks in the UK are pulling the cheapest mortgage deals as the interest rates are set to rise. Consequently, they are increasing the home loans cost. The bank of England is expected to increase the historic low rates of 0.1%, with the base rates expected to be raised to 1%.

However, since two-thirds of the £1.6 trillion mortgages in the UK are fixed-rate, they won’t be affected immediately. But, people on variable deals or trackers are going to feel the impact straight away.

The head of personal finance at AJ Bell, Laura Suter, has said: “for a long time, the mortgage rates have been extremely low, and homeowners are unfamiliar with high-interest rates. Therefore, any rise in rates can bring a shock for them. And people need to be aware that mortgage providers do not hang around when it comes to passing on the rate rises. Hence, anyone who is on a tracker deal will experience a hike in cost immediately. For example, if 0.5% points are added to mortgage interest, it will add about £50 a month to a £200,000 cost, 25-year mortgage or around £120 a month on a £450,000, 25-year mortgage.”

The Bank of England governor Andrew Bailey dropped a hint that interest rates are going to rise to counter the inflation. So, behind the scenes, banks are moving quickly.

The Nationwide Building Society has confirmed reviewing the mortgage pricing while Barclays has already adjusted some of the fixed-rate deals. UK’s biggest mortgage lender and the owner of Halifax, Lloyds, has also made some fixed-rate deals expensive. It announced those moves to mortgage brokers. However, they didn’t make any formal announcement. The pricing rises are now deemed inevitable. Nonetheless, brokers have noted that the lenders are moving ahead of an actual decision on interest rates from the Bank of England.

The chief executive of mortgage broker SPF Private Clients, Mark Harris, said: “the underlying swap rates have hiked up over the past weeks with 5-year swaps now over 1%. The cost will be passed on to the borrower, and we may see a 5-year fixed rates increase accordingly. Barclays is rising its 5-year fix at 75% LTV from 1.21% to 1.31%. Also, the Barclays is rising its 2-year fix at 60% LTV from 0.86 to 0.9%.”

So, a jump in interest rates to 1% for a £250,000 mortgage over 25 years would add a cost of £100 a month.

There are £1.6 trillion in outstanding home loans across the 13.3 million mortgages, which makes the average mortgage about £120,000. In London, that figure is much higher.

Households across the UK will be £1,000 worse off in 2022 from a cost-of-living squeeze created by the increasing energy prices and shortage of workers. The Resolution Foundation has stated that high inflation will hit workers’ earnings in 2022, which would contribute to heavily impacting the average household income.

Barclays said: “we continuously review our offerings and make modifications where necessary, to make sure we can deliver high-level service to mortgage and their clients. Consequently, in a recent review, some products across our Buy to Let and Residential have gone through price changes.”

Ian Gordon, an analyst of Investec, said: “the Mortgage rates are going to rise. The energy crisis is going to add to the inflation and worsen the squeeze of household incomes. This increases the upside pressure on mortgage rates, adding to the household pain.”

All the above is for information purposes only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Is peer to peer lending passive income?

Most people earn income by making smart investments and having a system in place which helps them earn money without exerting much time or effort. This is called passive income.

Passive income means earning from sources other than an employer. This income comes from various sources without putting in a significant amount of effort, energy, time and other resources. Portfolio income, income from royalty, and rental income are some traditional examples of passive income. Some latest examples include peer to peer lending, YouTube channels, and eBooks.

What is Peer to Peer Lending?

Peer to Peer lending is a type of lending that directly connects the individuals who want to invest their money by lending to the individuals who need money. It cuts out the need for an intermediary such as a bank or financial institution. It offers benefits to both borrowers and lenders by enabling the lenders to earn higher returns and borrowers to get quick access to funds.

How to Earn Through P2P Lending?

Lenders get their money back, which they lend in the form of equated monthly investments (EMIs) that include their capital investment plus the interest earned. Borrowers repay the lenders every month through EMIs. Peer to peer lending platforms collect the monthly repayments from the borrowers on behalf of lenders and add them to the lender’s account. Lenders can choose to withdraw or reinvest this money.

Lenders can earn stable and high returns by building a diversified portfolio. Moreover, with the help of a diversified portfolio, they can mitigate the risk of default by investing their money across borrowers with different risk profiles, occupations and demographic regions. However, selecting the borrowers or loans can be a time-consuming process. That is why peer to peer lending platforms like Kuflink offer innovative products such as auto-invest to make it easy for investors to build a portfolio without spending much time and effort.

How To Make Passive Income Through Peer to Peer Lending?

By definition, passive income is a type of income in which you do not need to put much time and energy. You can also earn passive income through peer to peer lending by making smart investments.

Automated Investment

Peer to peer platforms offers auto investment options that help investors build a portfolio without spending considerable time and energy. This way, you do not need to spend time reading borrowers’ profiles. Instead, you can add funds in auto investment and set specific lending criteria according to your investment strategy.

You can sit back and relax, let the algorithms build your portfolio automatically by matching you with the borrowers according to your investment goals and set criteria. Auto investment is a less time consuming and efficient method of investing in peer to peer lending that can help investors earn passive income.

Reinvestment

Investors earn income from p2p loans as monthly instalments through EMIs, which is transferred to their escrow accounts. They can either withdraw this money or reinvest it to get more stable and high returns.

If you choose to reinvest your money, it can provide you with several benefits, such as the benefit of compounding interest. Investors who reinvest can earn more returns than those who do not reinvest. Furthermore, it reduces the time and effort of investors. By activating the reinvestment option, you allow a platform to auto-invest your money in the same products to continue generating profits. This way you do not need to spend more time investing funds again and again.

Systematic Income Generation Plans

One latest, least time consuming, and most efficient method of investing in peer to peer lending is a systematic income generation plan. It is used when a lot of investors pool their investments into a single portfolio so that they can achieve efficiency in building and managing a platform.

This pool uses new technologies such as artificial intelligence and data science to build and manage a portfolio that can provide them with stable and high returns.

You just need to deposit your money to an authorised peer to peer lending platform to disburse it in this type of investment. The platform will disburse your pool money in different types of loans and products from which you can get high aggregate returns.

Make Kuflink Your Passive Income Partner

Let’s discuss the reasons you should choose Kuflink peer to peer lending to earn better returns:

• Kuflink co-invests up to 5% alongside investors* (Select-Invest only)

• Entire loan book is secured against UK property* (1st & 2nd legal charges)

• Independently AUDITED Accounts since 2014 (Kuflink Group Plc)

• Peer to Peer Platform (Kuflink Ltd) profitable since 2020

• Bridging Loans since 2011 & Online P2P Platform since 2017

• Blended LTV & LTGDV 63.93% (Pool) (1st November 2021)

• Over 820,540 investments with over £91 million capital repaid (1st November 2021)

• Loan book monitored daily by our in-house collections team

• Collections use 30-day Default rule v 180-day FCA Default rule

All the above is for information purposes only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.