0% Benefit in Kind Tax for Electric Cars Changes from 2020/21

Kuflink Green News! Company drivers for completely ‘Electric Vehicles’ (EV), have to pay 0% Benefit in Kind Tax in 2020/2021. Also, EV’s do not pay any road tax, and get a 100% discount on London’s Congestion Charge.

The UK government is trying to increase the number of Electric Vehicles (EV) on the road while also changing road tax for electric cars. This commitment comes from the efforts to meet climate change targets and enhance the cities’ overall air quality. Therefore, the government will impose a ban on the sales of vehicles (cars & vans) powered by diesel or petrol from 2030. However, there are going to be some exceptions to the ban, such as the plug-in hybrids, and some full hybrids will be sold until 2035.

Along with the ban, the government has also announced a £20 million fund for electric vehicles. This funding will help with the research and development for Electronic vehicles technology innovation. This fund will also be a support for zero-emission emergency vehicles, battery recycling and charging infrastructure.

According to the bank of England, during the course of lockdown, Britons have been able to save more than £100 billion.

One decision that most postponed last year was buying a new car. Despite the pandemic, over 76,000 battery-powered electric vehicles have been sold in the UK. This coming year more people will go with electric cars. And people buying these will be company owners and company drivers because of the EV tax benefits.

This is for information only. Please always seek professional advice before acting.

CHANGING BENEFIT IN KIND

.png?width=627&name=PIE%20CHART%20%20(1).png)

Zero Emission Cars Now Pay 0% BIK

Benefit in Kind

Employees get benefits in kind from their employment, but these are not part of their wages or salary. This covers items like company cars. Benefits in Kind (BIK) is payable on a company or business car if used for private use.

0% Benefit in Kind (BIK) Tax for Electric Cars Changes from 2020/21

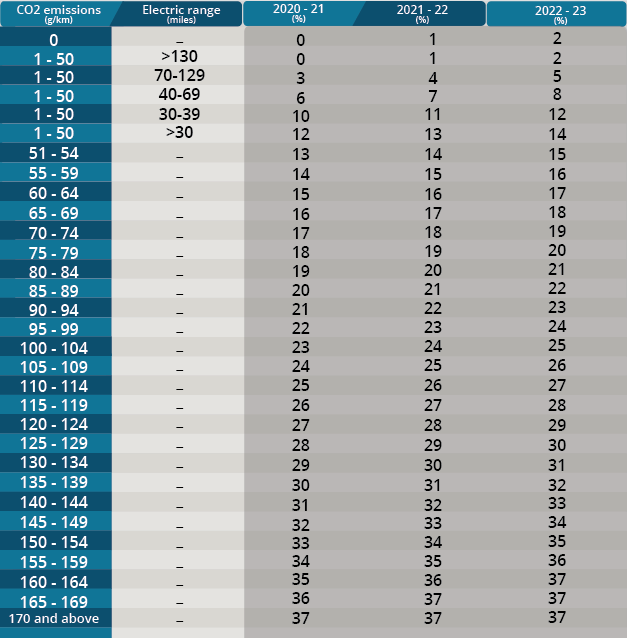

Tax changes made by the government came into effect in 2020/2021, which helps in reducing company car tax bills, especially company drivers. From April 6th, completely electric cars have to pay 0% BIK Tax in 2020/2021. However, they will have to pay 1% in 2021/22 and 2% in 2022/23.

Additionally, the UK government has launched five new Company Car Tax bands for the plug-in hybrid cars, which only emit 1-50g of CO2 per km. This benefits the electric vehicles that drive with zero tailpipe emission. So, there is no better time than the present to change your business vehicles or fleet to electric.

BIK Tax: Electric Cars v Petrol/Diesel Cars

Someone who has got a new BMW petrol-fuelled company car (146g/km of CO2) in April 2020 has to pay a BIK tax of 32%, which will rise to 34% in 2022/23. Similarly, a Nissan Leaf E has 0% BIK tax for the current financial year, which will increase to 1% next year and 2% for the year after. So, if you do that calculation correctly, the BMW will cost you more than £13,000 more in tax over 3-years.

For employers, there are extra benefits. People who earn £100,000 to £125,000, lean towards buying electric company car because, with every £2 that you get over £100,000, you also lose £1 of your personal allowance. This way, your income tax comes to 60%. So, paying 0-2% in BIK tax is better if you are in that position. In addition, the overall cost of the electric car can be written off against the profit you earn in the first year. This cuts your corporation tax as well.

Running Costs : Electric Cars v Petrol/Diesel Cars

However, you don’t have to be a business owner to enjoy the benefit in kind tax on electric cars. These cars also can cost half as much compared to petrol and diesel, depending on the price of electricity and the time you charge the car batteries.

An average UK driver covers 7,400 miles in a year, and on average, the fuel consumption can be around 50 miles per gallon. So, a new car usually gets through 148 gallons of fuel in one year. If the average cost of one gallon is around £5.45, this means the ‘average’ electric car can help you save £400 in a year in fuel cost. Plus, you don’t even have to pay road tax which increases this saving by £150.

Furthermore, electric vehicle drivers get to take advantage of a 100% discount on London’s Congestion Charge. Do you know what that means? You get to save thousands that a daily commuter has to pay!

Even the UK government offers up to £2,500 for buying an Electric Vehicle (cars must cost less than £35,000 – RRP including VAT and Delivery fees) along with £350 for installing a charger at home. (Source: https://www.gov.uk/plug-in-car-van-grants)

Electric Vehicles Excise Duty

Fully EVs don’t have to pay the Excise duty. This encourages the drivers to choose the most environmentally friendly and cleanest vehicles. All cars with less CO2 emission than 75g/km have to pay less road tax in the first year. In addition, fully electric cars get exemption from the expensive car supplement until 2025, March 31st.

Salary Sacrifice on Electric Cars

With salary sacrifice, employees can exchange a part of their salary for non-cash benefits from their employer, like a company car. Salary sacrifice on electric vehicles is a hassle-free and cost-effective way of driving an electric vehicle, whether fully electric or hybrid.

Once you are enlisted on a scheme and have selected an electric car, a monthly payment covering leasing, maintenance and insurance is deducted directly from your salary, before national insurance and income tax. This way, both employer and employee save money. This means the employee will have to pay less tax on a lesser portion of their salary, while the employer has to make fewer National Insurance contributions while supporting more zero-emissions motoring.

Despite your role, salary sacrifice encourages the employees to drive an electric car while saving money at the same time. Just remember that with salary sacrifice, your pay is reduced, which can affect your mortgage applications or maternity pay.

Let’s see, how many types of electric cars are available?

If you don’t want to drive a fully electric car, then there are other environmentally friendly options for you:

- Hybrid Electric Vehicle (HEV): these cars produce their own electricity through a regenerative braking system. Hybrid cars have the capacity to alternate better fossil fuels and rechargeable batteries, depending on the usage.

- Plug-in Hybrid Electric Vehicle (PHEV): these cars are powered by two motors, one is a fuel-injected engine, and the other is an electric vehicle. The fuel engine is deployed when the driver needs more range and power.

- Battery Electric Vehicle (EV): these cars are fully electric and run only on rechargeable batteries. They can be charged either at home or at special charging points across the UK.

The Most Important Question, can you save money?

Want more? You got it. Electric vehicles don’t cost a lot in the long run as you save money on fuel and servicing. An electric car’s capacity is measured in kilowatt-hours which is how much energy the car stores. At public stations, you can get your car recharged for 35p per kWh, and if you charge during off-peak hours at home, then your cost will be as low as 5p per kWh. This means you can charge your car for just a few pounds compared to £30 or more on fuel.

New Bands and Tax Rates For Tax Years 2020 To 2023 For cars first registered from 6 April 2020

What is the Distance Electric Vehicles Can Travel?

The electric car with the longest range is the Tesla S, with a 405 miles range. With this kind of range, you can travel from Leeds to Cornwall with just a few miles left over. The car costs £80,000, but there are other affordable options available in the market.

Top 9 EV Options in the Market

| Car | Range |

| Hyundai Kona Electric | 300 miles |

| Jaguar I-Pace | 292 miles |

| Kia e-Nero | 282 miles |

| Mercedes-Benz EQC | 255 miles |

| Audi e-Tron | 252 miles |

| Renault Zoe R135 | 245 miles |

| Nissan Leaf e+ | 239 miles |

| Hyundai IONIQ | 193 miles |

| Volkswagen e-Golf | 144 miles |

How many charging stations are available across the UK?

According to Zap-Map, there are 15,398 locations with 24,128 charging stations with 41,537 connectors. The number of charging points are increasing rapidly. 7,000 new charging stations were added in 2020. The rapid increase of EV charging points has now outnumbered the 8,500 petrol stations in the UK.

How much does it cost to charge an electric car?

Full charge for a 60 kWh EV can cost up to £9.00. But, if you want to charge your electric car at a public rapid charger station it will cost more than £10.

The cost depends on the location, energy cost, tariff, charge level, battery capacity and charging speed. But one thing is certain, charging an electric car undercuts the cost for a fuel car.

So, is it worth buying an electric car?

There has never been a better time for buying an electric car with the rising fuel prices. Plus, you get to save money in the long run.

This is for information only. Please always seek professional advice before acting.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IFISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes.