Which are the biggest P2P Lending Platforms in the UK

Copy the link below if the Read More link expires. Copy the link below if the Read More link expires.

https://www.kuflink.com/wp-content/uploads/2021/10/Screenshot-2021-10-28-at-12.10.46.png

Can the bridging industry support more new lenders?

Kuflink CEO: Being a firm believer in competition, I think there is always room for new lenders when the demand is as strong as it is now. The bridging market is currently an attractive place to be.

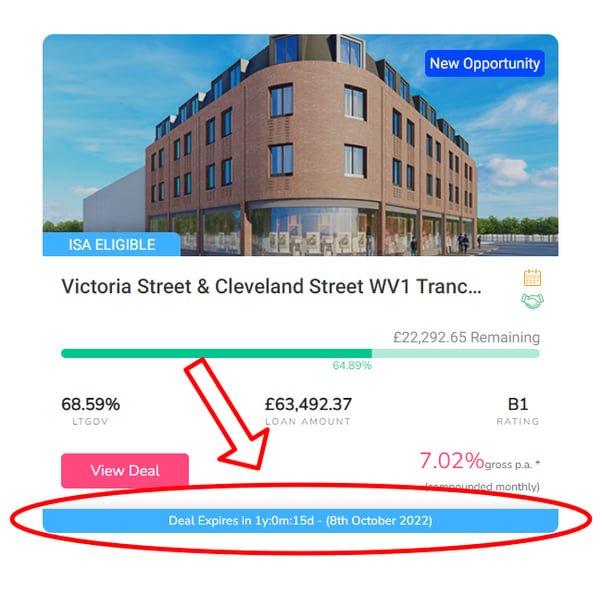

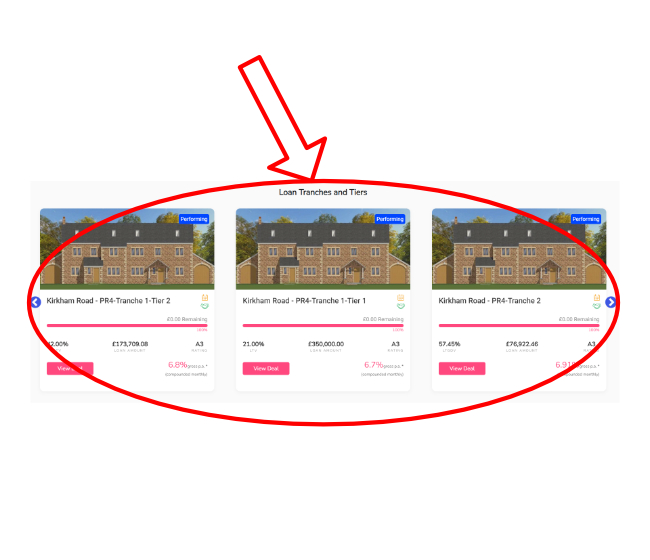

Kuflink makes deals and dashboard clearer for investors

Kuflink has released new features to make its deals and dashboard clearer for lenders. The peer-to-peer property lending platform has introduced a countdown clock following feedback from investors, which shows how long available deals have until the end of their terms.

Kuflink’s New features for October 2021. Stand Up with CTO

The Kuflink Tech Team continue to bring new features to the platform. Together, with your feedback, we are able to fulfil Kuflink’s purpose in ‘Connecting People to Financial Freedom’.

Quote for October 2021

“Pleasing Personality: A pleasing personality is the aggregate of all the agreeable, gratifying, and likable qualities of any one individual.

It is essential that you develop a Pleasing Personality – pleasing to yourself and others” – 5 of 17 Napoleon Hill’s 17 Principles of Success. (To see previous Napoleon Hill’s 17 Principles of Success please refer to previous CTO blogs).

What’s New or on its way to the Kuflink Platform for October 2021

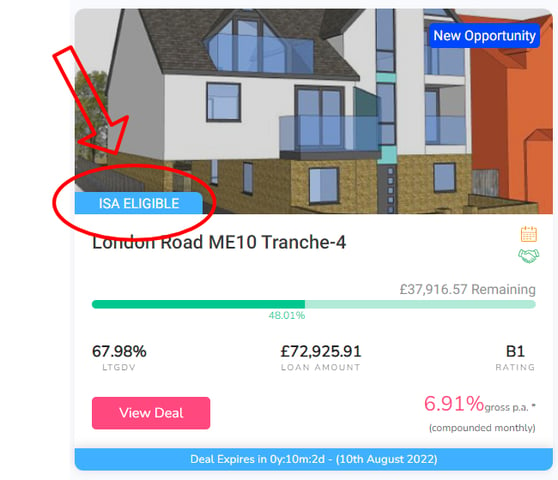

1) Released! We have a countdown clock

You asked, and we listened. A countdown clock on available deals, showing how long until the end of their term. Simply view the available deals, and after a few seconds you’ll see the clocks populate.

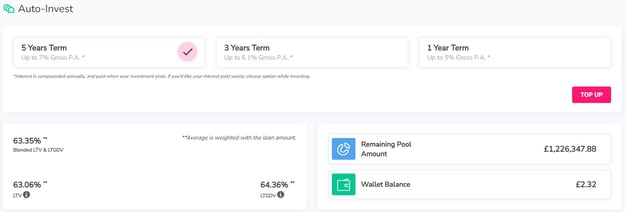

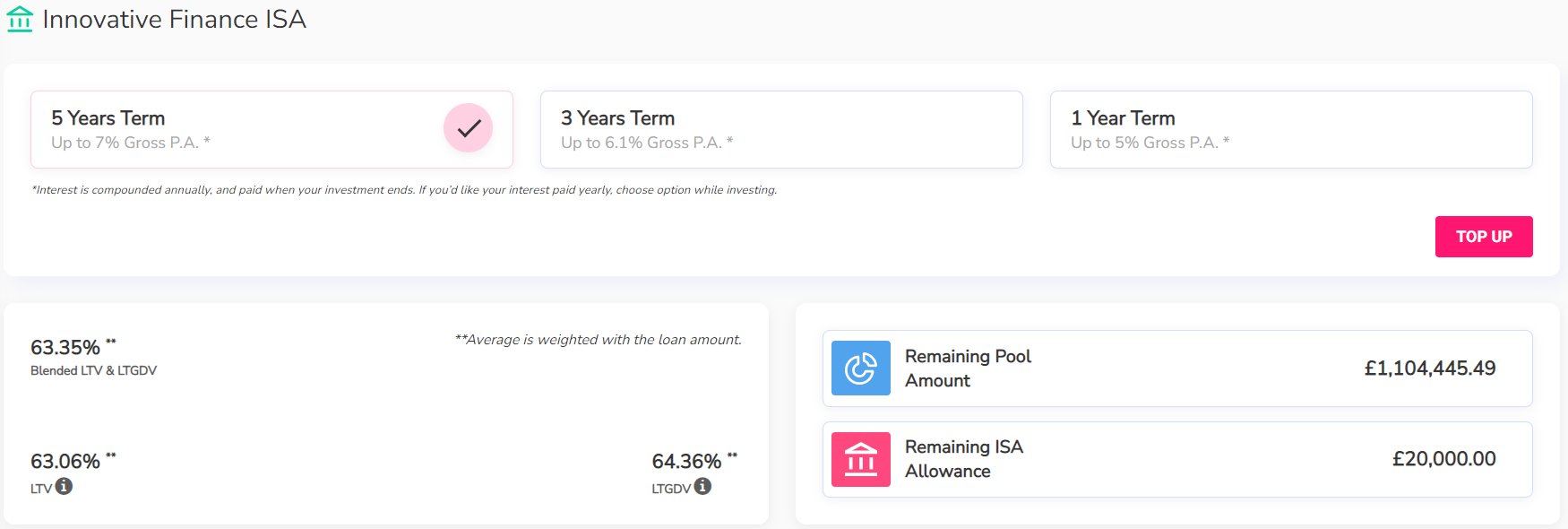

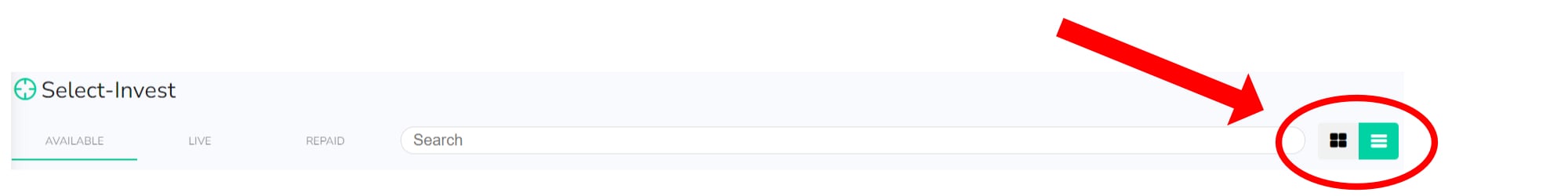

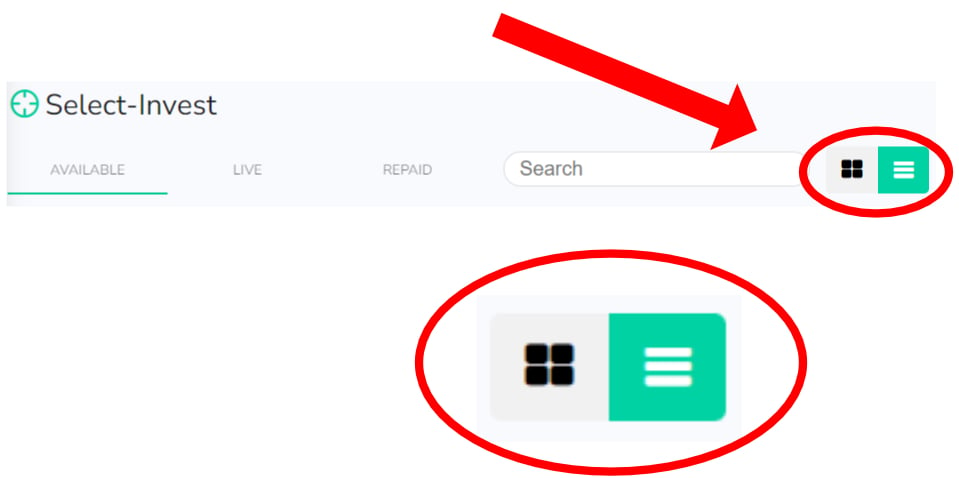

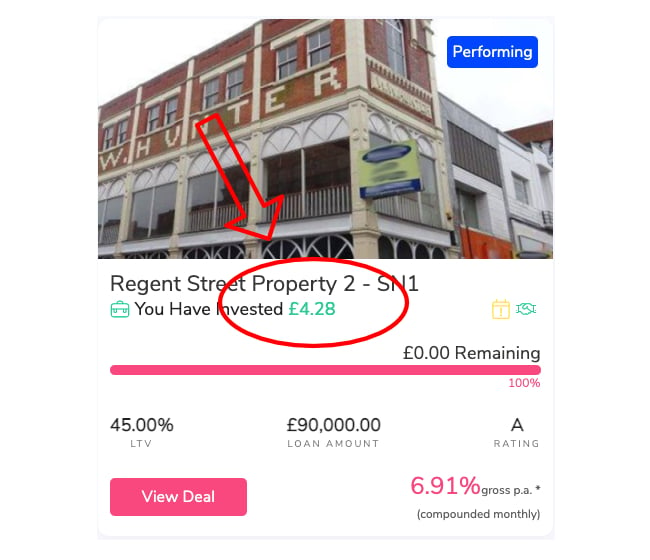

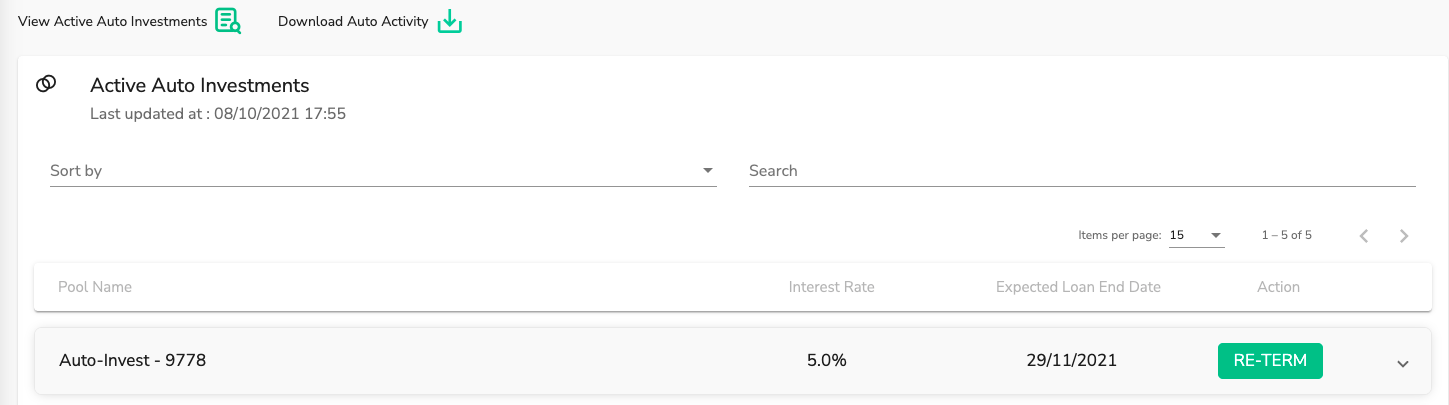

2) Released! Updated Dashboards

Available in Select-Invest, Auto-Invest and IF-ISA products, giving you a more simple overview of your investments, and available options.

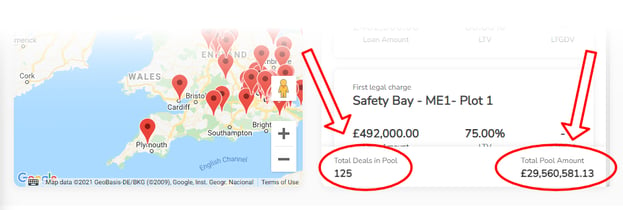

3) Released! Pool total deals and total value.

You are now able to see both the total value of our pool (the amount invested across our diversified range of loans in our Auto-Invest product), as well as the total number of loans.

Simply go to your Auto-Invest dashboard, and scroll down to the bottom to see.

It’s worth sharing again these fantastic features, also recently released to the platform.

4) Released! An IF-ISA wrapper around our ISA eligible Select Invest Deals; We have an FAQ on this subject if you’d like to know more.

10) Coming Soon! A new segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started.

11) Coming Soon! A new feature showing borrowers who have links as individuals, shareholders or directors, to other loans already on the platform is being built. As an interim measure, we comment within the lending case if there is a link to another loan for the borrowers.

12) Coming Soon! A new feature showing where each development loan is in regards our new 7 phases of development – work is progressing.

13) Coming Soon! On the lending arm, we are currently building the process, through Open banking, to add an additional layer of borrower verification in real time and building a process to ascertain income vs expenditure for a potential borrower across all accounts. This is a step forward in reducing paperwork and unnecessary communication thereby improving efficiency in the process. All in all we should, in theory, gain access to all necessary information through a simplified online process as opposed to numerous phone calls, email chasers etc.

14) Coming Soon! Work on upgrading our proprietary deal risk / pricing tool in our CRM system by connecting to live data feeds, and allowing new fields to better assess the risk and price on deals is continuing. This is especially important in light of economic events like Brexit, the COVID-19 pandemic, and price hikes on raw materials (which will affect on-going Development appraisals). We are working with a ‘Royal Institution of Chartered Surveyors’ (‘RICS’) valuer and a seasoned developer / builder (both in our Credit committee), to further enhance the tool’s sensitivity to such events. We envisage connecting this information to our live loans on our platform to provide a timeline of any given loans risk.

15) Coming Soon! We are working on upgrading our Dashboard. Live Charts, proprietary budget tools, links to other investments, accrued interest, etc. will be on display in a singular view.

CTO thoughts for October 2021

The most successful CTO’s have an active and abstract thinking model. They challenge the status quo and consider out of the box alternatives. They flow like water and are entrepreneurial in their methods. They are masters at bridging the gap between agendas and functions. They have a keen eye on the purpose and vision. They are quick to course correct when necessary. They are business and results-driven. They are self-driven and independent in thought. They anticipate future events and consistently ask questions about how technology will impact the business and direction. They focus on the power of technology and think well beyond their function. They acknowledge their shortcomings and mistakes and have the ability to transform company cultures overnight for the betterment of their clients.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Extensions and Re-terms; why?

Occasionally we send out updates to a loan, sharing details of informal extensions and re-terms. At first glance, this may seem frustrating, but the reasons for them, and the results they produce, continue to remain positive.

Extension vs Re-term

We use different language, depending on the specifics of what is happening. If a borrower is not able to pay their loan back on the date agreed, they may simply ask us for a small, informal extension. For example, 30 days. In this case, the loan would be deemed to be in arrears (as the agreed redemption date will have passed).

In the case of a re-term, this is a formal request for an extension – typically 3 months and longer. In such cases, we perform our always-high levels of due diligence and consider the request on its individual merit. Once agreed and the formal extension is confirmed, the loan is then deemed to be performing as it should be.

In both cases, our investors would continue to receive interest on their investment throughout.

Why the additional time?

The past 18 months have been difficult for a number of industries, and the knock-on effects of supply challenges and personnel difficulties have meant the shortage of products that the UK has seen on supermarket shelves, at petrol pumps, in builders merchants and a wide range of shops and services.

The effect on loans? Well, lack of building materials is proving a challenge for development projects, and those that can be sourced, have increased in price dramatically. Even for non-development loans, we’ve seen delays in solicitors and the entire house-purchasing process; partly brought about from the stamp-duty freeze, but then also the change in working lives, with employees moving outside cities and towards the countryside.

All of these elements sound like big problems, right? For your investments, the effect is simply a delay. And don’t forget, you continue to earn interest during that delay. Though a small delay may sound frustrating, it is the most effective way for us to ensure you receive both your capital and your interest; working with our borrower for the best outcome. We’ve successfully managed that process on every single one of our loans; no investor has ever lost a penny with Kuflink.

What is Kuflink’s default rate?

We share all of our statistics, updated monthly, on our website; www.kuflink.com/statistics. You may ask why our default rate appears to be higher than that of some of our competitors. Well, we share any loans that are past 30 days in default. Many competitors use the FCA standard definition of 180 days. On relatively short term bridging finance (3 months +) we believe 180 days hides the true picture.

What if…?

Ultimately, our loans are asset backed and that means every single one of your investments are secured against UK property* – and even then, we only allow a maximum 75% LTV (Loan to Value). Don’t forget, Kuflink co-invest up to 5% alongside you on Select-Invest deals – giving a further buffer. In the most extreme circumstances, if a borrower is ultimately unable to repay their loan, then we have a legal charge on the property and are able to sell it to recoup funds. In the highly unlikely event that we were only able to achieve 75% of the RICS approved valuation at auction (notwithstanding associated costs), we would still be able to repay our investors every penny.

That is why we can proudly say that after 800,000 investments totalling £146m, no investor has ever lost a penny with Kuflink.

* Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Fintech vs digital banking

Traditional banking has been challenged to progress towards a digital approach. Today banking has reached a point where the digital business model has proven and matured. The majority of the population has already moved to a digital era. Digital networking has become the foundation of financial institutions. In addition, the internet and mobile are the cherries on top of the cakes. Most retail banks have turned into digital banks, being dominated by fintech trends.

What is Digital Banking?

Financial innovative technologies have shaped banking through digitisation, and digital banking is the perfect example of this process. Digital banking is known as the digitisation of traditional banking, where people can access all services online without having to go to the bank.

Digital banking is a step forward from physical to online with a high level of automation and web-based services using a web interface or a mobile application. This revolution has made it easier for people to access their financial data through ATMs and mobile services. Thus, a paradigm shift from traditional banking to a digital banking ecosystem has been triggered by the culmination of financial innovations.

What is Fintech?

A fintech is a hybrid approach to financial technology. It has brought a new wave for businesses looking to revolutionise their financial services using innovative technologies. Fintech is a financial industry comprising companies aiming to compete with the conventional economic methods to shape the future of banking.

Fintech covers a wide range of technologies, business models, and products that have changed the way people send, receive, pay, lend, invest and borrow money.

Different industries are now adopting Fintech to make their existing delivery processes efficient in all aspects. For instance, if you send money through your mobile phone using an app or check your bank statement online, then you are already a part of the fintech industry. This industry is changing the world economy. The financial crisis and people’s distrust in the banking system have led to this financial revolution.

Fintech Example

Peer to Peer lending has become a huge player in the Fintech industry. Companies like Kuflink peer to peer lending match borrowers and lenders without depending on traditional banks.

In addition, lenders can invest without having to pay any overhead charges, in turn for better interest rates.

Difference between digital banking and Fintech

- Fintech offers people transparency, trust and technology using an efficient and improved business model where customers can benefit from the enhanced efficiency. This revolution of financial services has allowed the automation of processes and has eliminated the middleman to improve customer experience. In contrast, digital banking aims to improve customers’ banking experience via digital channels like bill pay, mobile payment, etc.

- Digital banking is a virtual process that completely integrates with the core banking solutions while decreasing the use of extensive paperwork such as pay-in slips, cheques, loan applications, etc. However, digital banking’s scope is limited to banking-related tasks such as personal financial planning, online banking, digital wallets, bill payments, mobile transfer and digital coupons. On the other hand, the Fintech industry comprises business models either within or outside the scope of financial institutions.

- Fintech aims to reshape financial services through technologies such as machine learning, big data, automation, blockchain bonds, artificial intelligence (AI), Robo-advising, crowdfunding and more.

- Digital banking has also redefined the retail banking experience to be more customer-centric, using chatbots, machine learning, robotic process automation, CRM and blockchain etc. Flexibility and user-friendliness are the keys to the digital banking model.

Why is Fintech growing rapidly?

During the COVID-19 pandemic, the use of mobile banking increased immensely, and it is predicted that the user will remain the same even after the pandemic. This is because most people have grown to prefer multi-channel interaction and like digitally-enabled banking with remote assistance, which is available when needed.

In order to fulfil customers demand for efficiency, speed and smooth user experience, financial service providers are integrating technology into their financial services. This has allowed them to provide a better user experience. For example, if giant retailers like Amazon can enable customers to complete purchases in seconds, it should not require a physical meeting to open a new bank account.

The fintech industry bridges the gap between traditional banking and modern customer expectations. As a result, the industry has grown massively and is expected to grow to £309 billion at a growth of 25% throughout the year 2022.

Is Fintech going to last?

Fintech is the future of banking; hence it is not surprising that the Fintech companies in Europe have raised more than £14.3 billion in venture capital funding and are valued at £78 billion. Conventional banking has drastically evolved its functionality thanks to new-age technology such as machine learning, analytics and AI. Also, they have begun to acquire fintech start-ups to diversify their services.

It is a highly competitive market; therefore, some Fintech companies thrive while others struggle to survive. However, this also presents an opportunity for banks and Fintech start-ups to work together.

.png?width=690&name=Finch%20vs%20Digital%20Banking%20%E2%80%93%205%20(1).png)

Can traditional banks and Fintech companies work together?

Traditional banks and Fintech companies both work as financial intermediaries. However, even though banks have been around for hundreds of years, they still have to make drastic changes to fulfil the modern-day customer requirements.

Fintech’s technology provides users with advanced features along with the services that banks offer. Therefore, it is highly unlikely that people will completely switch to Fintech from banks. However, banks and Fintech can collaborate and co-operate to create a bigger impact. If the two industries partner up, they could have immediate advantages.

Banks can benefit from the technological advancement and agility of Fintech. Let’s have a look over the benefits of traditional banks and Fintech collaboration:

- If banks collaborate with Fintech, they could be regulated in the same way and work in the same way as each other which could help build customer trust.

- Compared to Fintech, traditional banking gets huge deposits. So, their partnership can build a better financial system which could be easier for banks.

- The overall financial system can improve immensely because of the advanced Fintech technology.

Traditional banks are now embracing advanced Fintech features to improve customer experience. In addition, as the overall finance system is continuously evolving, allocating resources for digital agility has become a priority for the banks.

Combining trust and support (banks) and innovation (Fintech) is a win-win situation to create a better digital future for the finance sector.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Investment to pay off your mortgage

Have you got spare cash in a lump sum or some cash in your monthly budget? Either way, it makes more sense to do something meaningful with it. However, you might be confused about whether to repay your debts early or invest. Being a proud homeowner, you may not like the idea of paying the mortgage every month over the next few decades. However, considering the diverse investment options, it can feel like you are missing out by not investing.

Invest or Pay Mortgage Early: What should you do?

Being a homeowner, most people dream of the day when they no longer need to pay the mortgage. Being free of debt is a great goal. However, it might not make the most sense financially. There is an opportunity to grow your money through investments.

For example, say you have a mortgage of £200,000 for 30 years with a 1.5% fixed rate. You would make monthly payments of £690. This means you would spend a total of £48,474 in interest on that mortgage.

Now, let’s say you manage to earn £300 extra each month, to put towards that mortgage. As a result, you would be able to reduce your repayment period by 10 years 7 months, and save yourself £17,831 in interest.

Alternatively, you could take that £300 monthly and invest it.

Kuflink’s Auto-Invest product, diversified across hundreds of loans, returns 7% annually – so let’s use that for our calculations;

Investing £300 each month with a 7%pa return, compounding it annually, would earn you a massive £246,803 in interest!

So rather than save £17,831 in debt interest, EARN £246,803 of investment interest.

If you want to get really detailed – consider that the interest you are earning on your investments will, over time, become greater than the outstanding mortgage debt. If you want to be debt free, you could pay off your mortgage sooner by investing.

Should you Pay Your Mortgage Early or Invest?

It is best to invest the money instead of funnelling savings towards paying off your mortgage early from a financial perspective. However, to help you make the right decision according to your financial plan, let’s discuss the pros and cons of paying off early vs investing.

Pros of Paying Your Mortgage Early

- Peace of mind: the idea of constant debt can be unpleasant. Hence paying the mortgage early can give you peace of mind. In case of emergency, having a paid home means you do not have to worry about missing the monthly mortgage payments.

- Building equity: by paying the mortgage faster, you can build equity in your home. This way, you can qualify for refinancing, which means you can save more in the long term.

- Saving on interest: this is probably the biggest benefit of paying your mortgage early. You can save thousands of pounds in interest payments by paying your mortgage early.

Cons of Paying your mortgage early

- Wealth is tied up: the property is an illiquid asset, so you cannot convert it to cash. In case of a financial emergency, you would be left with only one option of selling your house, which too can take a long time until the right buyer is available.

- Loss of tax breaks: if you decide to pay off your mortgage instead of maxing out your tax-advantaged retirement accounts, you will be giving up those tax savings.

- Opportunity cost: the money you spend on paying the mortgage early is the money you are unable to use for other financial goals. Think about it; you may be paying off the mortgage at the expense of your retirement savings, your emergency fund or other higher return investment opportunities.

Benefits of Investing

- Returns On Investment: the most significant benefit of investing your money rather than paying your mortgage earlier is that you can get high returns. For example, for several years, the returns on stocks and shares are significantly higher than the mortgage rates, which means you can save the money even after paying your mortgage amount.

- Contribution matching: you can invest your extra cash in a retirement account, and your employer offers a matching contribution to it. You can enjoy the benefits of compounding interest on this additional free money.

- Liquid Investment: when you invest in a home, it ties up your money. Invest in bonds, stocks, peer to peer lending, or other alternative investments so that you can have access to some cash in the time of need.

Drawbacks Of Investing

- Increased Debt: Investing money may not be a good option for individuals who do not like the idea of having a loan to their name. You cannot own your home until you repay the mortgage amount. Moreover, there is always a risk of repossession if you fail to repay on time.

- Higher Risk: the stock market is more volatile than the real estate or housing market year on year. Similarly, alternative investments carry their own risk. So, there may be chances of losing money. When you make your investment strategy, always keep in mind your risk tolerance and be mentally prepared for any type of risk.

Refinance and Invest: The best of both worlds

If you still don’t know which option is the best, you may not have to choose one. Instead, you can take a hybrid approach to reduce your debt and grow your wealth.

Mortgage rates are low; this means it is the right time to refinance. If you took out a mortgage or refinance years ago, you can save more by refinancing to a lower interest rate and reduce your mortgage term length. Just make sure to consider the closing costs when calculating the numbers.

With your newfound mortgage savings in place. You can invest as well. This way, you will spend less on the mortgage while you can still take advantage of higher returns.

All the above is for information purposes only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

Update On Kuflink’s Financial Results And Auditor Reports

These accounts have received a clean bill of health from its new auditors, who are the respectable MHA MacIntyre Hudson. This is the news we’ve been waiting for.

The 2021 Peer2Peer Finance News P2P Power 50

Khattoare has said that Kuflink “is in a strong position” this year, which is demonstrated by the fact that the P2P property lending platform moved into profitability for the first time during the pandemic. Kuflink surpassed the £100m lending milestone earlier this year and has introduced many new features such as a mobile app and instant bank transfers using open banking.