P2P outperformed UK stock market during the pandemic

Copy the link below if the Read More link expires.

Peer-to-peer lockdown: investors fear cash will be trapped for years

Copy the link below if the Read More link expires.

Budget For 2021

Rishi Sunak has delivered his budget for 2021, here are some of the key points and Tables for the current Tax year.

All of the below is subject to relevant legislation. This is for information only. Please always seek professional advice before acting.

Furlough

- The government has decided to extend the Furlough scheme until September 2021. This has supported 11.2 million jobs so far in the UK, worth almost £53 billion.

- The government will continue to pay 80% of employee wages until the scheme ends, but businesses will have to contribute 10% in July 2021 and 20% in August and September 2021, as the scheme will be gradually phased out.

Business support

- There is an initiative to deliver ‘Restart grants’ to businesses to get them going again. All non-essential businesses will receive a grant of up to £6,000 and will open first. However, all the leisure and hospitality businesses like hairdressers, gyms and personal care will open later with restrictions and get grants of up to £18,000.

- The government has decided to extend the unprecedented 100% business rates holiday for every eligible retail, leisure and hospitality business, a tax cut worth £10 billion. This will be applicable until June, before the rates are cut by two-thirds for the rest of the nine months. This way, most businesses will get a 75% cut in their next tax year, a tax cut worth £6 billion.

- A new help to grow scheme will be launched to increase the productivity of small businesses. This scheme will help SMEs get training through government-funded programmes, with companies contributing just £750, which is only 10% of the whole cost of the course.

- Small businesses will get 50% off when buying new productivity-enhancing software. The scheme will be launched by this Autumn and will benefit 130,000 SMEs.

Housing

- The government has extended the stamp duty cut for homebuyers. To avoid incomplete purchases, the £500,000 nil rate band will end on June 30, before bringing it down to £250,000 until the end of September 2021.

- From April 2021 to December 2022, lenders offering loan-to-value ratios of 91% to 95% will get a government guarantee on the full value of the mortgages. The new mortgage guarantee will allow homebuyers to take the first step towards owning a house. The maximum property value will be £600,000 and mortgages must be arranged on a repayment basis.

SDLT (England & N Ireland)

Residential property

To 30/06/2021

Up to £500,000 0%

£500,000 – £925,000 5%

£925,001 – £1,500,000 10%

Over £1,500,000 12%

Residential property

01/07/2021 to 30/09/2021

Up to £250,000 0%

£250,000 – £925,000 5%

£925,001 – £1,500,000 10%

Over £1,500,000 12%

Residential property

From 01/10/2021

Up to £250,000 0%

£125,000 – £250,000 2%

£250,000 – £925,000 5%

£925,001 – £1,500,000 10%

Over £1,500,000 12%

First time buyers: 0% on first £300,000 for properties up to £500,000 from 01/07/2021 Non-resident purchasers: 2% surcharge on properties £40,000 or more

Residential properties bought by companies over £500,000: 15% of total consideration, subject to certain exemptions

Commercial property

Up to £150,000 0%

£150,001 – £250,000 2%

Over £250,000. 5%

Corporation tax

- To resolve the issues created by the COVID-19 pandemic, the largest and most profitable companies will contribute more from April 2023.

- The rate of corporation tax paid on profits of at least £250,000 will be increased to 25%.

- At the same time, businesses making profits less than £50,000 will pay a new corporation tax at 19%.

- To encourage investments into qualifying new plant and machinery, will benefit from a 130% first year capital allowance. According to OBR, this can lift business investment by 9% and lift the UK from 30th to 1st in the OECD’s ranking for business investment. For two years, there will be a business tax cut worth £25 billion.

Capital Gains Tax

Tax Rates – Individuals

Below UK higher rate income tax band 10%

Within UK higher and additional rate income tax bands 20% Tax Rate – Trusts and Estates 20% Surcharge for residential property and carried interest 8% Exemptions

Annual exempt amount: Individuals, estates, etc £12,300 Trusts generally £ 6,150 Chattels gain limited to 5⁄3 of proceeds exceeding £ 6,000 Business Asset Disposal Relief

10% on lifetime limit of £1,000,000

For trading businesses and companies (minimum 5% participation) held for at least 2 years

Personal Tax Policy

- In the last decade, the personal allowance has doubled to £12,500, which means that now, a typical basic rate taxpayer pays £1,200, which is less tax in 2010. (Personal allowance reduced by £1 for every £2 of adjusted net income over £100,000). For 2021/2022 this will rise because of inflation to £12,570, and this higher level will be kept until April 2026.

- Marriage / Civil Partner’s transferable Allowance increases to £1,260 – 2021/2022 (Married couple’s/civil partner’s allowance reduced by £1 for every £2 of adjusted net income over £30,400 – 2021/2022, until minimum reached)

- Married couple’s/civil partner’s allowance at 10%† (if at least one born before 6/4/35)

– maximum £9,125 – 2021/2022

– minimum £3,530 – 2021/2022

(†Married couple’s/civil partner’s allowance reduced by £1 for every £2 of adjusted net income over £30,400 (£30,200 for 2020/2021), until minimum reached). - Blind person’s allowance £2,520 – 2021/2022

- Rent-a-room relief £7,500 – 2021/2022

- The CGT, inheritance, pension lifetime allowances, and VAT threshold will remain at the present levels. The tax-free inheritance threshold will remain at the present level until April 2026. The lifetime allowance will remain at over £1 million, 95% of people near retirement will remain unaffected by this change.

- The income tax, VAT or NICs will not increase, and the government is freezing fuel and alcohol duty.

Registered Pensions

Lifetime allowance £1,073,100 – 2021/2022 Money purchase annual allowance £ 4,000 -2021/2022 Annual allowance* £ 40,000-2021/2022 Annual allowance charge on excess is at applicable tax rate(s) on earnings Lifetime allowance charge if excess is drawn as cash 55%; as income 25% Pension commencement lump sum up to 25% of pension benefit value

*Reduced by £1 for every £2 of adjusted income over £240,000 to a minimum of £4,000, subject to threshold income being over £200,000

Inheritance Tax

Nil-rate band* £325,000 (2021/2022) Residence nil-rate band*† £175,000 (2021/2022)

Rate of tax on excess 40% Rate if at least 10% of net estate left to charity 36% Lifetime transfers to and from certain trusts 20% Overseas domiciled spouse/civil partner exemption £325,000 (2021/2022) 100% relief: businesses, unlisted/AIM companies, certain farmland/ buildings

50% relief: certain other business assets e.g. farmland let before 1/9/95

Annual exempt gifts of: £3,000 per donor £250 per donee

Tapered tax charge on lifetime gifts within 7 years of death

Years between gift and death 0–3 3–4 4–5 5–6 6–7

% of death tax charge 100 80 60 40 20

*Up to 100% of the unused proportion of a deceased spouse’s/civil partner’s nil-rate band and/or residence nil-rate band can be claimed on the survivor’s death

†Estates over £2,000,000: the value of the residence nil-rate band is reduced by 50% of the excess over £2,000,000

Tax Incentivised Investment

- Total Individual Savings Account (ISA) limit excluding Junior ISAs (JISAs)

£20,000 – 2021/2022 - Lifetime ISA £4,000 – 2021/2022

- JISA and Child Trust Fund £9,000 – 2021/2022

- Venture Capital Trust (VCT) at 30% £200,000 – 2021/2022

- Enterprise Investment Scheme (EIS) at 30%* £2,000,000 – 2021/2022

- EIS eligible for CGT deferral relief No limit – 2021/2022

- Seed EIS (SEIS) at 50% £100,000 – 2021/2022

- SEIS CGT reinvestment relief 50% – 2021/2022

*Above £1,000,000 investment must be in knowledge-intensive companies

Building our Future Economy

- The government has announced 45 new town deals and has launched a £150 million community ownership fund to help communities purchase local assets like theatres and pubs.

- There will be eight freeports across the UK including Humberside, Teesside, Thames Gateway, Felixstowe, Plymouth, Solent, the East Midlands and Liverpool.

- All businesses located in these freeports will get tax breaks such as no stamp duty, machinery investment and full rebates for construction, lower tariffs, five years of zero business rates, and customs obligations.

All the above is subject to relevant legislation. This is for information only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

How many ISAs can you have?

In the past few years, the ISAs (Cash, Stocks & Shares, IFISA, Junior) have consistently been on an upward trajectory.

The ISA allowance may be strict each tax year, but it doesn’t mean you have to limit yourself to one account. You need to look into different ways to spilt your ISA allowance. You can invest a specific amount into your ISAs each year (for example: £20,000 in 2020/21) but how you split your funds across ISA accounts is up to you.

The ISA Types

There are four ISA types you can invest in:

- Cash ISA: this works just like a regular savings account, meaning you do not have to pay tax on the earned interest.

- Stocks & Shares ISA: with this ISA, you can invest in a range of bonds, funds and individual company shares. All your gains are free from capital gains tax.

- Innovative Finance ISA: this allows you to earn tax-free interest on funds that are lent through peer to peer lending platforms. The IFISA market is believed to have broken the £1bn barrier in the 2019/2020 tax year, according to data from The Investing and Saving Alliance (Tisa). This means IFISA went up from £711m in the 2018/2019 tax year and is on a steady rise.

- Lifetime ISA: this ISA helps you save for retirement or home deposits. Deposits in Lifetime ISAs get a 25% bonus from the UK government.

- Junior ISA: this is a long-term savings account which a parent or a legal guardian can set up for children. Only the child will be able to access the funds once they reach the age of 18.

Understanding your ISA allowance

Every year investors and savers get an annual ISA allowance. For the tax year of 2020/21, it is £20,000.

| Tax Year | Annual Individual Savings Account Allowance |

| 2015/16 | £15,240 |

| 2016/17 | £15,240 |

| 2017/18 | £20,000 |

| 2018/19 | £20,000 |

| 2019/20 | £20,000 |

| 2020/21 | £20,000 |

In 2017/18, the adult ISA allowance increased from £15,240 to £20,000, and it has been the same ever since. Similarly, in 2019/20, Junior ISA increased from £4,260 to £4,368 and took a big leap in 2020/21, as Junior ISA stands at £9,000. However, the Lifetime ISA has not increased after being introduced in 2017/18. It offers a £4,000 allowance per tax year.

Understanding your ISA allowance is important to know how much you can invest in the ISA. You can invest your whole allowance, or you can split it by paying into each separate type of ISA, whether that is an existing account or a newly-opened one. You can divide up your allowance according to your financial goals.

How to choose the right ISA mix for you?

In order to choose the right ISA mix, you must consider your appetite for risk, the timeframe you would like to invest or save over and what your ultimate financial goal is.

You can split your ISA allowance half-half between cash and stocks & shares ISA, or you can put in the whole allowance to just one type of ISA account. Ultimately it is up to you, as long as you do not exceed the limit. If you want to take complete advantage of the Lifetime ISA bonus, remember these ISA accounts have an annual limit of £4,000, which leaves you with £16,000 to save or invest somewhere else.

What happens to your previous years ISAs if you open a new ISA account?

Along with opening a new account for each type of ISA every tax year, also you can retain your previous years ISA, which means you can build up a collection of ISAs. But remember, you cannot add the previous years ISA account if you have opened a new account for the same type of ISA.

Simply put, if you have a cash ISA account with one company that dates back to a previous year, you can open a new cash ISA account and put your money into the current year while your previous account continues to earn interest. But you cannot make contributions to both accounts.

Also, you can transfer all or part of the previous years ISA funds into your new account to get a better interest rate, along with opening a new ISA account for the current year. Again, you can’t invest in both accounts in the same tax year.

There is no limit to the transfers you can make in a tax year, however don’t do transfers by yourself. If you wish to make the transfer, contact your provider to move the funds, or you risk losing the tax-free status.

The exception for the age of 16 and 17

While both junior and adult ISAs are subject to annual allowance, there is actually a loophole that allows 16- and 17-year-old to open both types of ISA accounts in the same tax year. This means they can get a combined annual allowance of £29,000.

Whether you should invest in multiple ISAs or not ultimately depends on what your financial goal is. It’s always a good idea to consider your risk tolerance and the timeframe you are looking to save over.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

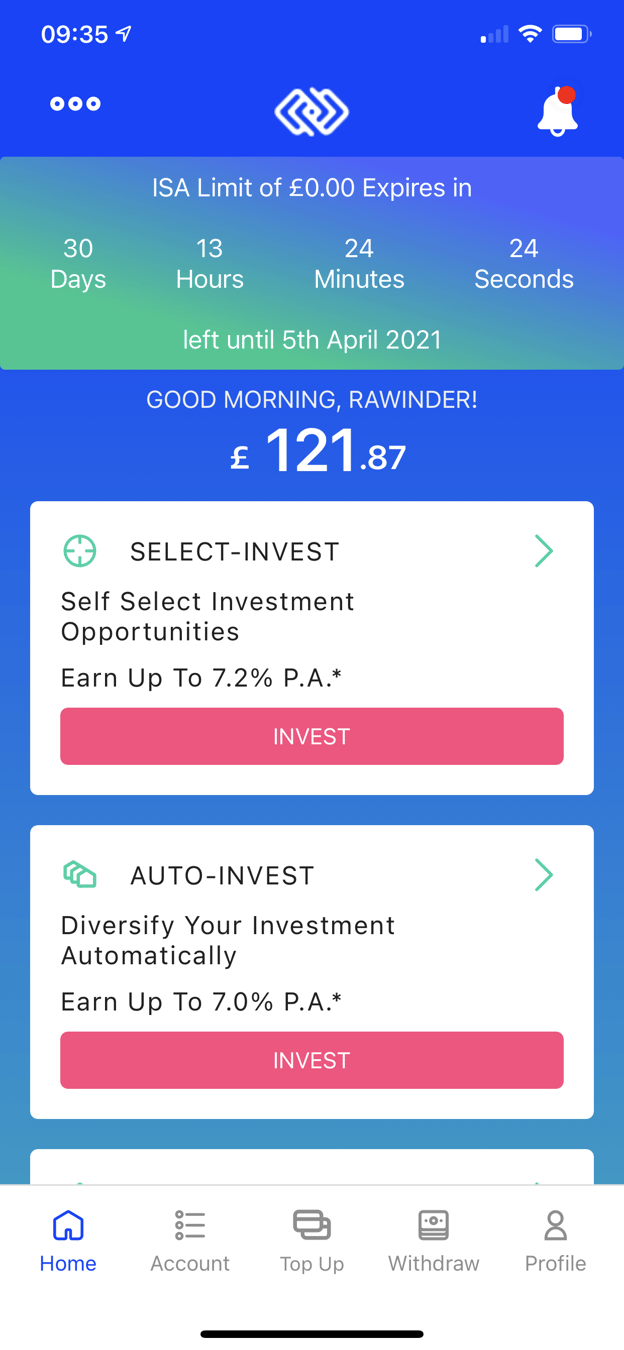

Kuflink’s New features for March 2021. Stand Up with CTO

Allow me to quote Tony Hsieh, from Zappos, who said that “Zappos is a customer service company that just happens to sell shoes”. This is something that has stayed with me all my life and it is refreshing to find like minded people in the Kuflink family. Tech stop everything the moment we have an issue that is affecting a clients experience on the platform. It is this commitment that the CEO drives in all of us in the daily stand ups for the whole company and in our team stand ups. Our shining light, Lisa, is an embodiment of this in our Investor Relations team.

Bit of fun (We have uploaded a video showing our code commits over the last few years)

What’s New on the Kuflink Platform for March 2021

1) A new “Loan Status” column in your Portfolio section, showing each status (E.g. “Performing”, “In Default”, etc.) of all Select Invest live loans;

2) Kuflink Mobile App (Beta) Fixed on the Apple Store

I am happy to report that the “Kuflink Mobile App” is up and running and has launched on App stores for Android and Apple phones as a new “Beta Version”. We are constantly adding some of the new features you see on the Web Invest platform on an ongoing basis and releases will be scheduled at different times to the Web Invest Platform upgrades.

Some Updates on the New Features that have the green light and are coming soon!

1) We have started works on providing an IF-ISA wrapper around some of our Select Invest Deals – development has started – release date in the next few weeks;

2) We are working on showing updated Images and information of our Development Loans – development has started – release date in the next few weeks;

3) A new search feature on Live deals in Select Invest – development has started;

4) Pool to show ribbons which indicate which loans are in default or performing;

5) IF-ISA Transfer IN Sign up process to be digitised is now ready for end to end development and release in the next few weeks;

6) Connect to our Open Banking App, which then means we do not require an uploaded bank statement, and gives the ability to make bank transfers in real time – development has started;

7) A New segregated IF-ISA wallet, and SIPP wallet (which also comes with surprise features) – development has started – release in the next few weeks; and

8) Much more.

Kuflink Algorithms

It has been a sad week where we have seen another Peer to Peer platform (House Crowd) going into administration. Reading through their reviews we can see that there seems to be common cracks such as those presented by Lendy.

We have been a bridging company since 2011 and allow this part of the business to continue the platform’s debt collections. In our algorithms and statistics page, we do not follow the recommended FCA default definition of 6 months before a deal goes into default, but rather follow our Kuflink Bridging default definition of 1 month after a payment (interest and/or capital) is due. We, in fact, have triggers to alert the teams in advance of these dates.

The key answers are due diligence (by experienced underwriters), RICs appointed valuers, strong credit committee(s), minimum 2 solicitors appointed by the Solicitors Regulation Authority (SRA), Directors getting involved in site visits, early debt collection markers, and much more.

For those affected we express our warmest prayers!

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF-ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.