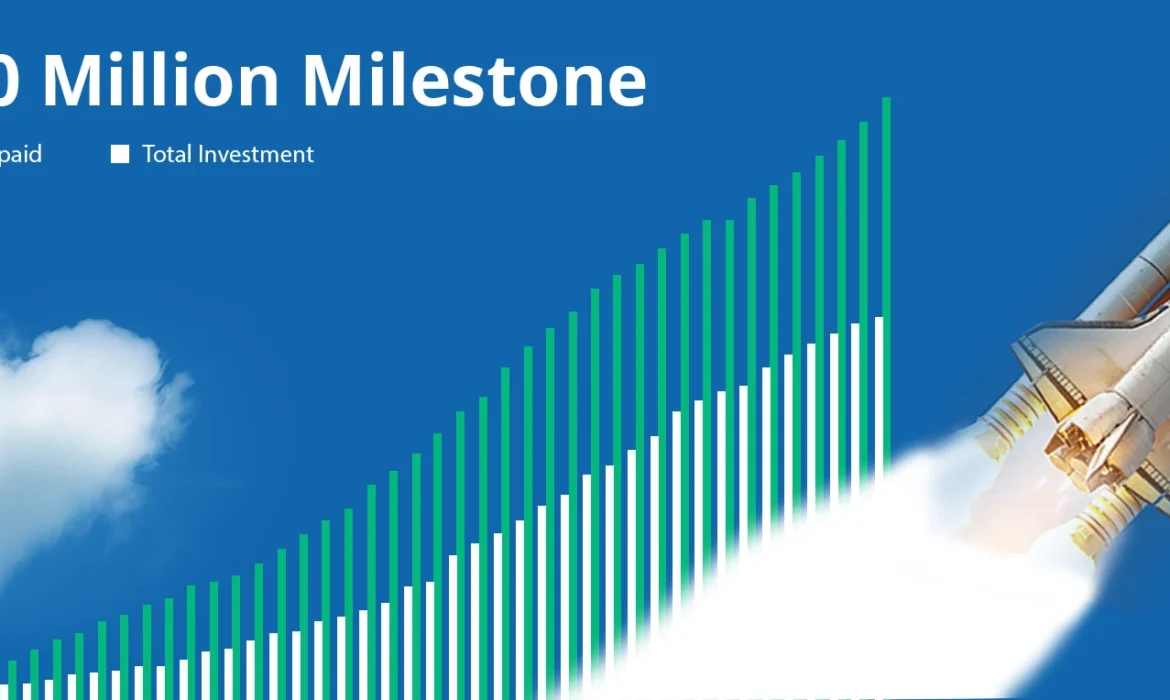

Kuflink, P2P Platform, Celebrates £100 Million Lending Milestone!

KUFLINK, a global P2P online platform bringing people together through Lending, announced that it had surpassed £100 million lending milestone across the Platform. Further, Kuflink borrowers have repaid £63 million in capital to Investors through the platform. Kuflink still maintains zero loss to investors to date.*

“We started bridging finance back in 2011, just after the great recession. It was an era of fewer banks lending on property, increasing enquiries for these type of loans, increased demand from investors for better returns than the low-interest environment offered from banks and volatility from the stock market. April 2017 saw us having a FCA authorised and regulated online Peer to Peer Platform. By December 2020, investors and borrowers have together reached an amazing milestone of £100 million Lending, through the Kuflink platform, and long may this continue. It is through the investor’s and the team’s passion that the platform has evolved into what it is today.” says Narinder Khattoare, Kuflink’s CEO,

“I’ve used Kuflink for about three years now for both business and personal funds. When deposit rates continued to fall, I looked to get a better return on cash. Peer to peer lending was the obvious choice, and Kuflink has proved to be a sound choice. Interest rates are excellent, and what I like in particular is that all loans are backed by property with sensible LTV rates, giving a very good level of security. The company invests alongside investors as well. Communications from Kuflink are excellent, and even in the difficult year we’ve just had, there have been no significant issues. I hate the term ‘no brainer’, but with deposit rates at a fraction of 1%, Kuflink is a great home for cash you’re prepared to tie up for the next 12-18 months.” says John Harrison, an Investor since 2017.

“I have dealt with Kuflink as a borrower and lender. From both aspects, they were professional at all times. As a borrower, every ‘t’ was crossed and every ‘i’ was dotted, and if I ever need funding again, there is only one organisation I would approach. Also, as a lender, Gurbinder was 100% professional with no sales pressure and clearly outlining all aspects of the transactions. For my company, there will only be one place to go – Kuflink.” says David Hunter (Torpedo South), a borrower since 2017.

The milestone comes during the week when UK and EU agree on a post-Brexit trade deal and the global distribution of a vaccine. So together, we mark this occasion with promise, hope and good health for 2021.

About Kuflink

Kuflink’s vision is to bring the world together through Lending. Kuflink lets investors customise their own portfolio, from investing in specific loans which pay interest per month, or compound the interest to the maturity date, to investing in a pool of loans, and this product is available with an ISA wrapper.* Kuflink believes in building a passionate and enriched community – one that inspires people to invest together and help borrowers build the economy.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF-ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.

The day Saints FC explained Peer to Peer lending!

At Kuflink, we are an established bridging lender along with an online Peer to Peer (‘P2P’) platform. We offer investors opportunities to earn interest on loans that are all secured by UK Property*.

You may have seen the video below over the year, but if not it’s well worth a watch, the light-hearted video was filmed with Southampton Football club to promote our peer to peer investment opportunities. Seemed that not everyone knew about the new way of earning passive income or even what Kuflink was all about.

Great watch, we’re sure you’ll agree.

So why are we here?

Kuflink’s main aim is to connect people to Financial Freedom. It is interesting to see how everybody’s investor journey is so different, some people love to know each and every detail about the deals they are investing into (Select-Invest) whilst others have less time to spend looking at the deals and so prefer to spread their risk across a number of different opportunities that we have available at the time (Auto-Invest), which is also available with a tax wrapper (IFISA).

Either is fine by us just let us know if you have any questions.

Kuflink set up the platform so it could use Property* as an asset class, we have a wealth of property experience and and a vast knowledge in short-term bridging loans. By bringing these to the platform we are able to offer great deals to our investors.

As we briefly mentioned above, the platform allows clients to vet the deals individually, seeing the Property*, the valuation report, Kuflink’s loan rating and much more, or they can diversify their investments across a series of loans secured on Property*. Kuflink keeps the asset class to property only*.

So, peer to peer lending with Kuflink is another investment avenue to earn interest secured on Property*. Kuflink’s P2P platform sits firmly with investments such as rent from property, interest from Savings in Banking Institutions, dividends from stocks and shares, and much more.

Kuflink’s fascination with football does not end with Southampton Football Club, we are also the main sponsor for our local club, Ebbsfleet United Football Club and the stadium changed it’s name to the “Kuflink Stadium” back in 2017.

At the time, Harwinder Singh, founder of Kuflink, said: “Kuflink is excited to sponsor Ebbsfleet United Football Club and we look forward to working closely with them on a number of local community ventures.”

With both Southampton and Ebbsfleet we are really looking forward to working closely with them and being able to get back into the Stadiums with all the fans. Hopefully we will start to see this happen again as we move in to 2021.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed.

List of authorised ISA managers

Kuflink is on the list of managers of Individual Savings Accounts (ISAs) authorised by HMRC under the ISA Regulations 1998 (SI 1998 No 1870), as amended.

Coffee with Kuflink; Has Kuflink changed during Covid?

Coffee with Kuflink; a chat with Narinder Khattoare, CEO

Going into 2020 investors had already become more wary about peer-to-peer lending because of the failures of certain P2P platforms, such as Lendy. Potential investors were asking more questions about the security of their money and querying the quoted levels of return. We saw this as a good thing, because too many people had fallen for the hype from P2P platforms with neither the knowledge nor the expertise to operate but which had made claims that would subsequently not be backed up. People approaching us were now asking the right questions and were prepared to listen to all the pluses as well as the potential minuses that make up P2P investment.

Once COVID-19 came along, conversations became more challenging. But by talking to investors openly, with details of our vetting process for borrowers, particularly those who needed time to get through COVID-19, we reassured most investors that payment breaks were needed and loan extensions for some so they didn’t pay too much default interest. 10-15% of our book had payment holidays but we still honoured interest payments to investors.

The conversations with our retail investors was about reassurance, having to educate them on what could happen in a worst case scenario and what our plans were during this period.

Throughout this time, we communicated with the whole investor base letting them know what we were doing and how we were performing, giving regular loan updates and letting our investor community know how much we had paid back to them while other platforms had stopped trading.

It has been tough but we have remained confident in our underwriting, systems and processes. We have shown our investors that we are able to trade in a downturn and still provide good returns to our investors.

Predicting the demise of P2P funding is premature

The growing pains of peer to peer (P2P) investment have been the subject of much dissection in the media.